Stage Manager Contract With Ipad

Description

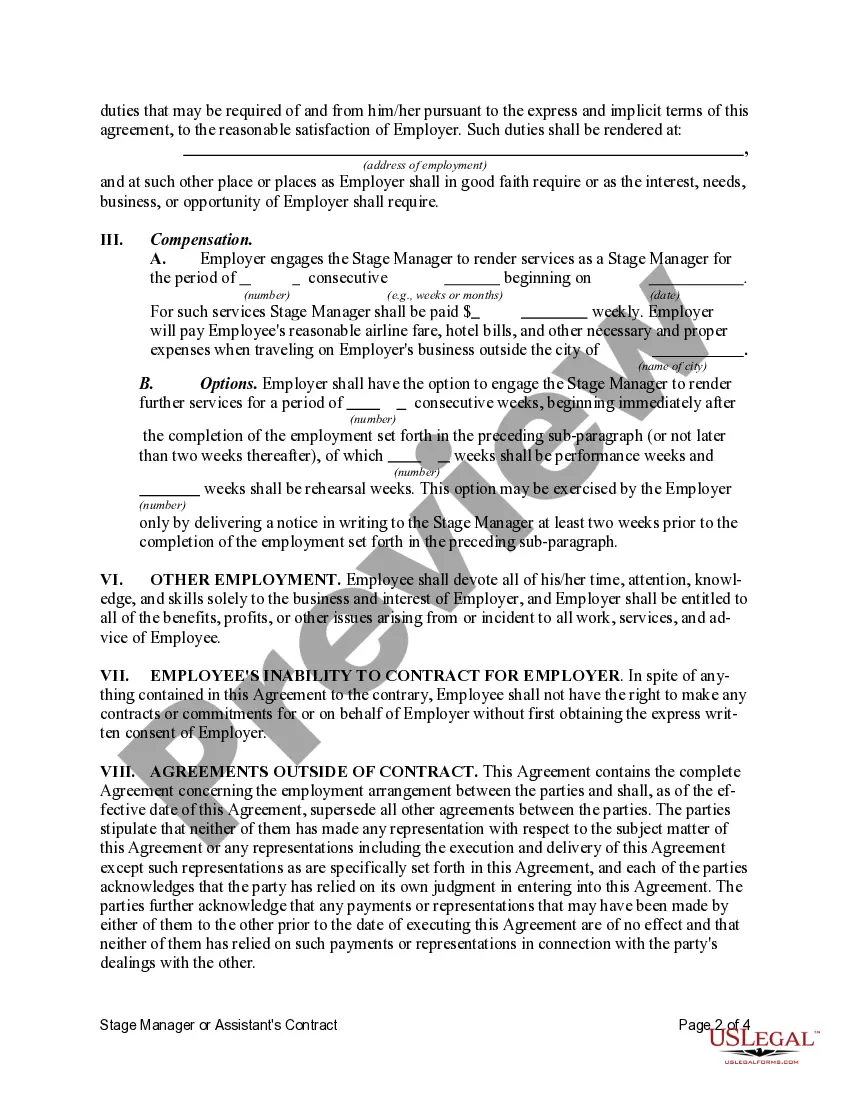

How to fill out Stage Manager Or Assistant Stage Manager Contract?

Acquiring legal document samples that adhere to federal and local regulations is essential, and the internet provides a multitude of alternatives to select from.

However, what’s the benefit of expending time looking for the right Stage Manager Contract With Ipad example online when the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the premier online legal repository featuring over 85,000 editable templates created by attorneys for various professional and personal scenarios.

Explore the template using the Preview option or via the text description to ensure it fulfills your needs.

