Executor Settlement With An Insurance Company

Description

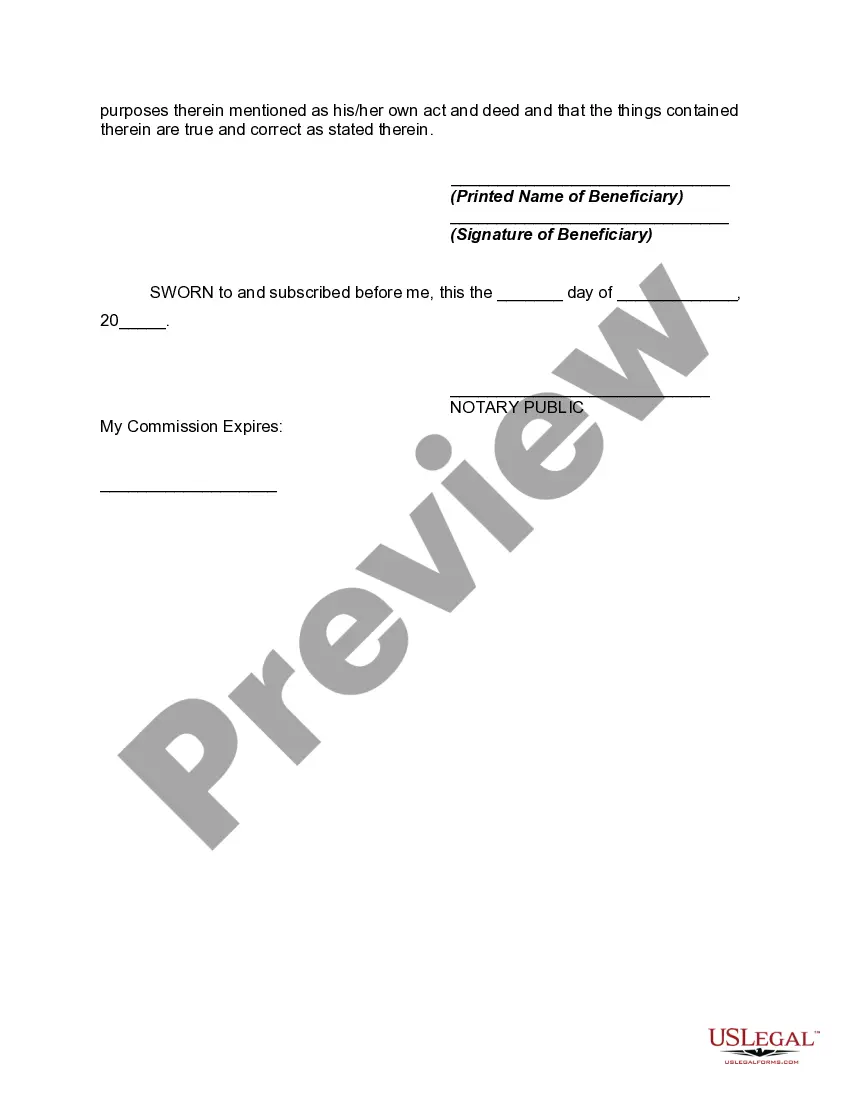

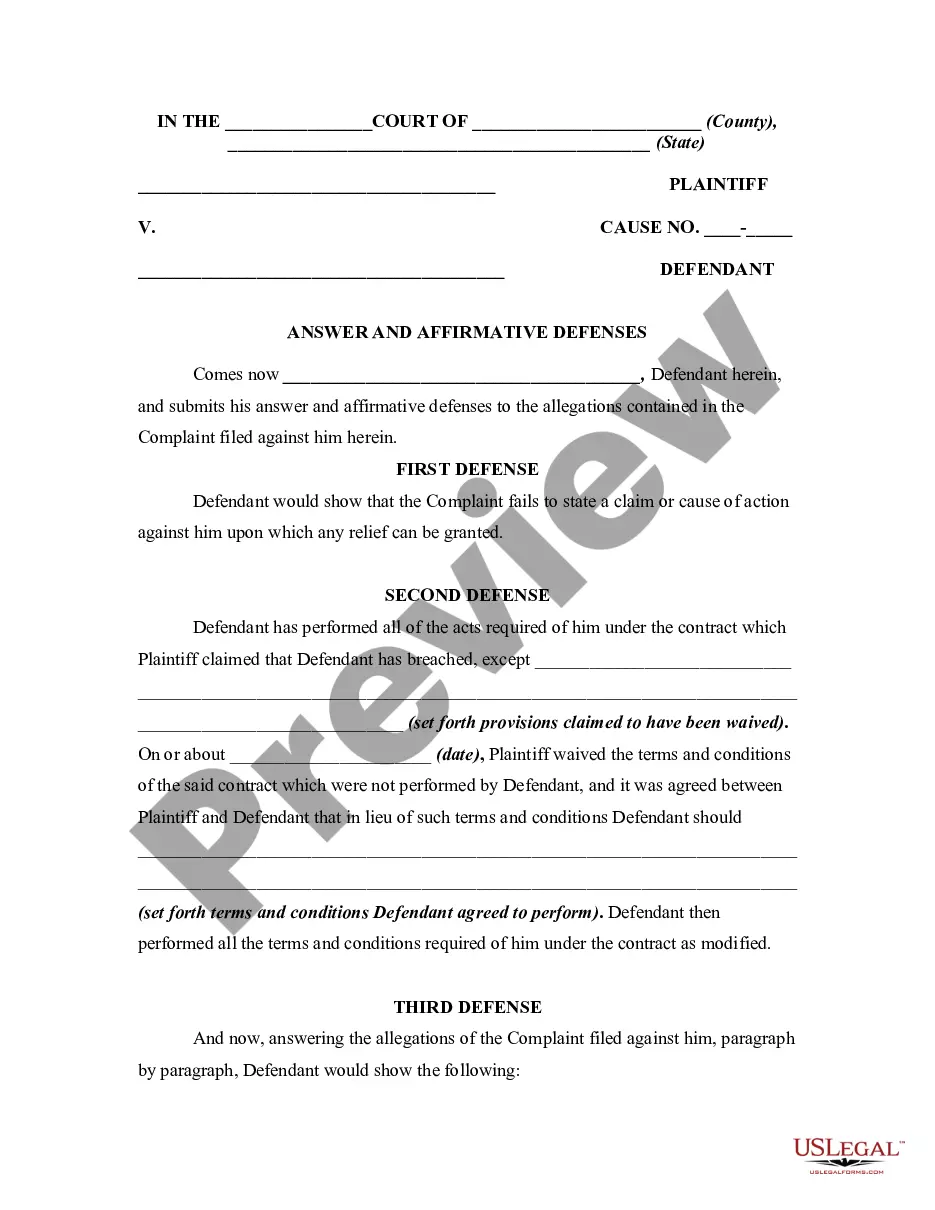

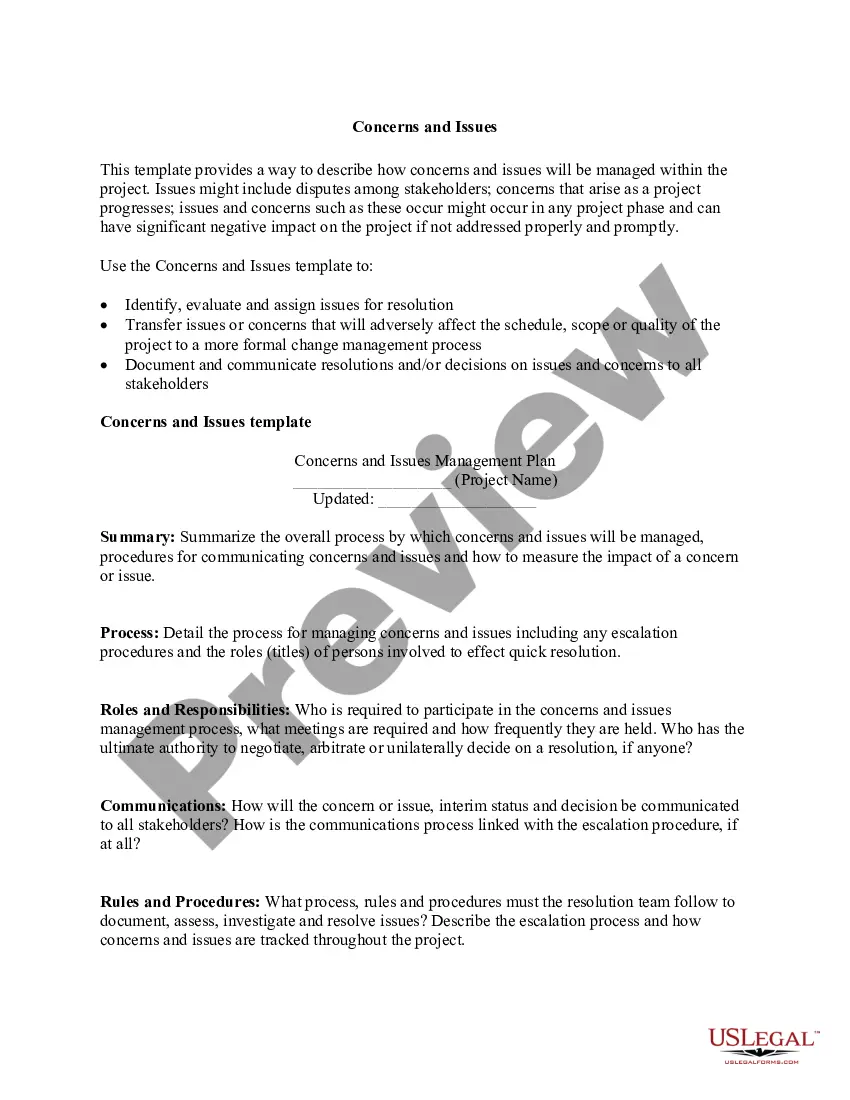

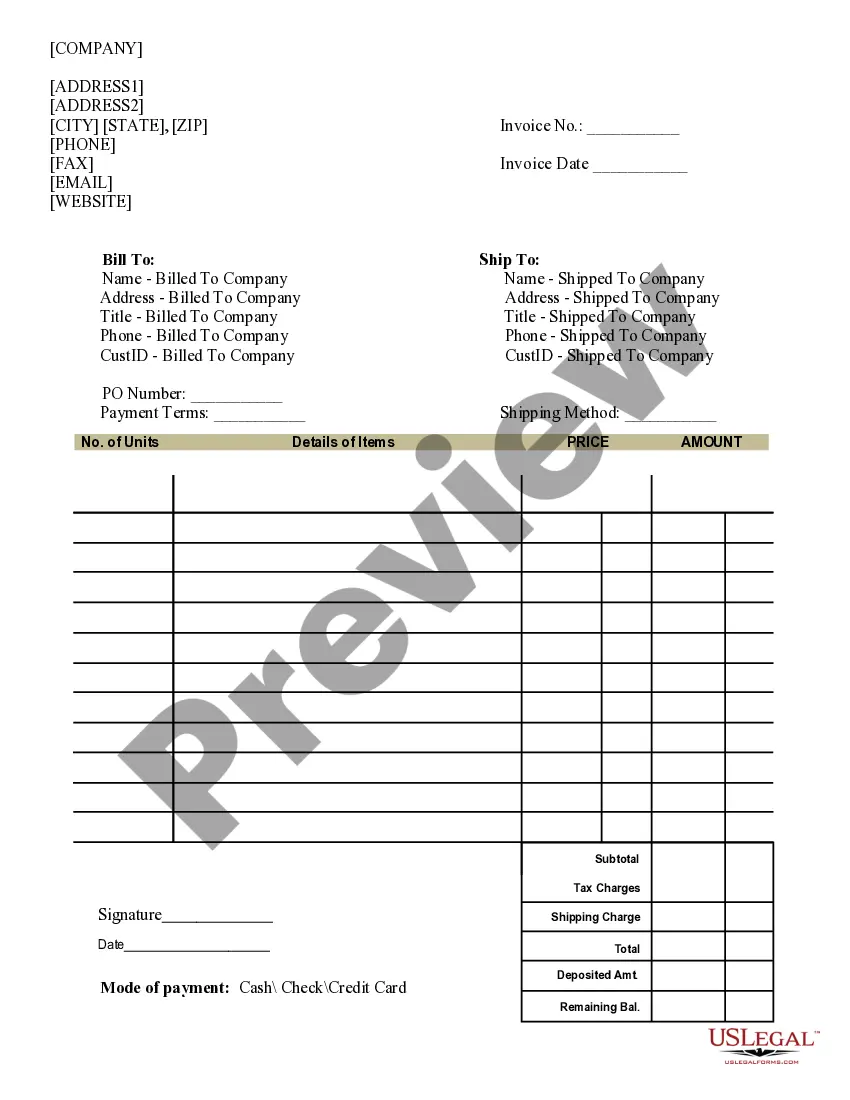

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

Creating legal documents from the ground up can occasionally be overwhelming. Certain situations may require extensive research and significant financial investment.

If you’re looking for a simpler and more cost-effective method of preparing Executor Settlement With An Insurance Company or any other forms without unnecessary complications, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal affairs. With just a few clicks, you can quickly obtain state- and county-compliant templates meticulously crafted for you by our legal experts.

Utilize our platform whenever you need reliable and trusted services through which you can swiftly locate and download the Executor Settlement With An Insurance Company. If you’re familiar with our services and have previously created an account with us, simply Log In to your account, find the template, and download it or re-download it at any time in the My documents section.

