Bankruptcy Unclaimed Funds For Foreigners

Description

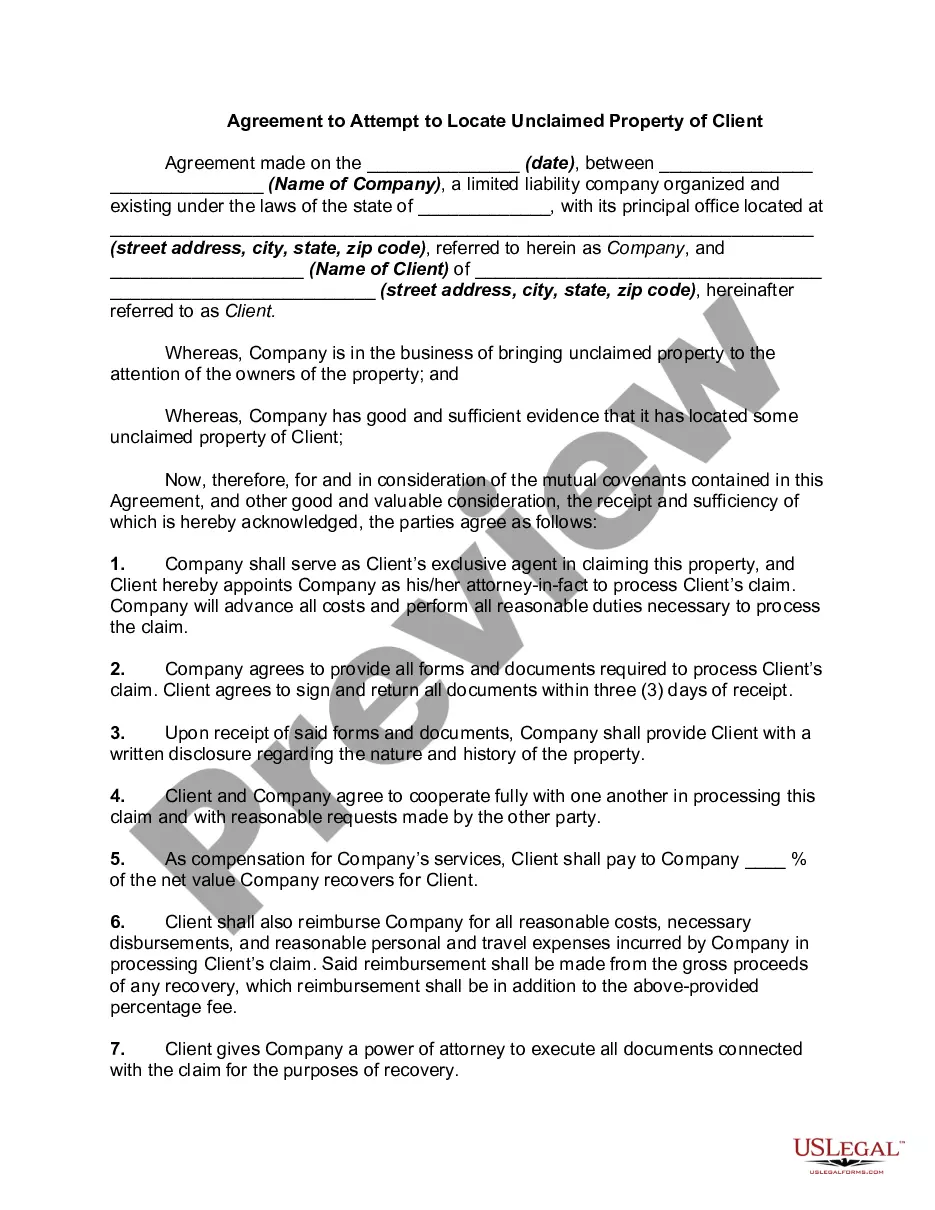

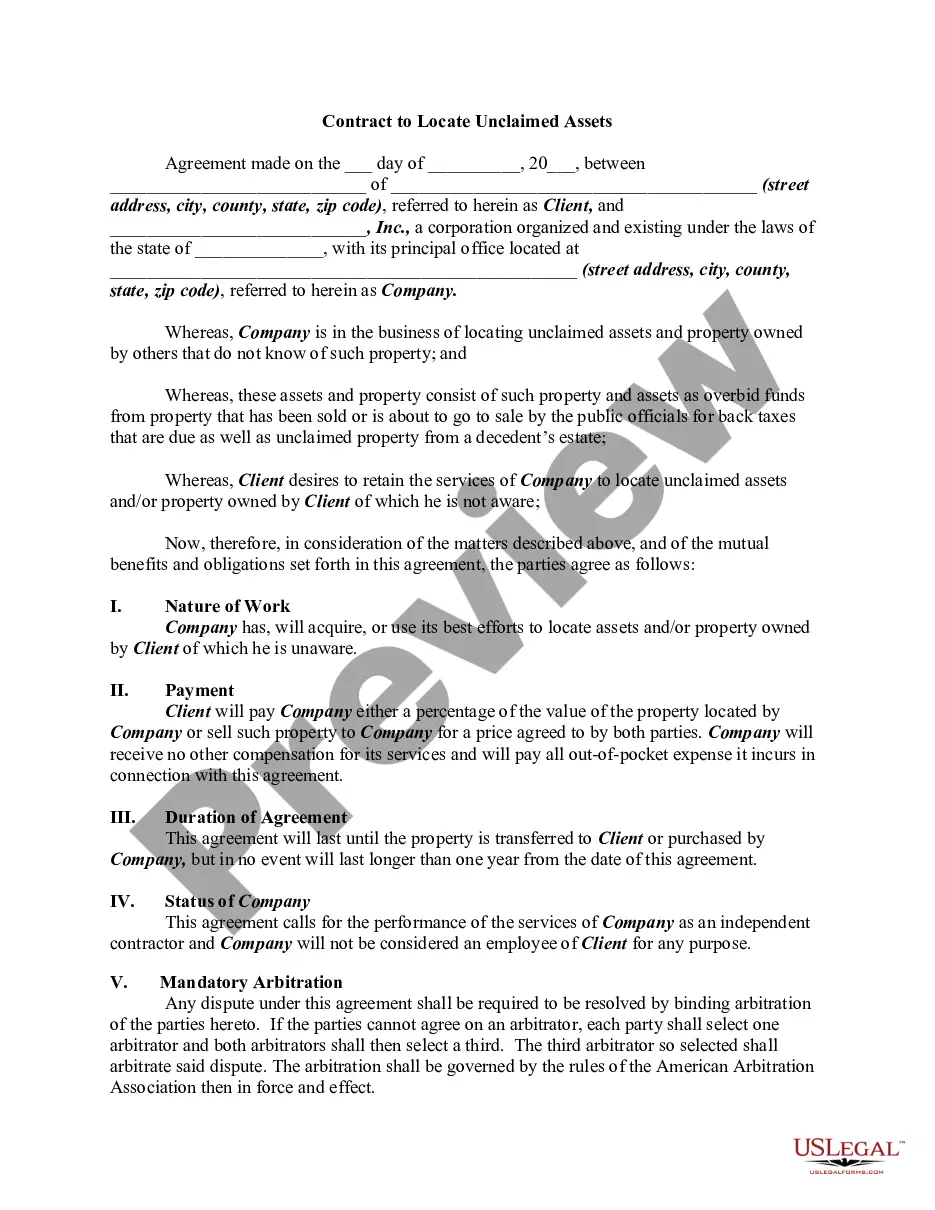

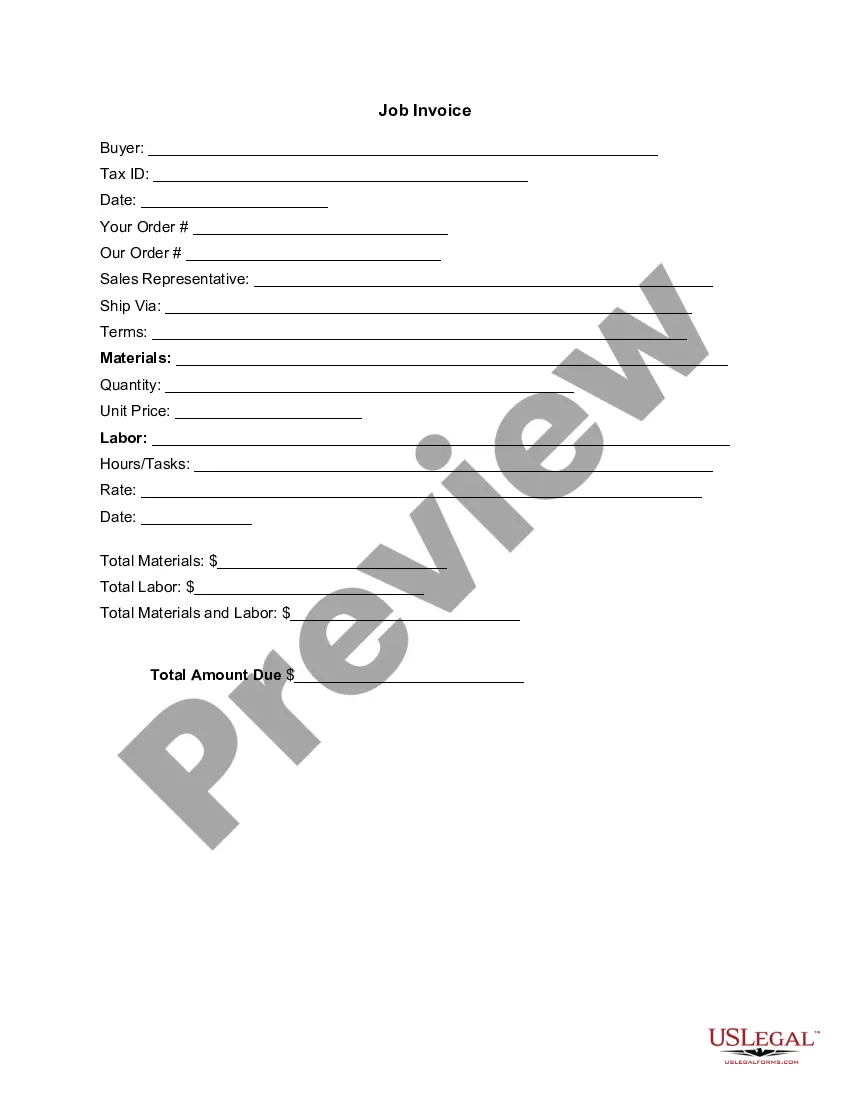

How to fill out Agreement To Attempt To Locate Unclaimed Property Of Client?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is valid, or renew it if necessary.

- Search for the specific bankruptcy form you require in the Preview mode. Make sure it meets your jurisdictional requirements.

- If you need a different form, use the Search tab to find the right template. Confirm it corresponds to your needs.

- Select the document you want. Click on the Buy Now button and choose a subscription plan that fits your needs.

- Complete your purchase using a credit card or PayPal. This will give you access to the necessary resources.

- Download the form to your device. You can access it anytime from the My Forms menu in your profile.

US Legal Forms allows users to create legally sound documents effortlessly. With a library boasting over 85,000 fillable legal forms, you can find what you need quickly and easily.

Don't let paperwork hold you back. Start your journey towards reclaiming your unclaimed funds today with US Legal Forms!

Form popularity

FAQ

Claiming unclaimed bankruptcy funds requires a clear understanding of the process. Begin by identifying where the funds are held and gather relevant documents to support your claim. You can use US Legal Forms to access templates and guides; this can greatly simplify your claim for bankruptcy unclaimed funds for foreigners. A little preparation goes a long way in ensuring you receive what is rightfully yours.

