Nonprofit Tax Form For Donations

Description

How to fill out Articles Of Incorporation For Non-Profit Organization, With Tax Provisions?

Securing a reliable location to obtain the most up-to-date and suitable legal templates is half the challenge of navigating bureaucracy.

Identifying the appropriate legal documents demands accuracy and meticulousness, which is why it is essential to obtain samples of Nonprofit Tax Form For Donations solely from trustworthy sources, like US Legal Forms.

Eliminate the hassle associated with your legal documentation. Explore the comprehensive US Legal Forms collection to discover legal templates, evaluate their applicability to your circumstances, and download them immediately.

- Use the library navigation or search bar to find your template.

- Access the form’s details to verify if it meets the criteria of your state and county.

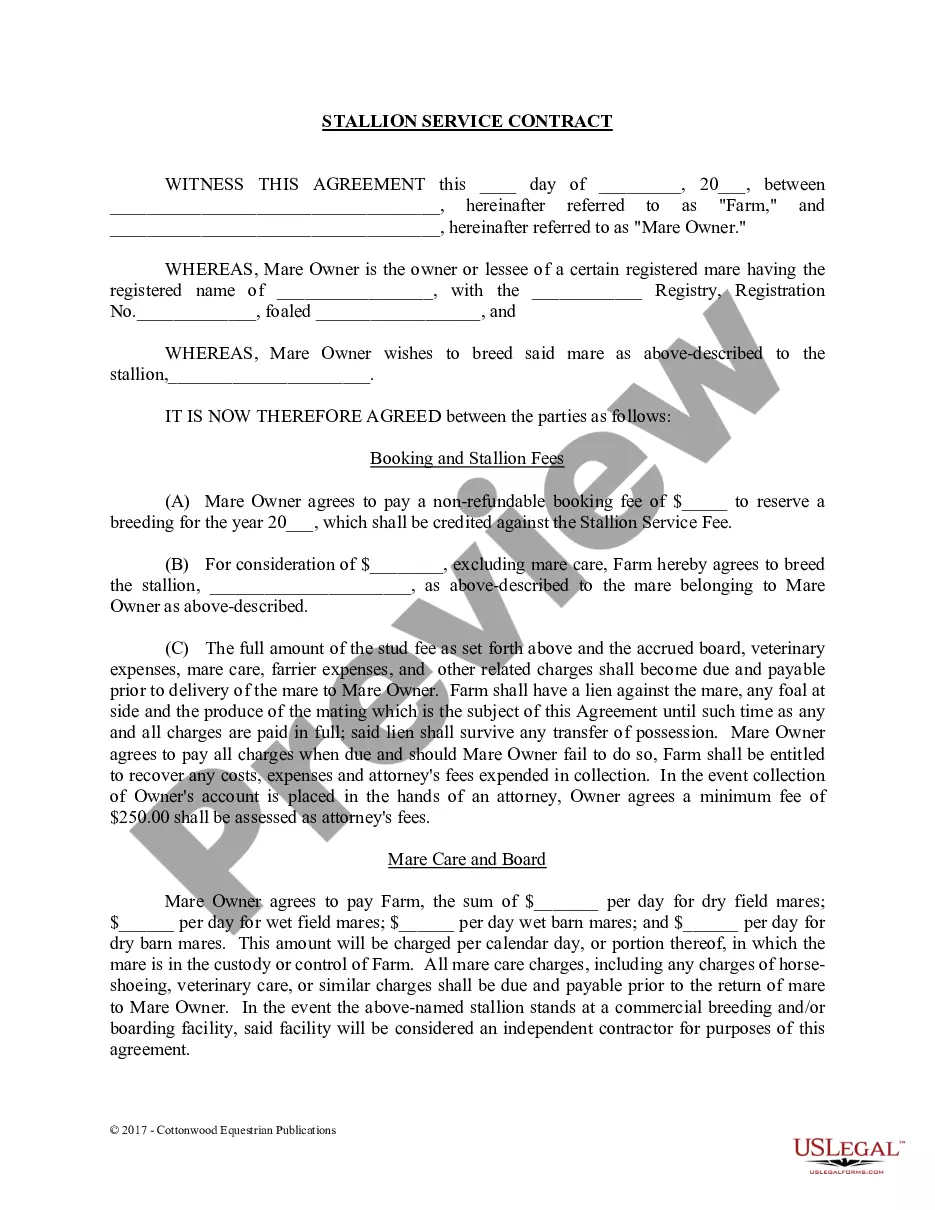

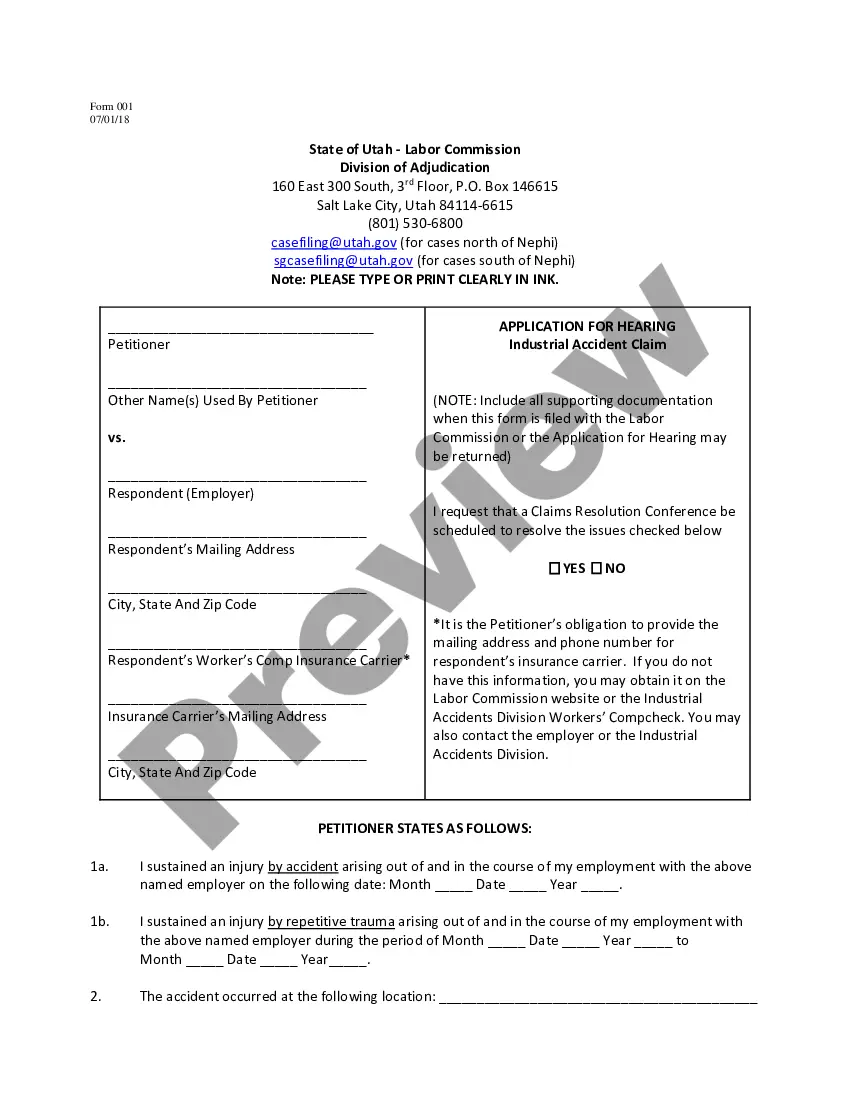

- View the form preview, if available, to confirm that it is indeed the version you wish to use.

- Return to the search to locate the suitable document if the Nonprofit Tax Form For Donations does not fulfill your needs.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to purchase the form.

- Select the pricing option that suits your needs.

- Continue to the registration to finalize your purchase.

- Complete your transaction by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Nonprofit Tax Form For Donations.

- After acquiring the form on your device, you can edit it using the editor or print it and complete it by hand.

Form popularity

FAQ

Form 990-N is specifically designed for small nonprofits with gross receipts under $50,000. If your organization falls into this category, filing 990-N is vital to maintain your tax-exempt status. This simplified form requires minimal information, which is ideal for smaller organizations looking to save time and effort.

Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.

Form 8283. For noncash donations over $5,000, the donor must attach Form 8283 to the tax return to support the charitable deduction. The donee must sign Part IV of Section B, Form 8283 unless publicly traded securities are donated.

Generally, you can only deduct charitable contributions if you itemize deductions on Schedule A (Form 1040), Itemized Deductions. Gifts to individuals are not deductible.

If you donated cash or a monetary gift, you must have written confirmation from the charity to claim the deduction. The confirmation must state the name of the organization, the date you made the gift, and the amount.

How To Document Cash Donations. Your nonprofit treasurer should record cash donations in your statement of activities, which is a component of your complete financial statement that provides a net change in assets over the course of the year. In other words, it is a picture of how "profitable" your nonprofit agency is.