Certification Form For Beneficial Ownership

Description

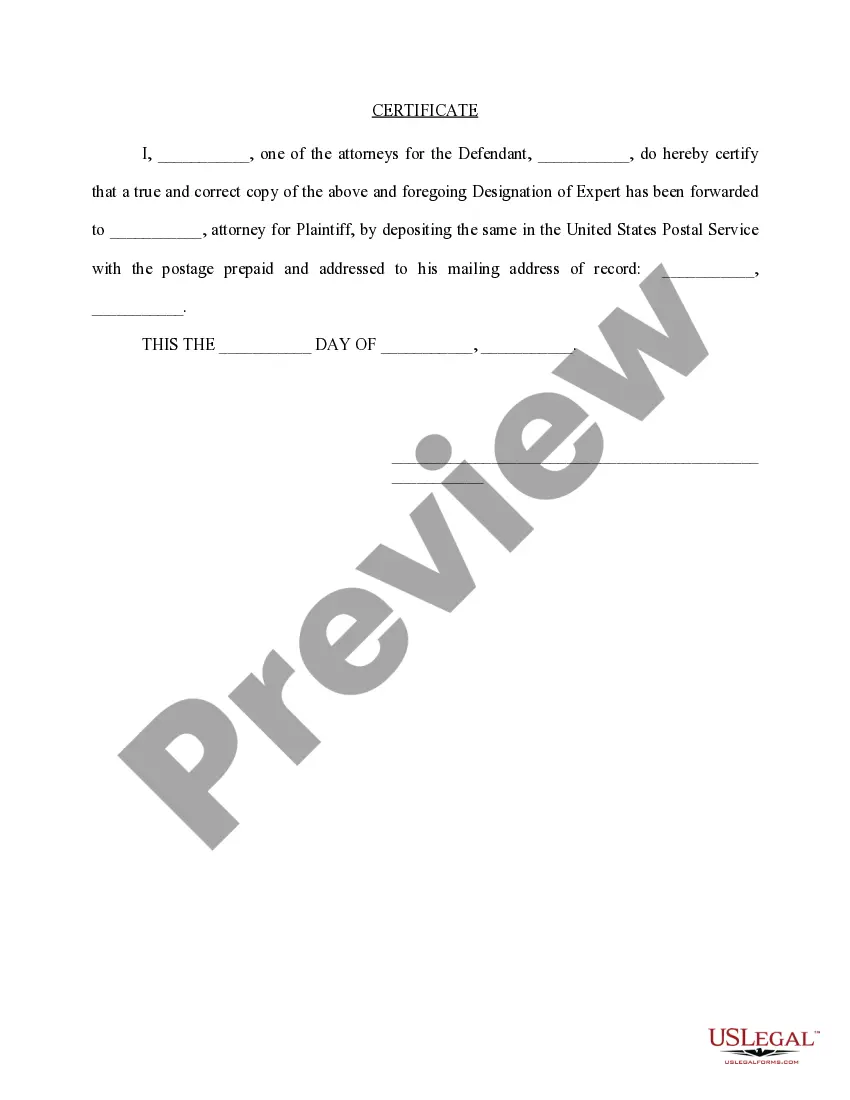

How to fill out Designation Of Expert?

It’s no secret that you can’t become a legal expert immediately, nor can you learn how to quickly prepare Certification Form For Beneficial Ownership without having a specialized set of skills. Putting together legal forms is a long process requiring a specific training and skills. So why not leave the preparation of the Certification Form For Beneficial Ownership to the specialists?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court documents to templates for internal corporate communication. We know how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our website and obtain the document you need in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Certification Form For Beneficial Ownership is what you’re looking for.

- Begin your search over if you need a different form.

- Register for a free account and choose a subscription plan to purchase the template.

- Choose Buy now. As soon as the payment is complete, you can get the Certification Form For Beneficial Ownership, fill it out, print it, and send or mail it to the necessary people or organizations.

You can re-access your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

The Beneficial Owner Declaration is a document signed by a director or legal representative of the company and the beneficial owner. The document is then submitted with any additional legal documentation required to verify the parties' identities.

To help the government fight financial crime, regulation requires financial institutions obtain, verify and record information that identifies each person who opens an account, including ownership of that account. The information you are providing will be used for that purpose.

Who Signs the Certification of Beneficial Owners Form? The individual providing the information used to open the account is the person who is required to sign the Certification of Beneficial Owners form. This person may or may not be an owner or associated person on the non-individual account.

In the context of legal arrangements such as trust, beneficial owner refers to natural person(s), at the end of the chain, who ultimately owns or controls the legal arrangement, including those persons who exercise ultimate effective control over the legal arrangement.

The CDD Rule requires these covered financial institutions to identify and verify the identity of the natural persons (known as beneficial owners) of legal entity customers who own, control, and profit from companies when those companies open accounts. The CDD Rule has four core requirements.