Trustee Title In Trust

Description

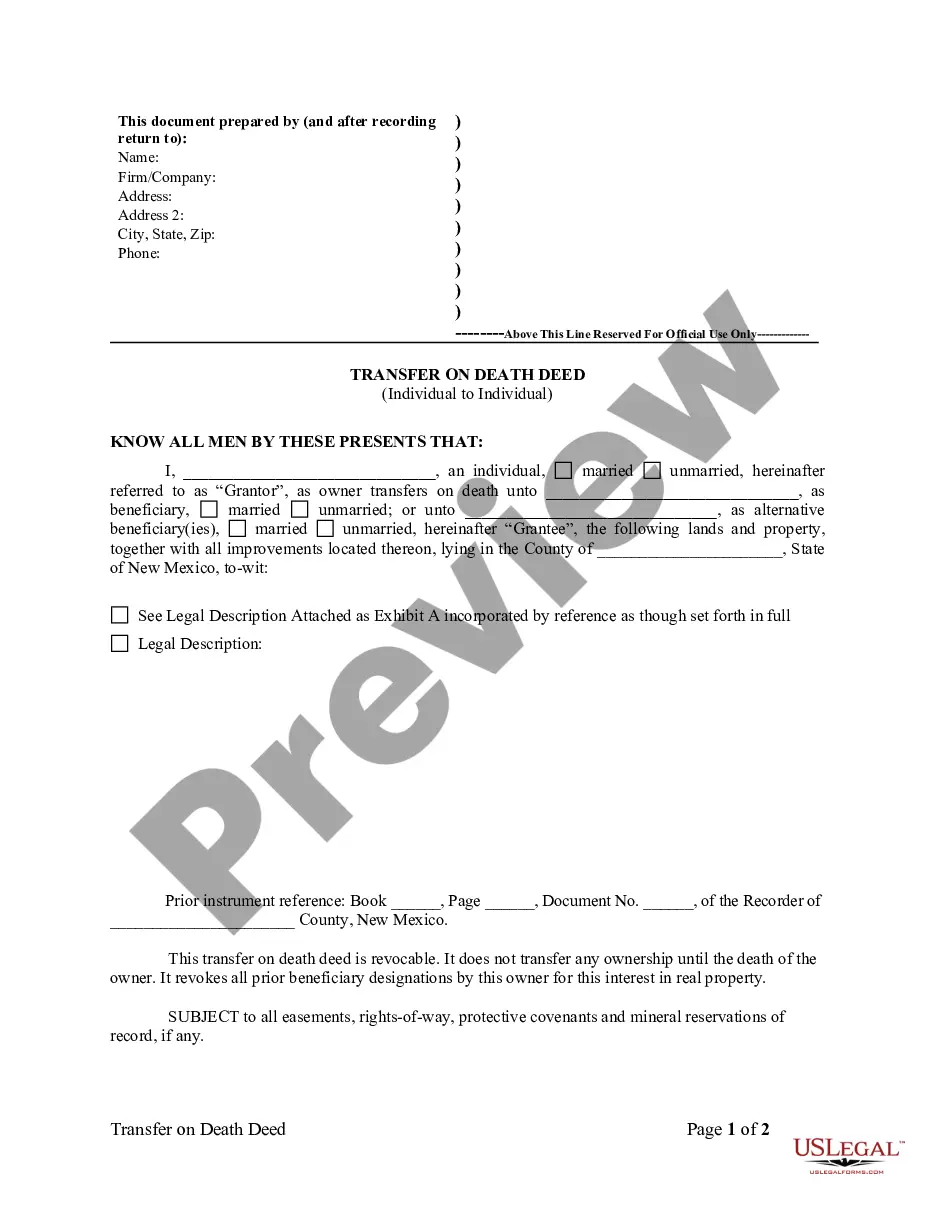

How to fill out Sample Letter For Naming A Trustee To A Deed Of Trust?

Creating legal documents from the ground up can sometimes feel overwhelming.

Certain situations may require extensive research and a significant financial commitment.

