Change Of Name With Irs

Description

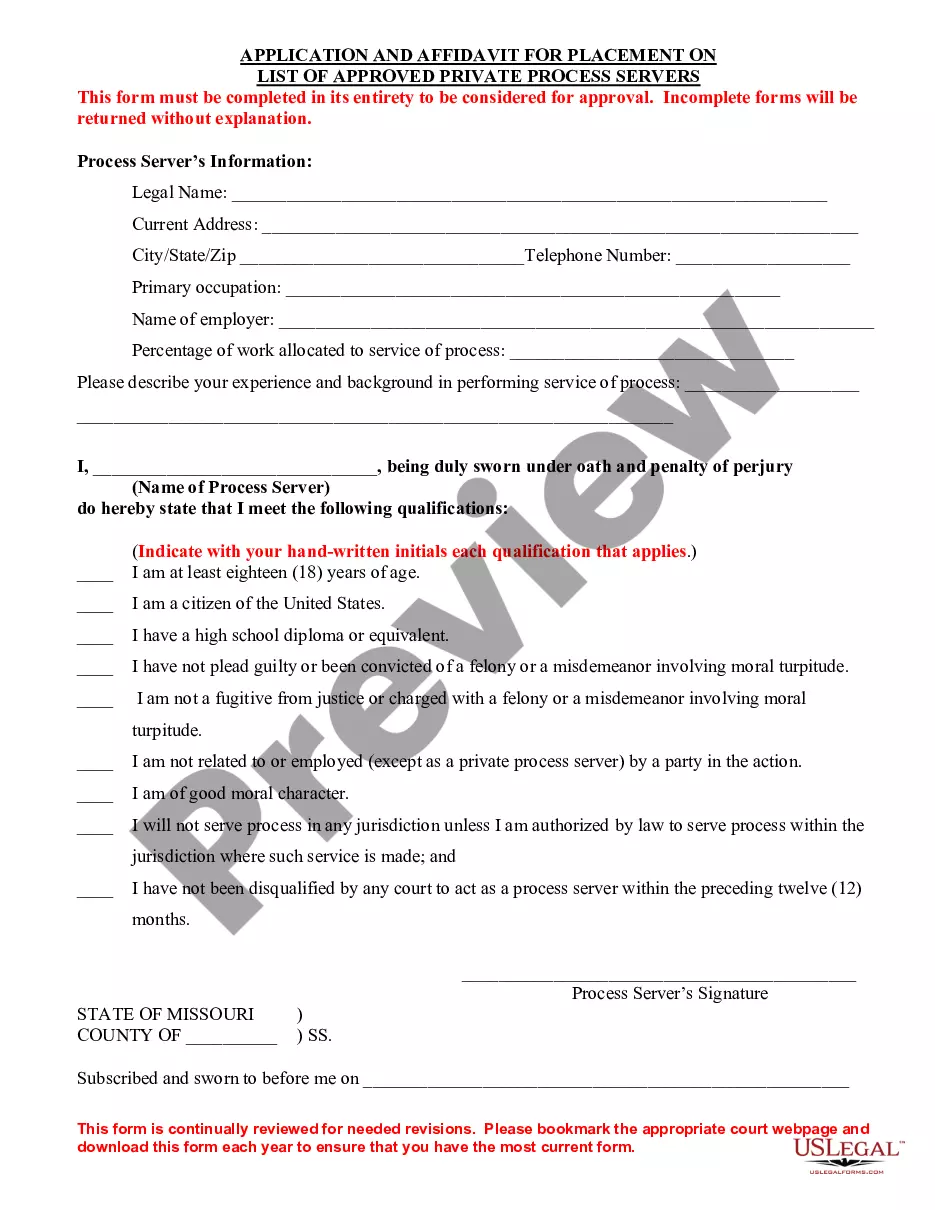

How to fill out Sample Letter Requesting Name Change On Social Security Card After Marriage?

Finding a go-to place to take the most current and appropriate legal samples is half the struggle of working with bureaucracy. Discovering the right legal files demands accuracy and attention to detail, which is why it is important to take samples of Change Of Name With Irs only from reliable sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and view all the information about the document’s use and relevance for the situation and in your state or region.

Take the following steps to complete your Change Of Name With Irs:

- Utilize the catalog navigation or search field to locate your sample.

- View the form’s description to see if it suits the requirements of your state and area.

- View the form preview, if there is one, to make sure the template is definitely the one you are looking for.

- Go back to the search and locate the correct document if the Change Of Name With Irs does not fit your requirements.

- When you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Choose the pricing plan that suits your preferences.

- Go on to the registration to complete your purchase.

- Complete your purchase by choosing a transaction method (credit card or PayPal).

- Choose the document format for downloading Change Of Name With Irs.

- Once you have the form on your device, you can modify it with the editor or print it and finish it manually.

Eliminate the inconvenience that comes with your legal paperwork. Check out the comprehensive US Legal Forms catalog where you can find legal samples, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

If you change your name soon after you file your annual tax return, then you can inform the IRS of the EIN number change name through a signed notification, similar to a sole proprietorship.

Generally, businesses need a new EIN when their ownership or structure has changed. Although changing the name of your business does not require you to obtain a new EIN, you may wish to visit the Business Name Change page to find out what actions are required if you change the name of your business.

Line 1 - Name If submitting this W-9 as an individual, you should enter the name shown on your tax return. If you have changed your last name without informing the Social Security Administration (SSA), enter your first name, the last name as shown on your Social Security card and your new last name.

By Form. To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party ? Business and send them to the address shown on the forms.

Contents of the Name Change Letter Your current EIN. The old name of the business as mentioned in the IRS records. Complete address of the business as it exists in the IRS records. The new name of your business. Date from which the name has been changed. New address if applicable.