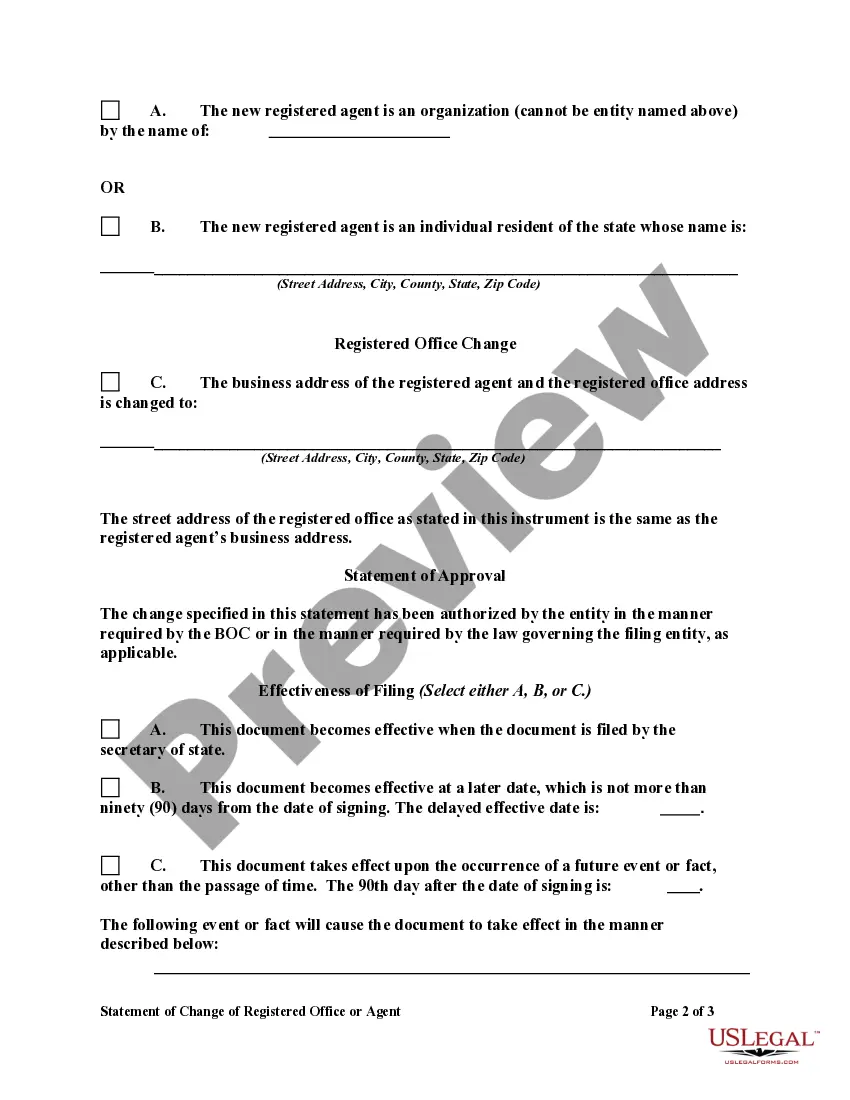

This form is used to change a registered agent or office.

Change registered address with HMRC is a process where businesses or individuals update their official address details with HM Revenue and Customs (HMRC) in the United Kingdom. This change ensures that all important communications and correspondence from HMRC reach the correct location promptly. Keeping the registered address up-to-date with HMRC is crucial to comply with legal obligations and avoid any potential penalties. When it comes to changing a registered address with HMRC, there are several types to consider based on the entity involved: 1. Change of registered address for a limited company: Limited companies must inform HMRC about any change in their registered office address as part of their legal obligations. This address is publicly available on the Companies House register, and companies are required to notify both HMRC and Companies House separately. 2. Change of registered address for a sole trader or partnership: Sole traders and partnerships also need to update HMRC about any change in their business address. They can do this by completing the relevant sections on their self-assessment tax return or by contacting HMRC directly. 3. Change of registered address for a trust or estate: Trusts and estates are obliged to inform HMRC if there is a change in their registered address. This can be done by submitting the appropriate forms to HMRC or contacting their Trusts and Estates Helpline. It is important to note that changes to the registered address alone may not be sufficient. For example, if a business is VAT registered, it must also update its VAT registered address separately using Form VAT484. To change a registered address with HMRC, individuals or businesses should complete the necessary notification forms specified for their entity type or contact HMRC directly through their helpline. It is crucial to provide accurate and updated information to ensure seamless communication and avoid any misunderstandings or delays in receiving vital correspondence from HMRC.