Executor Beneficiary Pertaining Withdrawal

Description

How to fill out Release And Exoneration Of Executor On Distribution To Beneficiary Of Will And Waiver Of Citation Of Final Settlement?

Whether for commercial reasons or personal matters, everyone must confront legal circumstances at some stage in their life.

Filling out legal documents requires meticulous care, beginning with choosing the appropriate form template.

Once it is downloaded, you can fill out the form using editing software or print it and complete it manually. With an extensive US Legal Forms catalog available, you never need to waste time searching for the appropriate template online. Utilize the library’s simple navigation to find the correct form for any circumstance.

- For example, if you select an incorrect version of the Executor Beneficiary Pertaining Withdrawal, it will be declined upon submission.

- Thus, it is crucial to obtain a trustworthy source of legal paperwork like US Legal Forms.

- If you need to acquire an Executor Beneficiary Pertaining Withdrawal template, adhere to these straightforward steps.

- Locate the template you require by utilizing the search box or catalog navigation.

- Review the form’s details to ensure it aligns with your situation, state, and county.

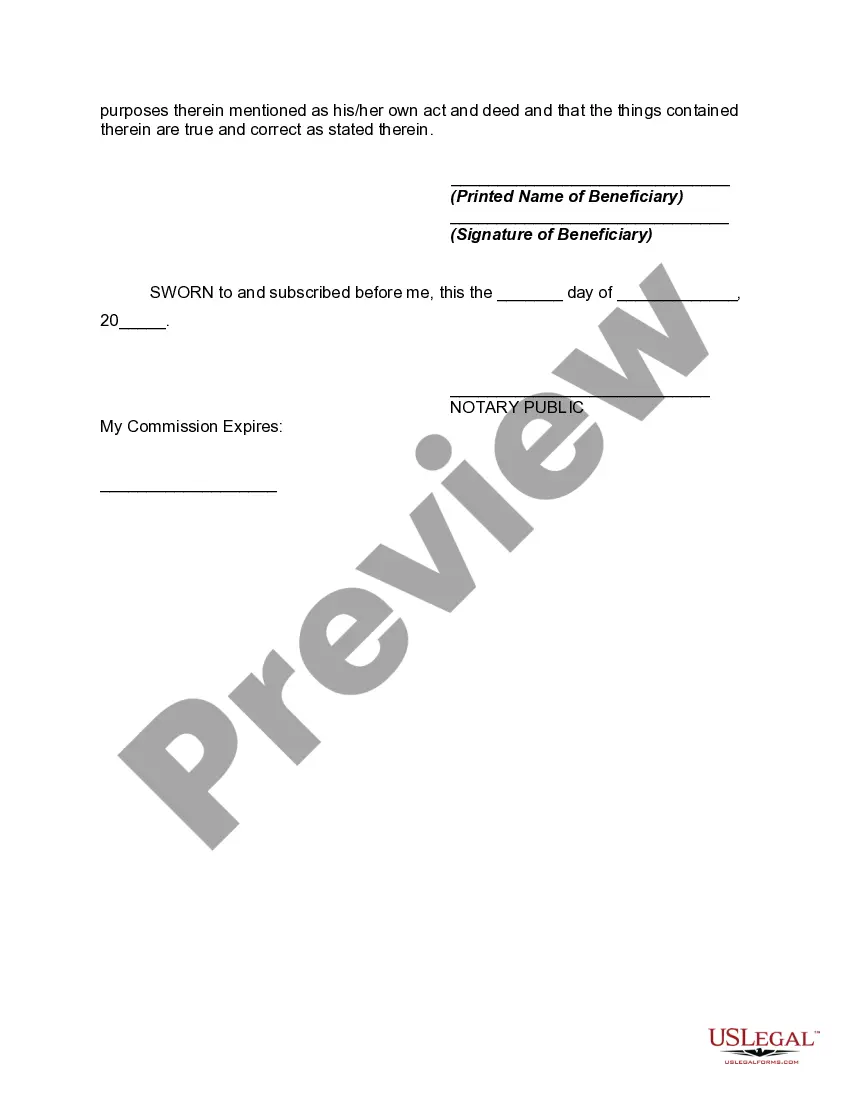

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search function to locate the Executor Beneficiary Pertaining Withdrawal template you need.

- Obtain the template when it corresponds to your requirements.

- If you already possess a US Legal Forms account, click Log in to access previously saved documents in My documents.

- In case you don’t have an account yet, you can acquire the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the profile registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the document format you desire and download the Executor Beneficiary Pertaining Withdrawal.

Form popularity

FAQ

Report income distributions to beneficiaries and to the IRS on Schedule K-1 (Form 1041). For calendar year estates and trusts, file Form 1041 and Schedule(s) K-1 on or before April 15 of the following year.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

An executor cannot change beneficiaries' inheritances or withhold their inheritances unless the will has expressly granted them the authority to do so. The executor also cannot stray from the terms of the will or their fiduciary duty.

Most assets can be distributed by preparing a new deed, changing the account title, or by giving the person a deed of distribution. For example: To transfer a bank account to a beneficiary, you will need to provide the bank with a death certificate and letters of administration.

Yes, in their capacity as the people who handle deceased's estates and execute their Wills, executors can move funds from a deceased's bank account to an estate account and take from it to pay estate debts, taxes, etc., but not as their own.