Trust For Name

Description

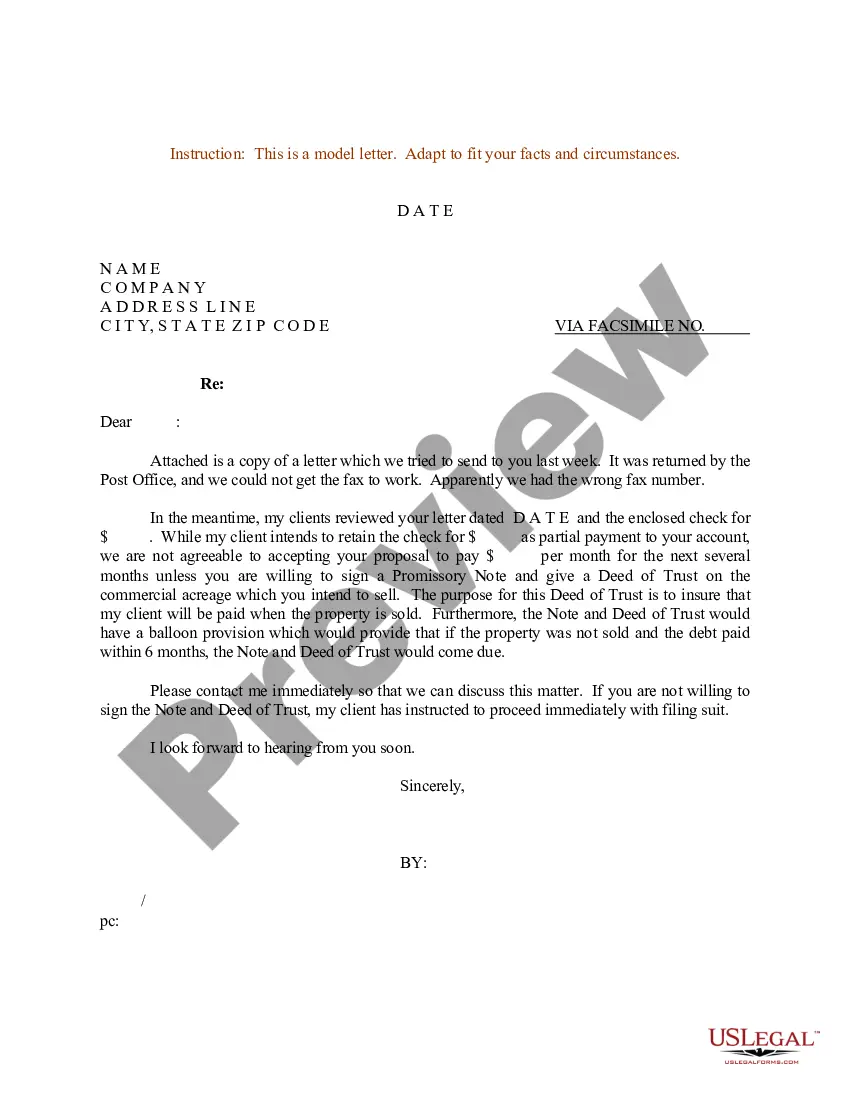

How to fill out Sample Letter For Deed Of Trust And Final Certificate Of Title?

Legal management can be exasperating, even for the most proficient professionals.

When searching for a Trust For Name and unable to devote time to find the suitable and current version, the processes can be taxing.

- A robust online form catalogue could transform the way individuals manage these circumstances effectively.

- US Legal Forms stands as a leader in the online legal forms sector, offering over 85,000 state-specific legal forms available for your convenience.

- With US Legal Forms, you gain access to state- or county-specific legal and organizational forms.

Form popularity

FAQ

The Texas tax power of attorney (Form 01-137) designates an agent to represent a taxpayer before the Texas Comptroller of Public Accounts. In most cases, it is accountants or attorneys that are appointed, although any individual can be named as the taxpayer's agent.

You can work with an attorney, use estate planning software or download Texas' Statutory Durable Power of Attorney or Medical Power of Attorney Designation of Health Care Agent forms to print and fill out yourself. Choose your agent and detail the authority you'd like them to have.

We often hear the question, ?does the power of attorney need to be notarized in Texas?? The answer is yes; the document and any changes to it should be formally notarized. Once these steps are completed, power of attorney is validly granted.

A Texas Tax Power of Attorney (Form 85-113) must be filled out to designate someone to represent you in tax matters that concern you before the Texas Comptroller of Public Accounts. This power of attorney grants the person you appoint the power to see your tax information and make filings and decisions on your behalf.

Where to get a power of attorney form in Texas. You can access Texas power of attorney forms for free online: The Texas Health & Human Services website offers Texas financial power of attorney forms. The Texas Health & Safety Code website offers a Texas medical power of attorney template.

In order for this power of attorney to be valid it must be notarized, but it doesn't need to be signed by any witnesses like a will does. You do not need to file a power of attorney at the courthouse unless you want your agent to be able to act on your behalf in regards to a real estate transaction.

A statutory or durable power of attorney gives an agent permission to access bank accounts, sell property and make other important decisions when the principal becomes incapacitated or unable to make decisions. It stays in effect until revoked or until the principal dies.