To claim unclaimed funds related to bankruptcy, you should first gather all necessary documentation. This includes your identification and any court documents that show your eligibility. Once you have this information, you can use the US Legal Forms platform to streamline your claim process. Remember, understanding the procedures for bankruptcy unclaimed funds for foreigners can help you efficiently navigate the system.

Foreigners can file for bankruptcy under U.S. bankruptcy laws if they meet specific residency requirements or if their debts arise from U.S. sources. The process can be complex due to various legal factors, so it is wise to seek professional advice to ensure all aspects are handled correctly. For foreigners interested in accessing bankruptcy unclaimed funds, exploring legal platforms like uslegalforms can provide the necessary resources and support.

Yes, you can file for bankruptcy using an ITIN number. This applies to individuals who may not have a Social Security number but need to address their financial situation. If you have unclaimed funds related to a bankruptcy case, it is advisable to consult experts who can guide you through the process tailored specifically for bankruptcy unclaimed funds for foreigners.

Disqualifications for filing bankruptcy can include previous filings within a certain timeframe or failing to attend mandatory credit counseling. Additionally, if you commit fraud or if you have not fully disclosed all your debts, that can hinder your filing. Understanding these factors is essential, especially regarding bankruptcy unclaimed funds for foreigners, as improper filings can complicate your situation.

Yes, you can file for bankruptcy while living in another country, but this depends on your specific circumstances and which country's laws apply. You must demonstrate residency in the U.S. or that your debts primarily arise from U.S. sources. If you are a foreign national interested in bankruptcy unclaimed funds for foreigners, seeking assistance from a legal professional can clarify your eligibility and the process.

Bankruptcy does not directly affect your immigration status. However, it may impact future applications or renewals related to your status, especially if there is a perception of financial instability. It’s crucial to consult an immigration attorney to understand the specific implications for your case. If you are dealing with bankruptcy unclaimed funds for foreigners, you might want professional help to navigate both legal aspects effectively.

To access bankruptcy unclaimed funds for foreigners, you first need to identify if you are entitled to any funds. Begin by checking the relevant state or federal databases that list unclaimed funds. Often, these databases allow you to search using your name or case number. If you find funds in your name, the next step is to follow the instructions provided on the database, which usually involves filing a claim and providing documentation to verify your entitlement.

The recovery of unclaimed property can be taxable, depending on various factors such as the nature of the funds. It is advisable to consult a tax professional to understand your situation fully. US Legal Forms provides guidance on bankruptcy unclaimed funds for foreigners, helping you to navigate taxation aspects effectively.

Yes, unclaimed funds may be reported to the IRS, particularly if they are considered taxable income. It is essential to keep thorough records of any claims you make involving bankruptcy unclaimed funds for foreigners. This helps ensure that you comply with tax requirements and avoid surprises during tax season.