Agreement Between Distributor With Carb

Description

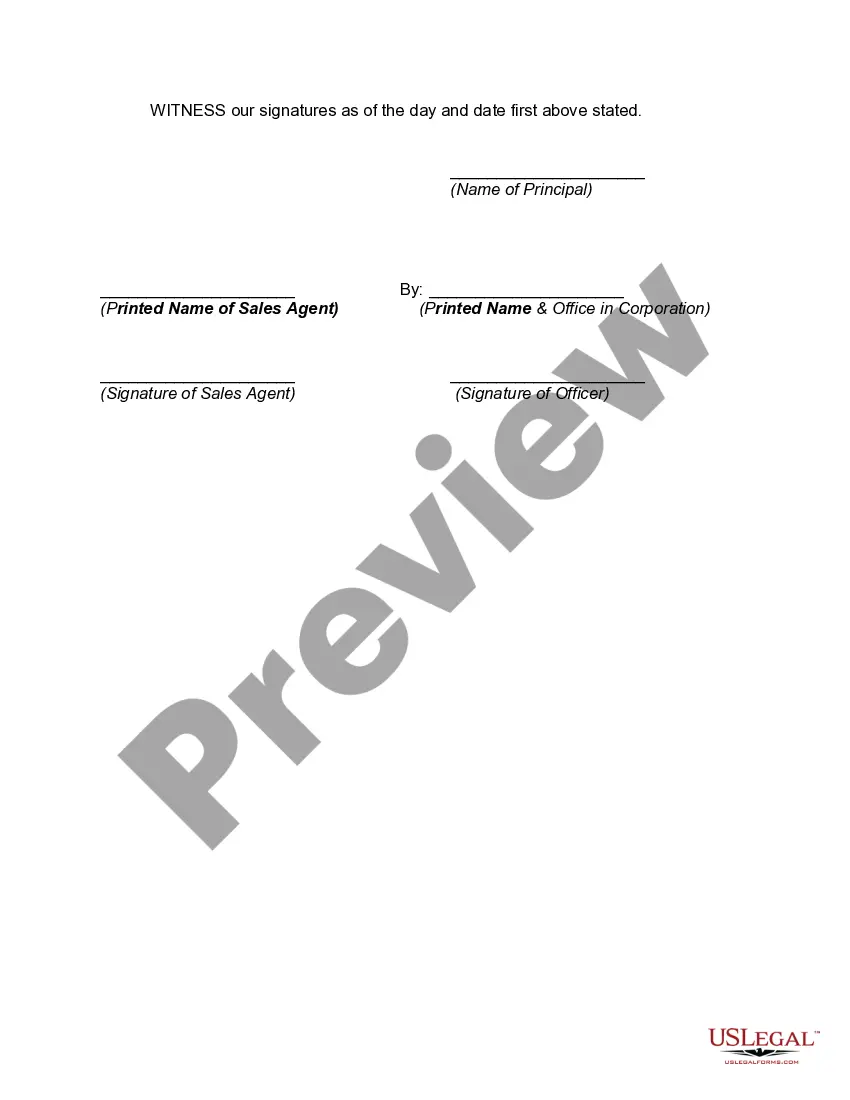

How to fill out Agreement Between Sales Agent And Distributor To Sell Retail Products In An Exclusive Territory?

Utilizing legal templates that adhere to federal and regional regulations is crucial, and the internet presents a variety of choices to choose from.

However, what is the purpose of spending time searching for the appropriately crafted Agreement Between Distributor With Carb sample online if the US Legal Forms digital library already has such templates gathered in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by attorneys for any business and personal situation.

Examine the template using the Preview feature or through the text description to confirm it meets your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts stay updated with legal changes, so you can always be assured your documents are current and compliant when obtaining an Agreement Between Distributor With Carb from our platform.

- Acquiring an Agreement Between Distributor With Carb is straightforward and quick for both existing and new users.

- If you already have an account with a valid subscription, Log In and download the sample document you need in the appropriate format.

- If you are new to our site, follow the instructions below.

Form popularity

FAQ

Renew your license in an inactive status by submitting the completed license renewal application with the license renewal fee. You are not required to complete CE if you renew your license in an inactive status; however, you cannot practice public accountancy while your license is in an inactive status.

Visit the Indiana Board of Accountancy or contact the Indiana Board of Accountancy at (317) 234-8800 or pla14@pla.in.gov.

A minimum of 120 total hours of instruction during the three year reporting period. No less than 20 hours per calendar year. A minimum of 10% of the total hours required for the reporting period must be in Accounting and/or Auditing (A&A). A minimum of 4 hours, for the reporting period, must be in Ethics.

In Indiana, the initial CPA Exam application fee is $170. Each section of the CPA Exam costs $238.15 to take. The re-examination fee is $85. You can apply for a CPA license in Indiana here.

Your certified public accountant license in the state of Indiana is expired. To renew, send this form with the renewal fee of $155.00 and required documentation to the address above, allowing 4 weeks for processing. Make check or money order payable to 'Indiana Professional Licensing Agency'.

In order to earn a certified public accountant license in Indiana, applicants must meet the following requirements: Pass all four sections of the CPA Examination. Indiana CPA experience requirements include the completion of 2 years of experience in government, academia, or public practice verified by an active CPA.

Your certified public accountant license in the state of Indiana has been expired over 3 years. To renew, send this form with the reinstatement fee of $190.00 and required documentation to the address above, allowing 4 weeks for processing. Make check or money order payable to 'Indiana Professional Licensing Agency'.

Indiana CPAs must complete 120 hours of CPE every 3 years including at least 4 hours in Ethics and 12 hours in Accounting or Auditing.