The Business Name Change Form for IRS, also known as Form 8822-B, is a crucial document for businesses that have changed their legal name. This form is used to update the IRS records with the new business name, ensuring accurate tax filings and avoiding any confusion or complications. The IRS recognizes that businesses may undergo name changes due to various reasons such as mergers, acquisitions, rebranding, or simply to better reflect their operations. By submitting Form 8822-B, businesses promptly notify the IRS about these changes and ensure that their tax obligations are properly associated with the new name. Completing this form requires accurate and detailed information to ensure a smooth process. The basic details to be provided include the old business name, the new business name, the Employer Identification Number (EIN), the business address, and the effective date of the name change. Additionally, businesses must explain the reason for the name change, whether it was voluntary or due to a statutory requirement. It is important to note that there are different types of Business Name Change Forms for the IRS, catering to specific circumstances. Two common types are: 1. Form 8822-B: This is the general form for businesses that have undergone a legal name change for any reason mentioned above. 2. Form 8822-B for a Reorganized Corporation: This specific form is used when a business restructuring involves a reorganization under the Internal Revenue Code Section 368 (a). This form is required for corporations going through a tax-free merger, consolidation, or division. Submitting the Business Name Change Form to the IRS ensures that all future tax-related communications, including refunds, notices, and updates, are properly directed to the new business name. It is essential to complete and submit the form promptly after the name change to avoid any complications in tax reporting or receiving important documents from the IRS.

Business Name Change Form For Irs

Description

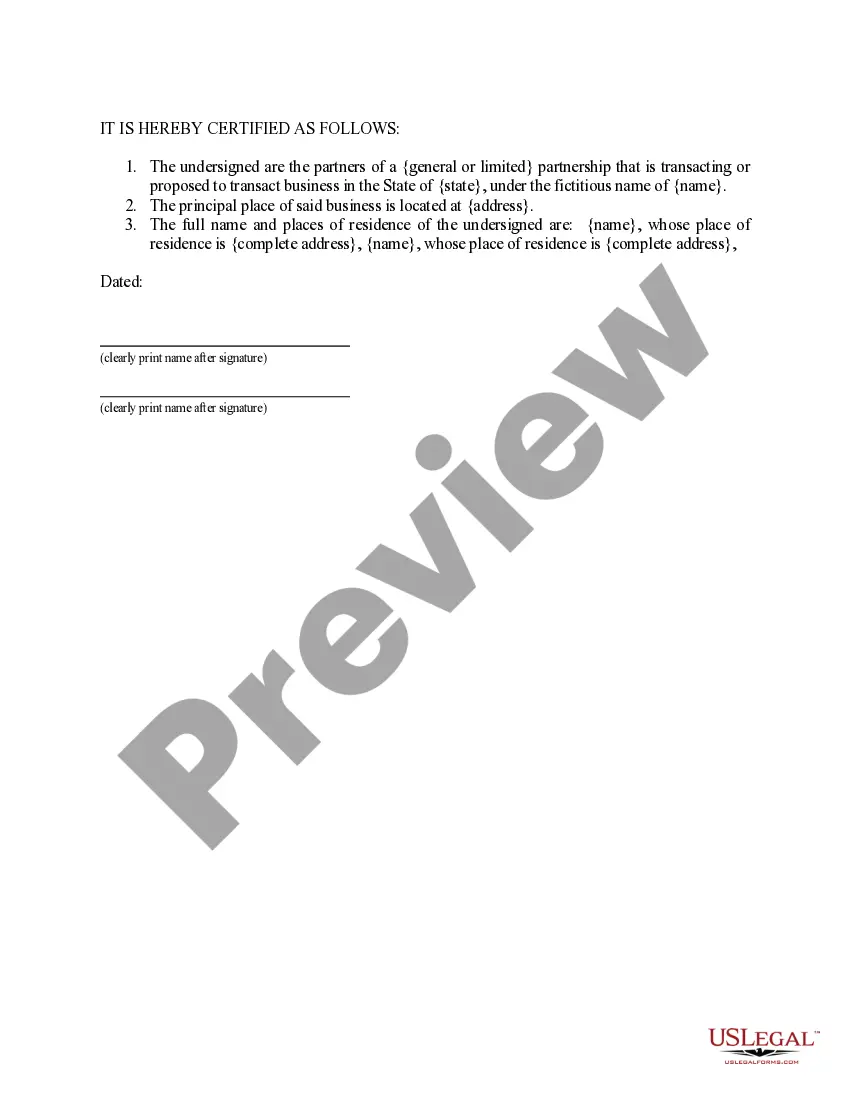

How to fill out Sample Letter For Certificate Of Transaction Of Business Under Fictitious Name - By Partnership?

Regardless of whether for professional reasons or personal matters, everyone inevitably encounters legal issues in their lifetime.

Completing legal paperwork demands meticulous focus, starting from selecting the appropriate form template.

With a comprehensive US Legal Forms catalog available, you won't need to invest time hunting for the right sample online. Utilize the library's straightforward navigation to locate the suitable form for any circumstance.

- For instance, if you choose an incorrect version of a Business Name Change Form For Irs, it will be rejected upon submission.

- Thus, it is essential to have a trustworthy source for legal documents such as US Legal Forms.

- To acquire a Business Name Change Form For Irs template, follow these straightforward steps.

- 1. Locate the sample required using the search bar or by browsing the catalog.

- 2. Review the form's description to ensure it aligns with your situation, state, and county.

- 3. Click on the form’s preview to inspect it.

- 4. If it is the wrong document, return to the search function to find the Business Name Change Form For Irs sample you require.

- 5. Download the file once it meets your needs.

- 6. If you already possess a US Legal Forms account, simply click Log in to retrieve previously saved documents from My documents.

- 7. If you do not yet have an account, you can acquire the form by clicking Buy now.

- 8. Select the correct pricing option.

- 9. Complete the profile registration form.

- 10. Choose your payment method: you can utilize a credit card or PayPal account.

- 11. Select the file format you desire and download the Business Name Change Form For Irs.

- 12. Once saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

When you change your business name, you generally do not have to file for a new EIN. Instead, you submit an EIN name change. The process you take depends on your entity type. Sole proprietorships need to send a signed notification to the IRS.

When filing a current year tax return, you can change your business name with the IRS by checking the name change box on the entity's respective form: Corporations ? Form 1120, Page 1, Line E, Box 3. S-Corporation ? Form 1120S, Page, 1, Line H, Box 2.

If you need to make a name change before filing a tax return with the IRS, you should send your request to the Cincinnati, Ohio, office of the IRS located at 550 Main St # 10, Cincinnati, OH 45202.

Use Form 8822-B to notify the Internal Revenue Service if you changed your business mailing address, your business location, or the identity of your responsible party.

Write to us at the address where you filed your return, informing the Internal Revenue Service (IRS) of the name change. Note: The notification must be signed by the business owner or authorized representative.