If you're looking for a simpler and more cost-effective method to prepare the Trustee Title In Trust or any other documents without unnecessary complications, US Legal Forms is readily accessible to you.

Our online assortment of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal matters.

Examine the form preview and descriptions to confirm you have located the document you need. Ensure that the template you select adheres to the laws and regulations of your state and county. Choose the most suitable subscription plan to obtain the Trustee Title In Trust. Download the document, then fill it out, certify it, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make form execution a simple and efficient process!

- With just a few clicks, you can quickly obtain state- and county-specific templates thoughtfully crafted by our legal professionals.

- Utilize our platform any time you need dependable services to easily find and download the Trustee Title In Trust.

- If you're already familiar with our services and have created an account with us in the past, simply Log In to your account, select the template, and download it or re-download it anytime from the My documents section.

- Haven't registered yet? No problem. It takes minimal time to sign up and browse the catalog.

- However, before rushing straight to downloading the Trustee Title In Trust, consider following these guidelines.

Form popularity

FAQ

Selecting a trustee for your trust is an important decision that can impact the trust's success. You might want to choose someone who is trustworthy, responsible, and understands financial matters. Consider your options carefully; this person will hold the trustee title in trust and be charged with managing your assets. If you have concerns, using a professional trustee service through platforms like US Legal Forms can provide added peace of mind.

A trustee in a trust is an individual or institution responsible for managing the trust's assets according to the trust's terms. For instance, if you establish a trust for your children's education, you may appoint yourself or a trusted family member as the trustee. The trustee holds the title to the trust assets but must act in the best interest of the beneficiaries. Understanding the role of a trustee is key to effectively utilizing a trustee title in trust.

A trustee does not have ownership of the trust's assets; rather, they hold and manage those assets on behalf of the beneficiaries. Their role is to ensure that the assets are distributed according to your instructions as outlined in the trust document. Understanding the distinction between ownership and the trustee's responsibilities is vital when considering the trustee title in trust.

Placing assets in a trust involves transferring ownership from your name to the trust. You may need to change titles on property, bank accounts, or investments to reflect the trustee title in trust. By doing this, you retain control while ensuring that these assets are managed according to your wishes.

Yes, a deed of trust generally needs to be filed with the local government to ensure public record and enforceability. Filing the deed protects your interests and clarifies the trustee's authority over the trust assets. This record is crucial when dealing with the trustee title in trust, as it provides transparency and clarity to all stakeholders involved.

To change the trustee of a trust with the IRS, you need to notify them of the change by completing IRS Form 56, which notifies the agency of fiduciary relationships. Additionally, you should inform the new trustee of their responsibilities and update any financial institutions or entities involved. These steps ensure that your trustee title in trust reflects the new changes and maintains trust compliance with IRS regulations.

The 5 by 5 rule for trusts allows beneficiaries to withdraw up to $5,000 or 5% of the trust assets each year, whichever is greater, without affecting the overall trust structure. This rule ensures beneficiaries have access to funds while maintaining the integrity of the trust. Understanding this rule is essential if you want to manage your assets wisely within the trustee title in trust.

The term 'trustee' does not equate to ownership of trust assets. Rather, a trustee title in trust signifies a fiduciary duty to manage those assets on behalf of the beneficiaries. This role involves adhering to the trust's guidelines and ensuring that the beneficiaries' interests are prioritized. If you're forming a trust and need more clarity on fiduciary responsibilities, consider using US Legal Forms for comprehensive legal resources.

Individuals involved in a trust hold specific titles that define their roles, such as settlor, trustee, and beneficiary. The trustee is particularly significant, as this title represents the person or entity responsible for managing the trust assets. Understanding these titles is essential for effective trust administration, and US Legal Forms can guide you in choosing the right structure and titles for your trust.

In a trust, there are various important positions, including the settlor, trustee, and beneficiaries. The settlor is the person who establishes the trust, while the trustee manages it according to the terms set forth. Each position has distinct responsibilities and functions, highlighting the importance of the trustee title in trust. US Legal Forms provides templates that clarify these roles and their implications.