Executor Distribution Beneficiary Force

Description

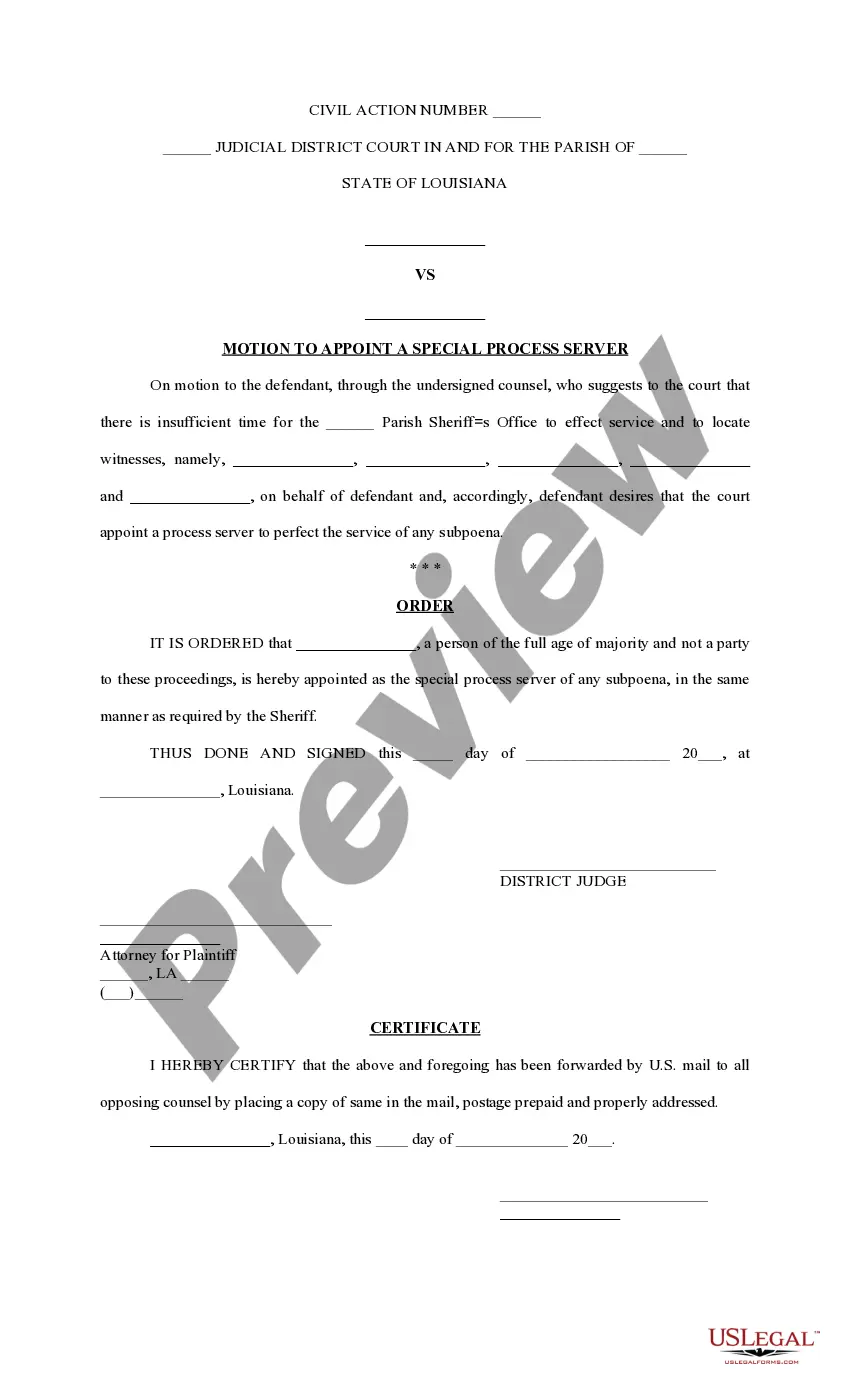

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

Legal management may be overpowering, even for the most experienced professionals. When you are interested in a Executor Distribution Beneficiary Force and don’t get the a chance to devote in search of the right and updated version, the operations may be demanding. A robust online form catalogue might be a gamechanger for anyone who wants to manage these situations effectively. US Legal Forms is a industry leader in online legal forms, with over 85,000 state-specific legal forms available anytime.

With US Legal Forms, you can:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any demands you could have, from individual to enterprise documents, all-in-one spot.

- Utilize advanced tools to complete and manage your Executor Distribution Beneficiary Force

- Gain access to a resource base of articles, tutorials and handbooks and materials related to your situation and requirements

Help save time and effort in search of the documents you need, and use US Legal Forms’ advanced search and Preview tool to discover Executor Distribution Beneficiary Force and acquire it. For those who have a subscription, log in for your US Legal Forms profile, look for the form, and acquire it. Take a look at My Forms tab to view the documents you previously downloaded and also to manage your folders as you see fit.

Should it be your first time with US Legal Forms, register a free account and get unrestricted usage of all advantages of the platform. Listed below are the steps to consider after downloading the form you want:

- Verify this is the right form by previewing it and reading through its description.

- Be sure that the sample is acknowledged in your state or county.

- Choose Buy Now when you are ready.

- Choose a subscription plan.

- Pick the format you want, and Download, complete, eSign, print out and send out your papers.

Enjoy the US Legal Forms online catalogue, supported with 25 years of expertise and reliability. Enhance your everyday papers management in a smooth and user-friendly process right now.

Form popularity

FAQ

As a beneficiary you are entitled to information regarding the trust assets and the status of the trust administration from the trustee. You are entitled to bank statements, receipts, invoices and any other information related to the trust.

Hear this out loud PauseA distribution is any money paid to the benefit or care of the beneficiary. After all of the disbursements are made, the deceased's outstanding debts are settled, and all final taxes are paid, the executor can distribute the remaining assets to the beneficiaries.

Hear this out loud PauseMost assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

Hear this out loud PauseA beneficiary can override an executor if the executor fails to follow the terms of the Will. Beneficiaries can override an executor if the executor breaches their fiduciary duty. A beneficiary who simply disagrees with an executor or does not like the executor's decisions cannot override the executor.

Hear this out loud PauseIf a beneficiary requests access to financial institution statements and the executor refuses to provide them, the beneficiary can take legal action. They can follow the court for an order compelling the executor to reveal the requested information.