Trustor With Forfeiture

Description

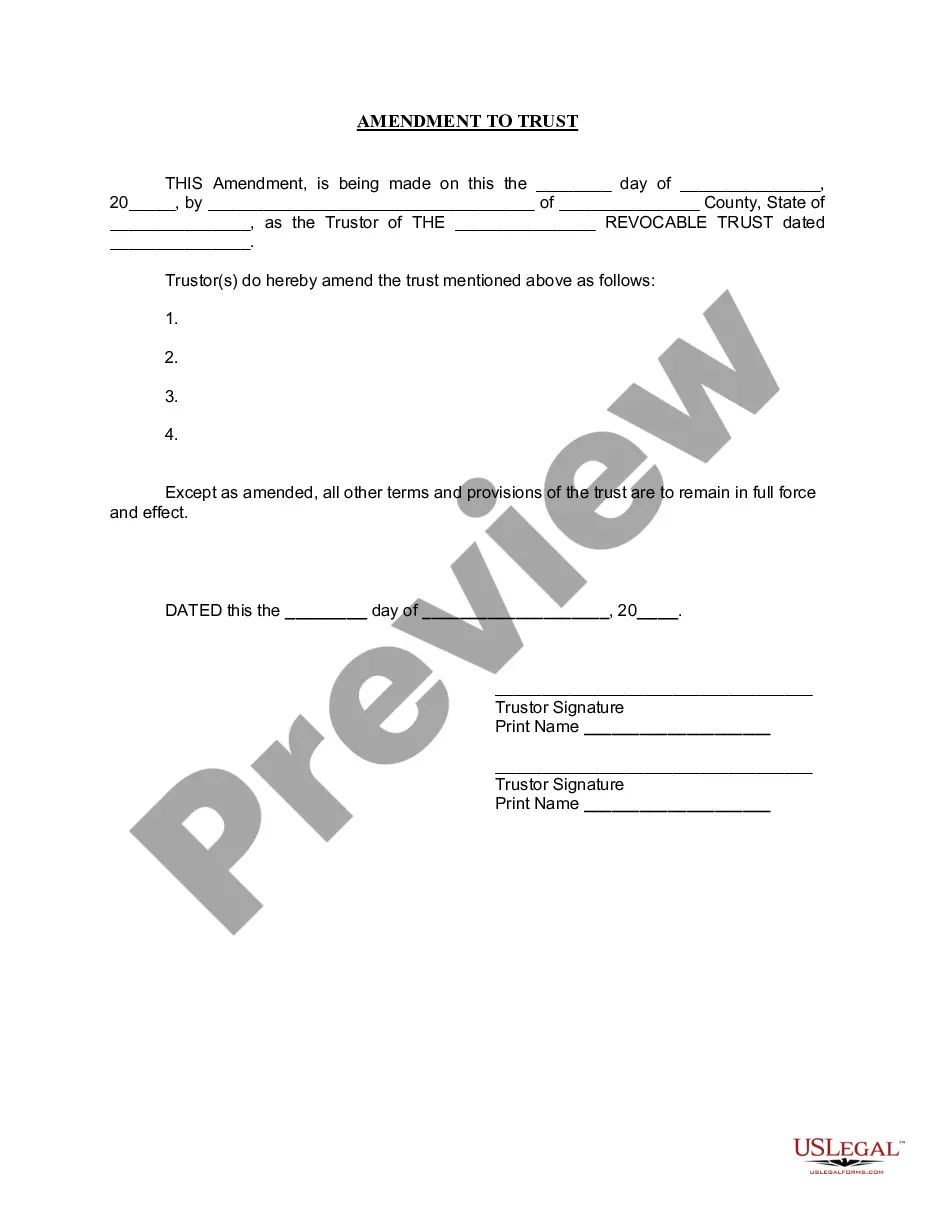

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

- For returning users, log in to your existing account and locate your desired form template by clicking the Download button. Be sure that your subscription is active; renew if necessary.

- If you're a new user, start by checking the Preview mode and description of the form to ensure it meets your needs and adheres to local jurisdiction requirements.

- Utilize the Search tab to find alternate templates if the first choice does not align with your specifications.

- Once select the appropriate document, click the Buy Now button and choose a subscription plan that suits you. Registration for an account is necessary for complete access.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Download the required form to your device, ensuring you can easily access it again through the My Forms section of your profile.

US Legal Forms stands out by offering a vast collection of over 85,000 editable forms, ensuring that users find exactly what they need swiftly. Access to premium support assists users in completing forms accurately, guaranteeing legal compliance.

In conclusion, utilizing US Legal Forms for 'trustor with forfeiture' documents not only saves time but also simplifies the process of legal compliance. Start your journey towards hassle-free documentation today and explore the benefits of our extensive library!

Form popularity

FAQ

When a trustee fails to act properly, their actions are often categorized as a breach of fiduciary duty. This situation can jeopardize the trust and its beneficiaries. Understanding the concept of trustor with forfeiture is essential, as it outlines the legal consequences that may arise from such breaches.

Dealing with difficult trustees requires a balanced approach. Engage in open communication to resolve conflicts amicably. If difficulties persist, consider mediation or legal action to address their behavior, especially if it threatens the integrity of the trust. Platforms like uslegalforms offer resources to help navigate these tough situations efficiently.

Yes, a trustor can be removed from a trust, but this process depends on the terms outlined in the trust document. If the trust specifies conditions for removal, then those must be followed. Additionally, if the trustor acts against the interests of the beneficiaries, one may pursue legal avenues focusing on trustor with forfeiture.

To remove a bad trustee, start by reviewing the trust agreement for clauses that outline the removal process. You may need to gather support from other beneficiaries or file a petition in court if the trustee refuses to step down. Legal aid, especially from platforms like uslegalforms, can provide valuable guidance on claiming trustor with forfeiture in this scenario.

To hold a trustee accountable, first document any violations or failures in their duties. You may initiate a dialogue to express your concerns. If necessary, you can seek a court's intervention to have the trustee removed, especially if their actions violate the trust's terms or harm the beneficiaries. This process often falls under the legal concept of trustor with forfeiture.

Dealing with a bad trustee can be challenging, but it starts with gathering evidence of their mismanagement. Review the trust documents and communicate your concerns directly with the trustee. If the situation does not improve, consider involving a legal professional who specializes in trust law to explore your options, including possibly pursuing a claim for trustor with forfeiture.

The trustor plays a vital role in establishing a trust by designating how assets will be managed and distributed. This individual outlines their wishes in the trust agreement, which guides the actions of the trustee. By understanding the role of the trustor, especially in contexts like trustor with forfeiture, you can ensure that your assets are protected according to your intentions with the help of platforms like US Legal Forms.

No, the trustor and trustee serve different functions in a trust. The trustor establishes the trust and puts assets into it, while the trustee administers the trust as outlined by the trustor. It is important to know who holds these roles when navigating trust terms and potential issues regarding trustor with forfeiture.

A forfeiture clause in a trust outlines conditions under which a beneficiary could lose their rights to trust assets. This clause can help protect the trustor's intentions by ensuring that beneficiaries adhere to specific behaviors or requirements. If you are setting up a trust, it is important to understand how such a clause may apply, especially in the context of trustor with forfeiture.

No, a trustor is not the same as a trustee. The trustor is the person who creates the trust and contributes assets to it. In contrast, the trustee manages the trust according to its terms and in the best interest of the beneficiaries. Understanding the distinction between these roles is crucial, especially when considering matters like trustor with forfeiture.