Trust Name For Beneficiary

Description

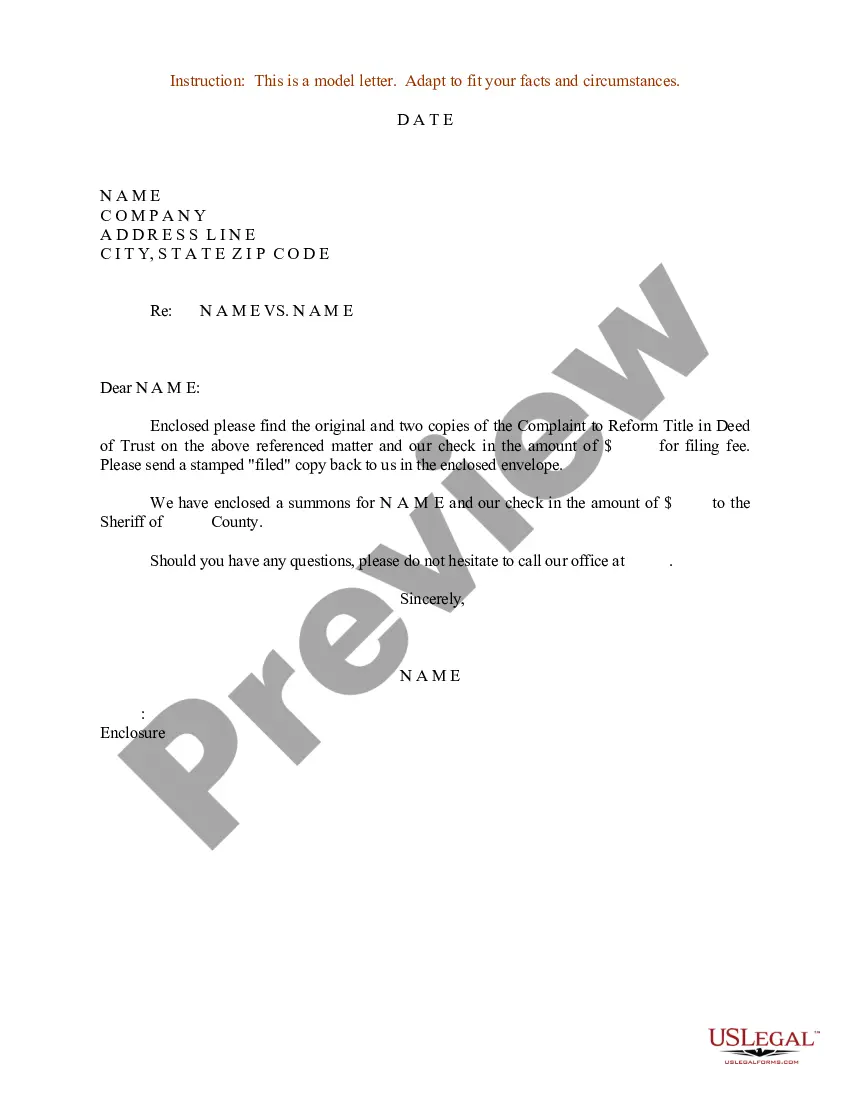

How to fill out Sample Letter For Complaint To Reform Title In Deed Of Trust?

The Trust Name For Beneficiary you see on this page is a reusable formal template drafted by professional lawyers in line with federal and state regulations. For more than 25 years, US Legal Forms has provided people, companies, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, simplest and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Obtaining this Trust Name For Beneficiary will take you only a few simple steps:

- Look for the document you need and check it. Look through the sample you searched and preview it or check the form description to confirm it satisfies your needs. If it does not, make use of the search bar to get the right one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Choose the format you want for your Trust Name For Beneficiary (PDF, Word, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to rapidly and precisely fill out and sign your form with a eSignature.

- Download your papers one more time. Use the same document again anytime needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write ?children? on one of the lines; instead write the full names of each of your children on separate lines.

Provide the following information on the beneficiary designation: The full name of the trust as it shows on the trust document. The date the trust was created. The name of the trustee, followed by the word ?trustee?, or if you cannot provide a trustee, ETF may accept another contact person. The trustee's address.

Naming beneficiaries for qualified retirement plans means that probate, attorneys' fees, and other costs associated with settling estates are avoided. Naming a trust as a beneficiary is a good idea if beneficiaries are minors, have a disability, or can't be trusted with a large sum of money.

Spouse, partner, children, parents, brothers and sisters, business partner, key employee, trust and charitable organization.

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.