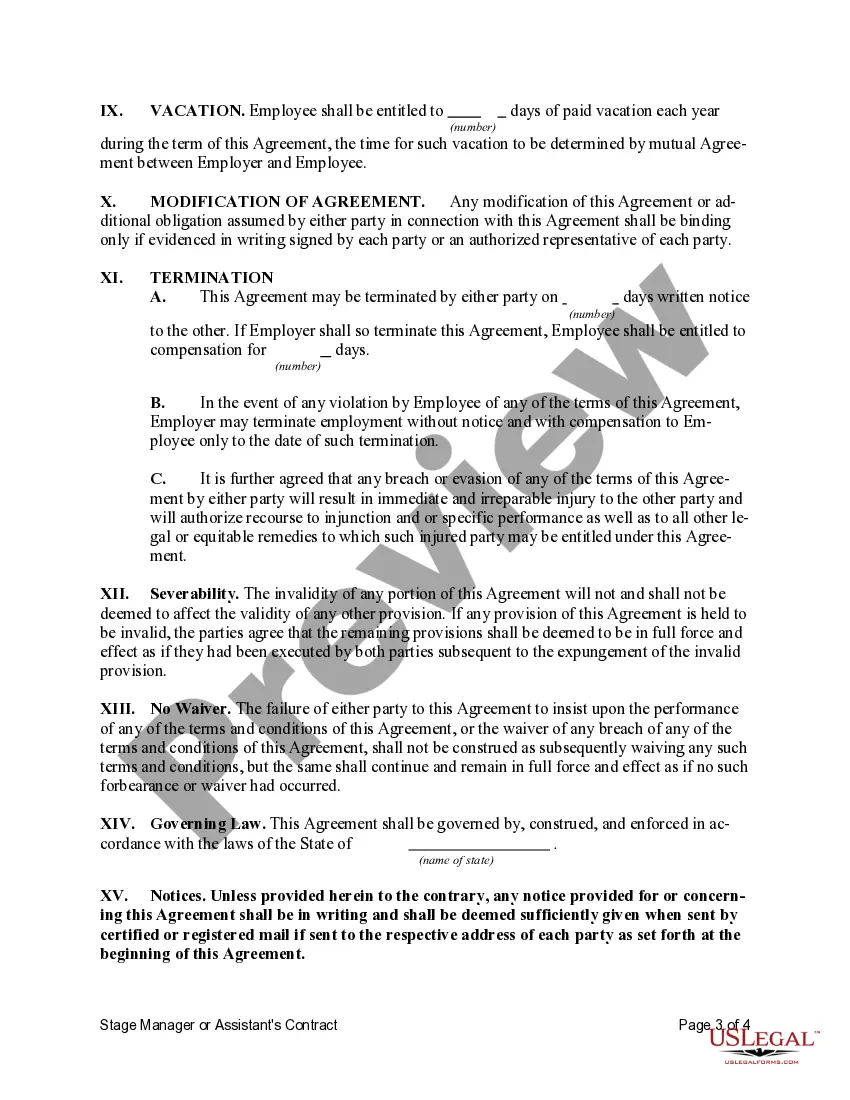

- They are user-friendly with all documents categorized by state and intended use.

- Our experts stay updated with legal amendments, ensuring your paperwork remains current and compliant when acquiring a Stage Manager Contract With Ipad from our site.

- Obtaining a Stage Manager Contract With Ipad is quick and straightforward for returning and new users.

- If you have an account with an active subscription, Log In to save the document sample you require in the correct format.

- If you're new to our site, follow these steps.

Form popularity

FAQ

A Certificate of Satisfaction You'll receive your deed and officially be the sole owner of your home. Note that some lenders may send the certificate of satisfaction directly to you. If this happens, you'll need to file it with your local government yourself.

Here are some of the things mortgage experts recommend you include: The date you're writing the letter. The lender's name, mailing address, and phone number. Your full legal name and loan application number. Your explanation, with references to any supporting documents you're including. Your mailing address and phone number.

In addition the following information should be included: The Payee Name. The Owner(s) of the mortgage holder. Total amount of mortgage. Mortgage date of execution. Full and legal description of the property to include tax parcel number. Acknowledgement that all payments have been made in full.

Whether you get a deed of reconveyance, a full reconveyance or a satisfaction of mortgage document, it means the same thing: your loan has been repaid in full and the lender no longer has an interest in your property. In short, your home is finally all yours!

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

Satisfactions Generally: Once a mortgage or deed of trust is paid, the holder of the mortgage is required to satisfy the mortgage or deed of trust of record to show that the mortgage or deed of trust is no longer a lien on the property.

A mortgage commitment letter is a formal document from your lender stating that you're approved for the loan. Lenders issue a mortgage commitment letter after an applicant successfully completes the preapproval process.