Ensure that the template you choose meets the requirements of your state and county. Select the most appropriate subscription option to purchase the Executor Settlement With An Insurance Company. Download the file, then complete, verify, and print it out. US Legal Forms has a solid reputation and over 25 years of experience. Join us today and make form execution a simple and efficient process!

- Not registered yet? No problem.

- It requires minimal time to set it up and browse the catalog.

- But before proceeding directly to downloading Executor Settlement With An Insurance Company, consider these suggestions.

- Check the document preview and descriptions to ensure you have the correct form.

Form popularity

FAQ

They have substantive responsibility for the financial settlement of an estate including the responsibility to see that estate taxes are paid. Even if the executor does not receive estate distributions as a beneficiary, the executor may be held personally liable for the taxes.

Executor may become liable if assets are lost, destroyed or wasted if proper precautions are not taken to preserve those assets. Executor has a duty to warn beneficiaries if there is a threat to the estate 11 assets.

Serving as an executor or trustee is a significant responsibility that requires careful consideration. While there are benefits, such as personal satisfaction and potential compensation, there are also drawbacks, including time commitment, emotional strain, and potential legal liability.

If an executor distributes the assets of an estate without obtaining a clearance certificate, he or she may be personally liable for any unpaid taxes, interest and penalties owed by the estate.

On the point of mistakes, it is often mistakenly thought that any debts of the deceased die with them. In fact, executors are responsible for dealing with the financial liabilities of the deceased, which includes recognising any debts of the estate and ensuring they are paid from the available funds.