Sample Allowance Form Without

Description

How to fill out Sample Letter For Employee Automobile Expense Allowance?

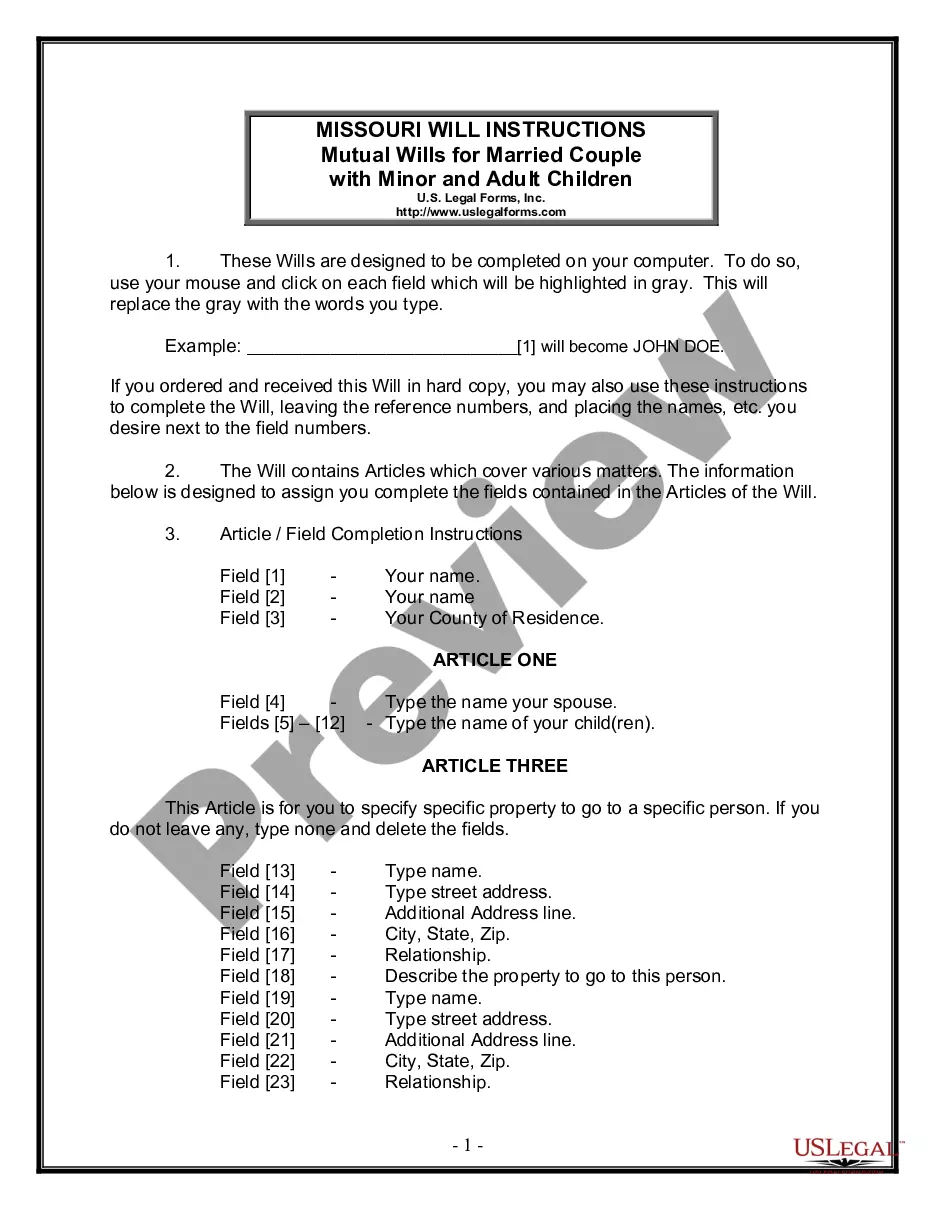

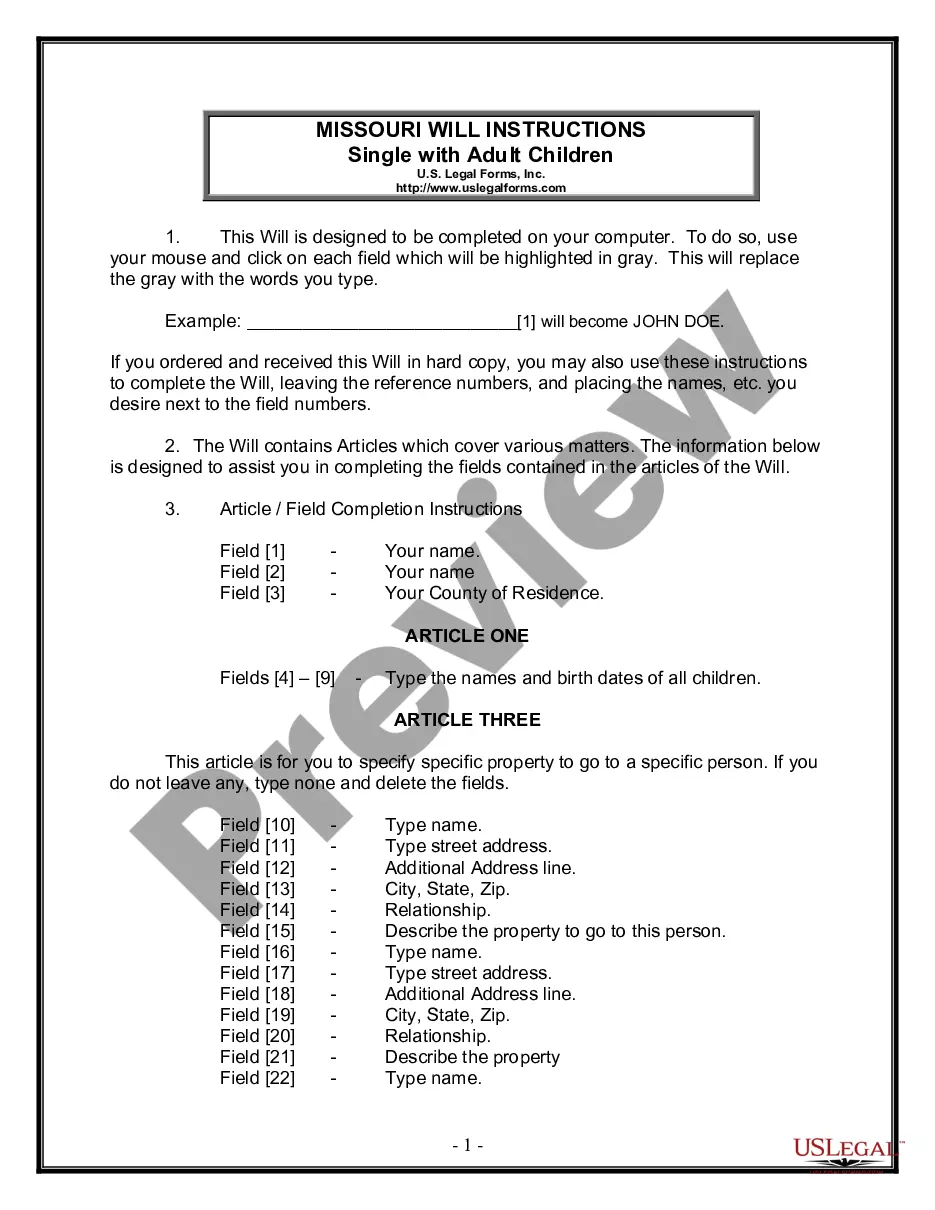

Legal document management might be overpowering, even for experienced professionals. When you are interested in a Sample Allowance Form Without and do not get the time to spend looking for the correct and updated version, the procedures might be stressful. A strong web form library could be a gamechanger for anybody who wants to take care of these situations successfully. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, you may:

- Access state- or county-specific legal and organization forms. US Legal Forms covers any needs you might have, from individual to enterprise papers, in one spot.

- Use innovative resources to complete and handle your Sample Allowance Form Without

- Access a useful resource base of articles, instructions and handbooks and resources relevant to your situation and requirements

Help save effort and time looking for the papers you will need, and utilize US Legal Forms’ advanced search and Review feature to get Sample Allowance Form Without and get it. In case you have a subscription, log in to the US Legal Forms profile, look for the form, and get it. Take a look at My Forms tab to view the papers you previously downloaded and to handle your folders as you see fit.

Should it be the first time with US Legal Forms, register an account and get unrestricted use of all benefits of the platform. Here are the steps to take after downloading the form you need:

- Validate this is the correct form by previewing it and looking at its description.

- Be sure that the sample is accepted in your state or county.

- Select Buy Now once you are all set.

- Select a monthly subscription plan.

- Pick the format you need, and Download, complete, sign, print out and send out your papers.

Take advantage of the US Legal Forms web library, backed with 25 years of experience and stability. Transform your everyday papers administration in to a smooth and user-friendly process today.

Form popularity

FAQ

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

The number of allowances you should claim depends completely on your personal situation. However, the following are a few scenarios where one can claim zero, one, two or three allowances. If you are single and are being claimed as a dependant by someone else's W4 then you should claim zero allowances.

If you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out Step 1 (your name, address, Social Security number and filing status) and Step 5 (your signature).

You can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.

You can claim anywhere between 0 and 3 allowances on the W4 IRS form, depending on what you're eligible for. Generally, the more allowances you claim, the less tax will be withheld from each paycheck. The fewer allowances claimed, the larger withholding amount, which may result in a refund.