Landlord Deduct From Deposit

Description

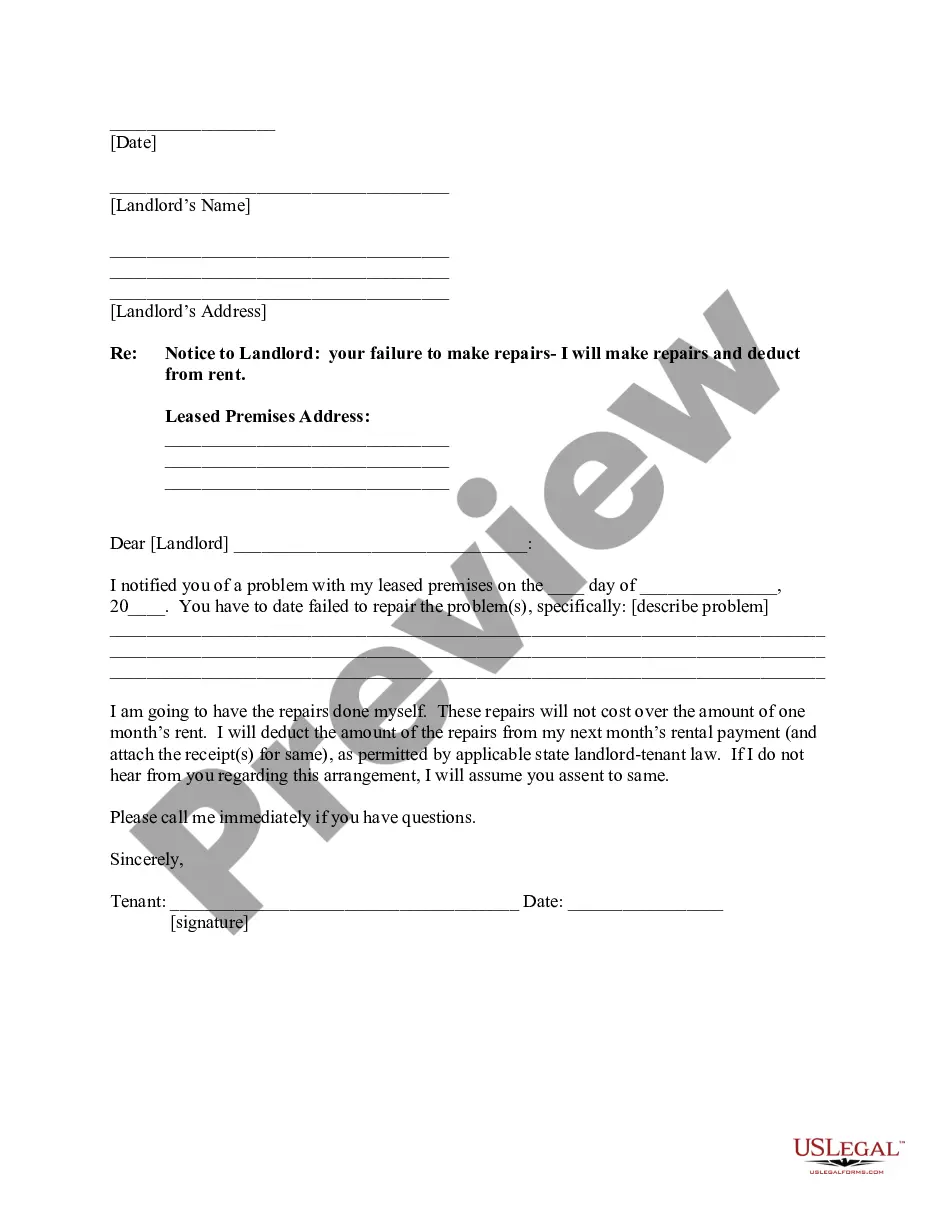

How to fill out Letter From Tenant To Landlord Containing Notice Of Use Of Repair And Deduct Remedy?

