Survivorship Affidavit Form For Name Change

Description

How to fill out Survivorship Affidavit?

Creating legal documents from the ground up can frequently be somewhat daunting.

Some situations may require extensive research and significant expenses.

If you're looking for a more straightforward and cost-effective method of preparing the Survivorship Affidavit Form For Name Change or any other paperwork without unnecessary hurdles, US Legal Forms is always available to you.

Our online collection of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters.

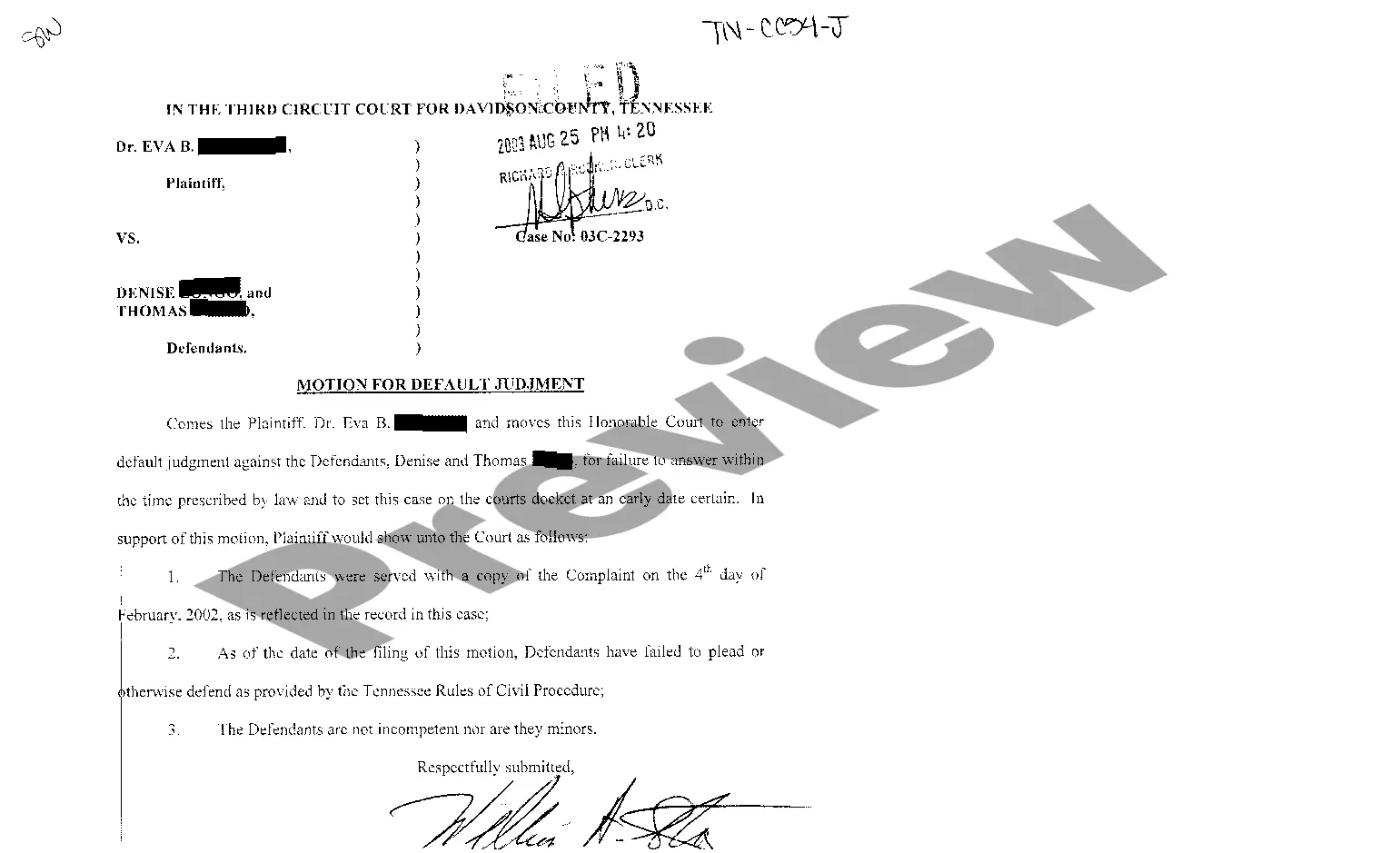

Review the document preview and descriptions to confirm that you have located the document you need. Verify if the template you choose aligns with the requirements of your state and county. Select the most suitable subscription plan to obtain the Survivorship Affidavit Form For Name Change. Download the document, then fill it out, certify it, and print it. US Legal Forms has a solid reputation and more than 25 years of expertise. Join us today and make document completion a seamless and straightforward process!

- With just a few clicks, you can swiftly access state- and county-specific templates meticulously crafted for you by our legal experts.

- Utilize our platform whenever you require a dependable and trustworthy service through which you can conveniently find and download the Survivorship Affidavit Form For Name Change.

- If you're familiar with our site and have previously set up an account, simply Log In to your account, find the form, and download it or re-download it anytime later in the My documents section.

- Don't have an account? No worries. It only takes a few minutes to register and browse the library.

- However, before you proceed to download the Survivorship Affidavit Form For Name Change, consider these recommendations.

Form popularity

FAQ

Generally, it is not necessary to have a new deed prepared removing the deceased co-owner. When the surviving owner sells the property in the future, the deceased co-owner's interest can be disposed of by providing his or her death certificate to the title company.

Fill out the affidavit completely. Sign the document in front of a notary. Attach a "certified" copy of the death certificate. Also attach a "legal description" of the property to be transferred (a copy of the survivorship deed or transfer on death designation or deed will suffice).

Property held in joint tenancy, tenancy by the entirety, or community property with right of survivorship automatically passes to the survivor when one of the original owners dies. Real estate, bank accounts, vehicles, and investments can all pass this way. No probate is necessary to transfer ownership of the property.

An Affidavit of Survivorship is a sworn statement signed by the surviving owner to verify that the co-owner of the property has passed, and that the property has passed to the surviving owner.

Unless someone co-signed the loan or is a co-borrower with you, nobody is required to take on the mortgage. However, if the person who inherits the home decides they want to keep it and take over responsibility for the mortgage, there are laws in place that allow them to do so.