Difference Between Leasing And Purchasing

Description

How to fill out Checklist - Leasing Vs. Purchasing?

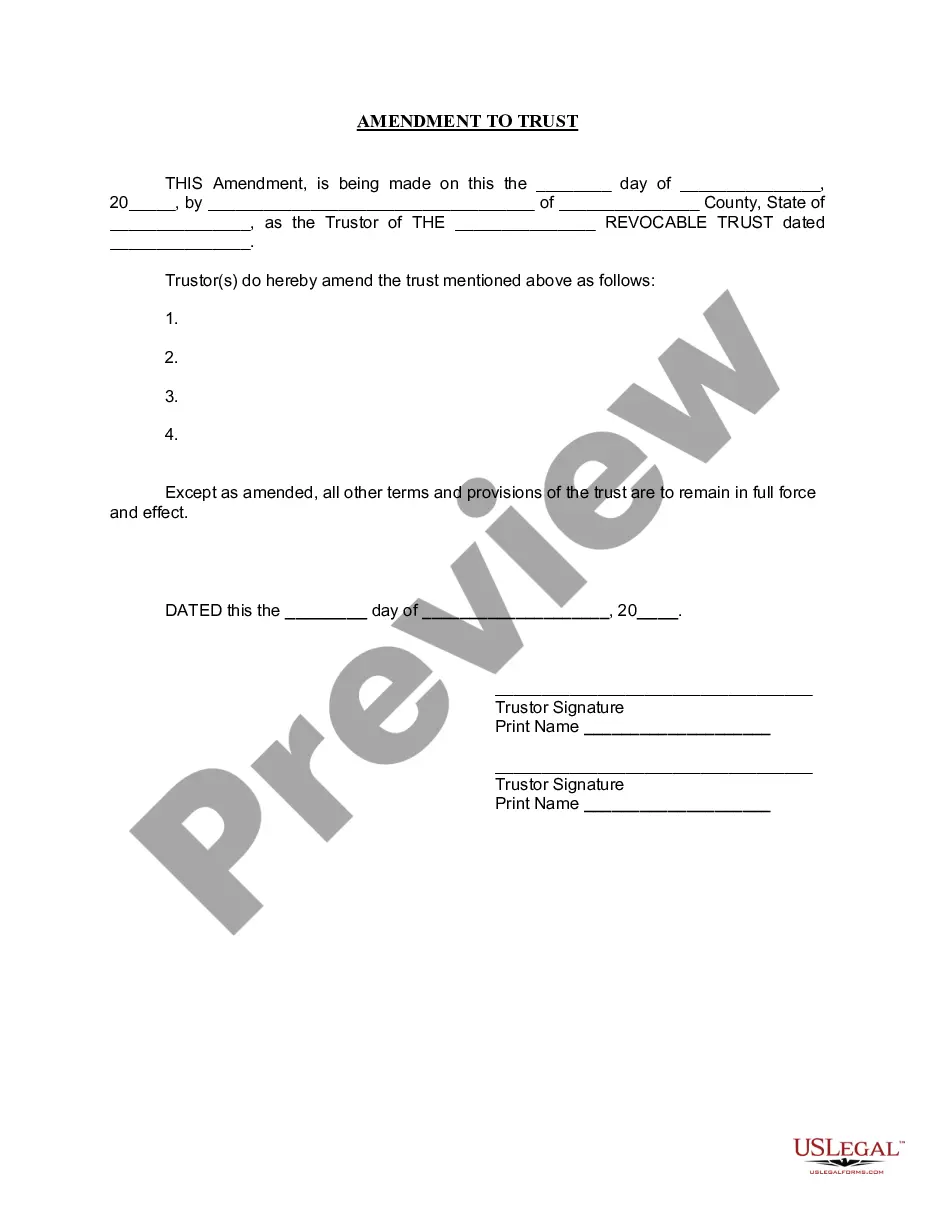

Utilizing legal document examples that comply with federal and local regulations is essential, and the internet provides numerous alternatives to choose from.

However, what is the benefit of wasting time searching for the appropriate Difference Between Leasing And Purchasing example online if the US Legal Forms digital library already contains such templates gathered in one location.

US Legal Forms represents the largest online legal repository with over 85,000 editable templates created by lawyers for any professional and personal situation.

Review the template using the Preview feature or by reading the text description to ensure it satisfies your needs.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts keep up with legislative changes, so you can always trust that your form is current and compliant when obtaining a Difference Between Leasing And Purchasing from our platform.

- Acquiring a Difference Between Leasing And Purchasing is straightforward and quick for both existing and new users.

- If you have an account with an active subscription, Log In and save the document sample you need in your desired format.

- If you are unfamiliar with our site, follow the instructions below.

Form popularity

FAQ

Determining whether you should lease or buy a car depends on a careful assessment of your finances and driving habits. Think about how much you can comfortably afford to pay upfront each month and consider how many miles you spend on the road to figure out the most cost-effective way to hit the highway.

The major advantages of leasing include: You drive the car during its most trouble-free years. You're always driving a late-model vehicle that's usually covered by the manufacturer's new-car warranty. The lease may even include free oil changes and other scheduled maintenance.

The most important factor to consider is that leasing is like renting, and your payments won't go towards owning the car, unless there's an option to purchase it. Instead, you'll need to return the car once the lease ends. To help you choose the best option for you, here are some of the key factors in buying vs.

Difference Between Buying and Leasing. Buying refers to owning the right on an asset or property. On the other hand, leasing refers to the permission granted to entities for using an asset or property on behalf of the owners.

The key difference between a hire purchase (HP) contract and leasing a car is that you will own your car at the end of an HP contract. In contrast, when you lease a car, you'll hand the car back once the contract term is up.