Legal Conflict Of Interest With Customers

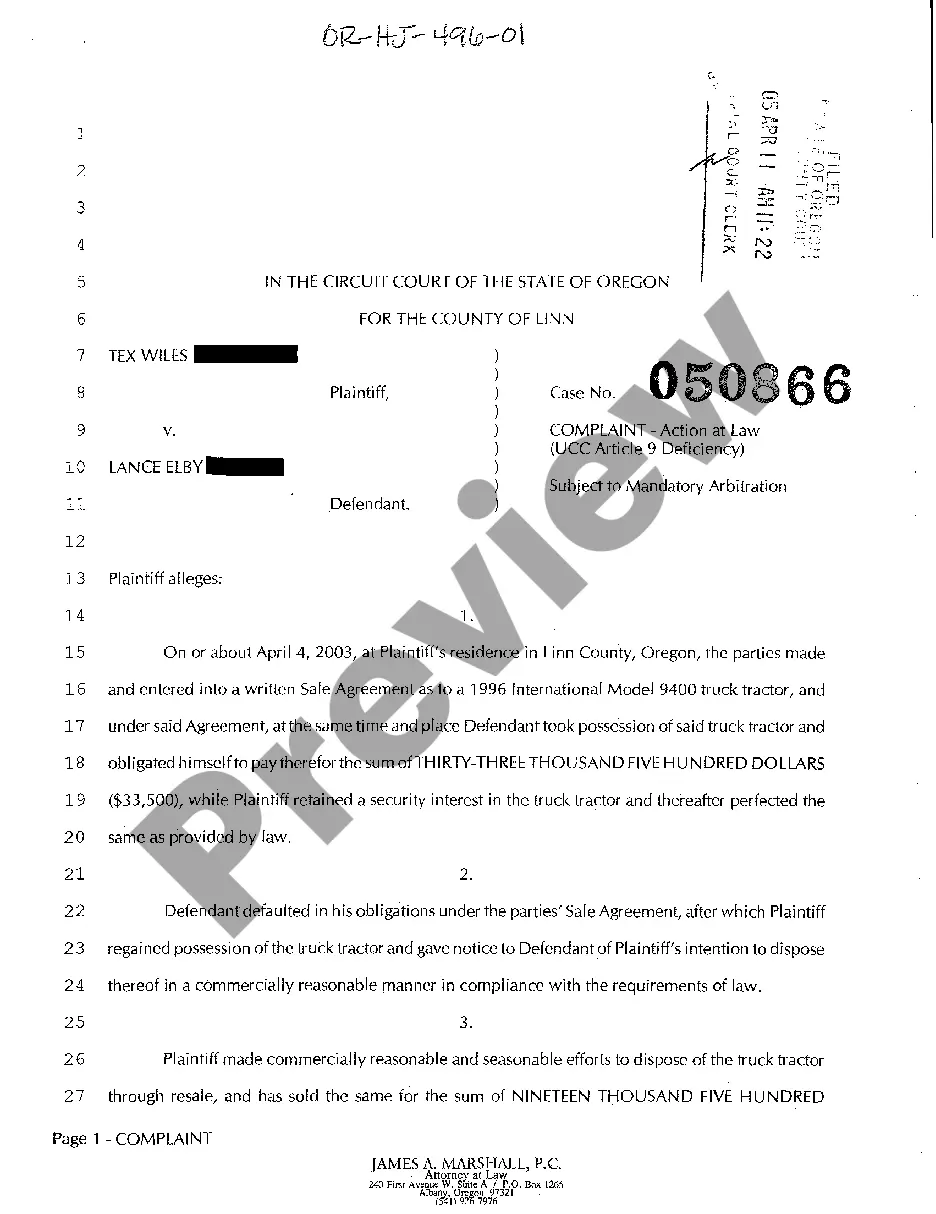

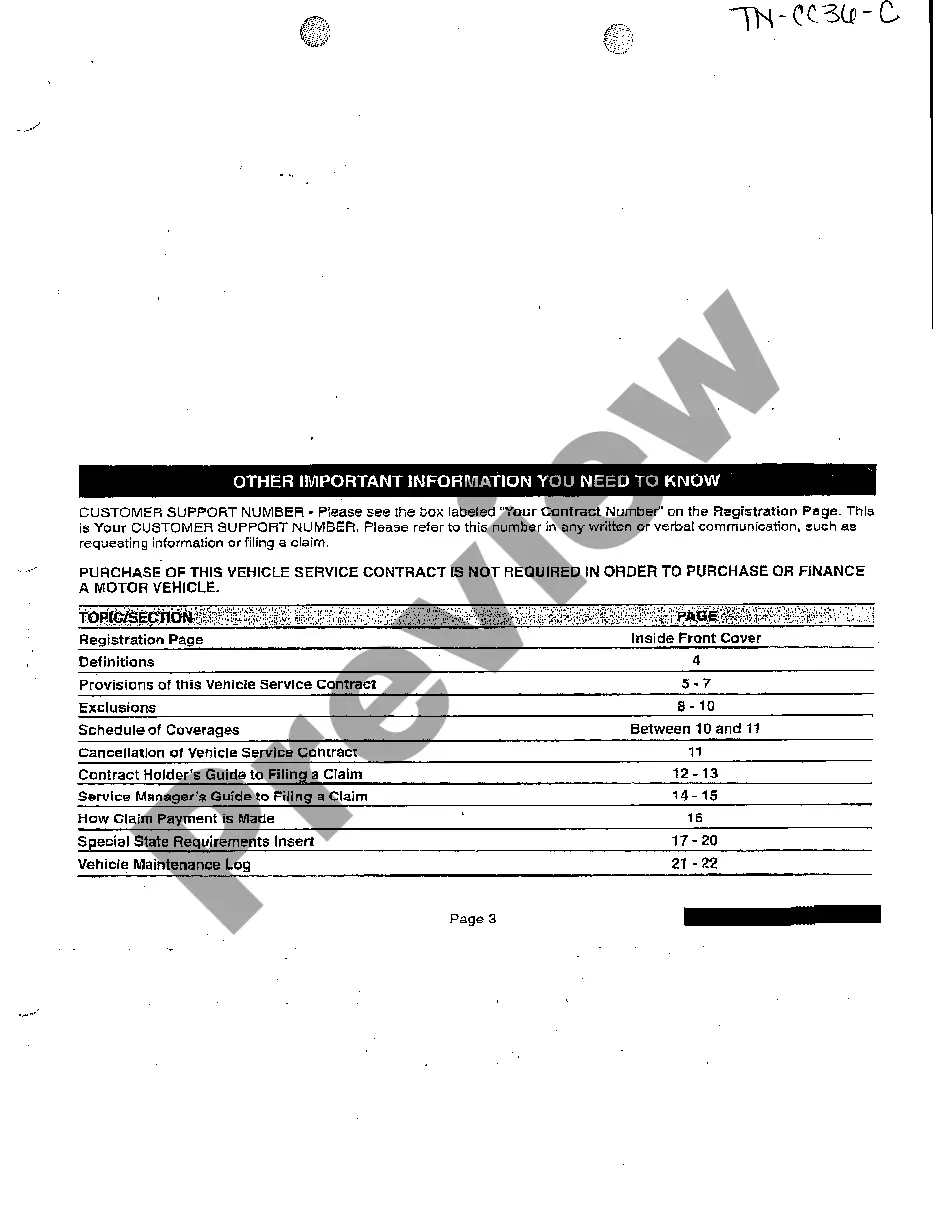

Description

How to fill out Sample Attorney Conflict Of Interest Waiver Letter?

Regardless of whether it is for corporate reasons or personal issues, everyone must manage legal circumstances at some point in their lives.

Filling out legal documents requires meticulous attention, starting with selecting the appropriate form template.

Choose the document format you prefer and download the Legal Conflict Of Interest With Customers. Once downloaded, you can complete the form using editing software or print it out and fill it in manually. With a vast US Legal Forms library available, there's no need to waste time searching for the right sample online. Utilize the library's easy navigation to find the correct form for any circumstance.

- For instance, if you select an incorrect version of the Legal Conflict Of Interest With Customers, it will be declined when submitted.

- Thus, it is vital to have a trustworthy source of legal documents like US Legal Forms.

- If you need to obtain a Legal Conflict Of Interest With Customers template, follow these straightforward steps.

- Acquire the sample you require by using the search field or browsing through the catalog.

- Review the details of the form to ensure it aligns with your situation, state, and area.

- Click on the preview of the form to inspect it.

- If it is not the correct form, return to the search feature to locate the Legal Conflict Of Interest With Customers template you need.

- Obtain the template when it satisfies your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you don't have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the profile registration form.

- Select your payment method: you can use a credit card or PayPal account.

Form popularity

FAQ

How to get a certificate of trust With a lawyer. An estate planning attorney can draft a certificate of trust for you to accompany your trust. With estate planning software. ... With a state-specific form from a financial institution or notary public.

The Disadvantage of a Revocable Living Trust Expansive: Creating a revocable living trust can be more expensive than a simple will due to legal fees and document preparation. Complexity: Managing a trust requires ongoing paperwork and record-keeping, which can be burdensome and time-consuming.

Limitations: Requires adherence to trust document's instructions on asset assignments. Joint assets, including certain IRAs and retirement plans, cannot be placed into a one-person trust. No complete tax avoidance: Total avoidance of taxes is rarely possible with living trusts, though there may be ways to reduce them.

To create a living trust in Tennessee, prepare a written trust agreement and sign it in the presence of a notary. The trust is not effective until you transfer ownership of your assets into it. Living trusts can provide flexibility and benefits that are not available with other estate planning options.

In Tennessee, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts may cost even more.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

The two basic types of trusts are a revocable trust, also known as a revocable living trust or simply a living trust, and an irrevocable trust. The owner of a revocable trust may change its terms at any time.