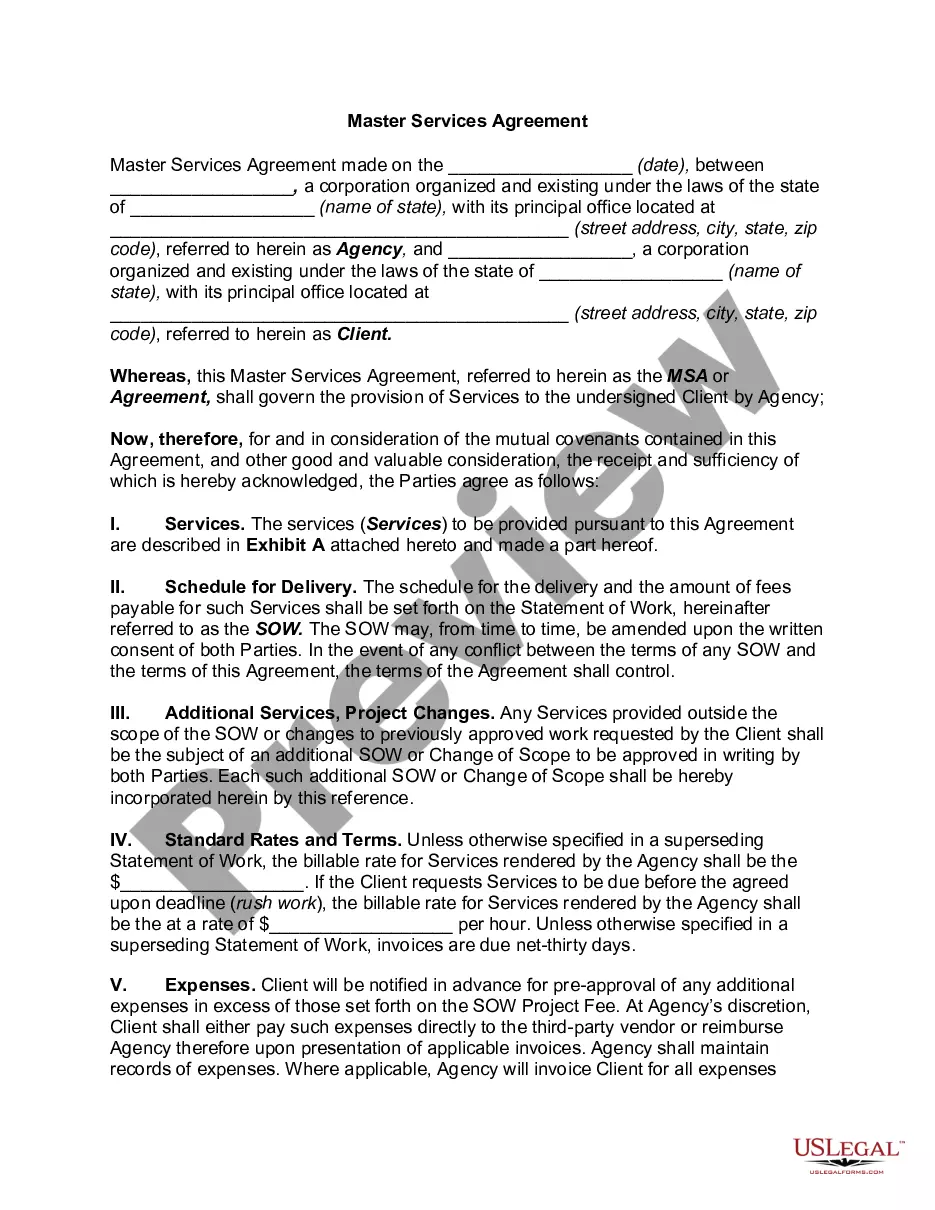

Drafting legal paperwork from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for a simpler and more affordable way of creating Landlord Deduct From Deposit or any other forms without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual library of over 85,000 up-to-date legal forms covers virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-specific forms carefully put together for you by our legal specialists.

Use our platform whenever you need a trusted and reliable services through which you can quickly find and download the Landlord Deduct From Deposit. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes minutes to set it up and explore the catalog. But before jumping straight to downloading Landlord Deduct From Deposit, follow these recommendations:

- Review the form preview and descriptions to ensure that you have found the form you are searching for.

- Make sure the template you select conforms with the regulations and laws of your state and county.

- Choose the right subscription option to get the Landlord Deduct From Deposit.

- Download the form. Then complete, certify, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of experience. Join us today and transform document execution into something easy and streamlined!

Form popularity

FAQ

Some landlords will charge tenants a nonrefundable fee, such as a fee for cleaning. Such fees are legal if clearly disclosed to the tenant as part of the leasing process. They represent part of the cost of leasing the unit and are different from a security deposit which is designed to ensure compliance with the lease.

Security deposit laws in Arizona allow a landlord to deduct charges from the deposit during the term of the lease agreement so long as the reason is allowed. Once the lease has ended, the landlord can use the security deposit to cover any of the following: Unpaid rent. Established charges covered in the lease agreement.

Deduction From Security Deposit Deductions (which must be itemized in a written notice to the tenant) from the security deposit may include: Past due rent; Cleaning fees; and. Damages (including any monetary losses resulting from noncompliance with the rental agreement or certain statutory requirements).

Section 92.104 of the Texas Property Code describes what a landlord may deduct from a security deposit: Before returning a security deposit, the landlord may deduct from the deposit damages and charges for which the tenant is legally liable under the lease or as a result of breaching the lease.

The landlord cannot charge you for normal cleaning after you vacate if you already paid a nonrefundable cleaning fee when you moved in. However, if the unit required extra cleaning due to tenant-caused damage, the landlord may be able to charge you for additional cleaning costs.