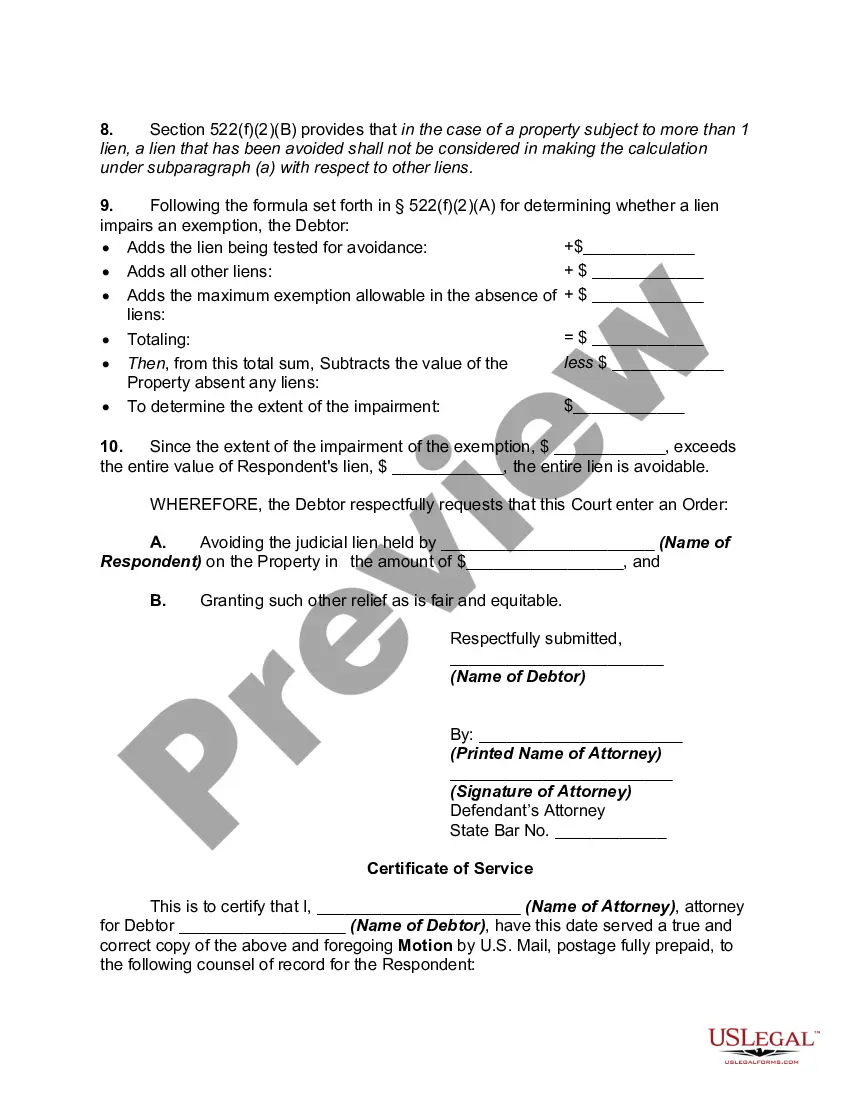

Creditors On Lien

Description

How to fill out Motion To Avoid Creditor's Lien?

Acquiring legal documents that adhere to federal and state laws is crucial, and the internet provides numerous options to select from.

However, what is the purpose of expending time searching for the appropriate Creditors On Lien example online when the US Legal Forms online repository already compiles such documents in a single location.

US Legal Forms is the largest online legal repository boasting over 85,000 editable documents crafted by attorneys for any professional and personal situation. They are easy to navigate with all files organized by state and intended use. Our experts stay updated with legal amendments, ensuring that your form is current and compliant when acquiring a Creditors On Lien from our site.

Press Buy Now once you’ve found the correct form and choose a subscription plan. Create an account or sign in, then complete your payment using PayPal or a credit card. Select the format for your Creditors On Lien and download it. All templates available through US Legal Forms are reusable. To re-download and fill out previously acquired forms, access the My documents tab in your account. Experience the most comprehensive and user-friendly legal document service!

- Acquiring a Creditors On Lien is quick and straightforward for both existing and new users.

- If you already possess an account with a valid subscription, Log In and store the document template you require in the desired format.

- If you are new to our site, follow the steps outlined below.

- Review the template using the Preview feature or through the text description to ensure it satisfies your needs.

- If necessary, search for another sample using the search function located at the top of the page.

Form popularity

FAQ

The difference between a lien and a non-lien lies in the legal claim over an asset. A lien signifies a creditor’s right to seize property if debts are unpaid, whereas a non-lien implies that the creditor has no claim over the asset. Understanding these differences is vital for anyone managing finances, especially when dealing with creditors on lien.

To be an independent contractor, someone should legally own a business. An independent contractor may not have benefits such as minimum wage, overtime, workers' compensation, health benefits or protections from workplace harassment.

Write the contract in six steps Start with a contract template. ... Open with the basic information. ... Describe in detail what you have agreed to. ... Include a description of how the contract will be ended. ... Write into the contract which laws apply and how disputes will be resolved. ... Include space for signatures.

An independent contractor agreement is a contract that lays out the terms of the independent contractor's work. It covers the contractual obligations, scope, and deadlines of the work to be performed. It affirms that the client and contractor are not in an employer-employee relationship.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them.

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.

Becoming an Independent Contractor Working as an Independent Contractor. Decide on Your Business Structure. Apply for a Tax ID Number and Other Tax Registrations. Register Your Business Name. Open Your Business Checking Account. Set up Your Business Record Keeping System. Frequently Asked Questions.

The IRS requires contractors to fill out a Form W-9, request for Taxpayer Identification Number and Certification, which you should keep on file for at least four years after the hiring. This form is used to request the correct name and Taxpayer Identification Number, or TIN, of the worker or their entity.

How to Write a Contractor Agreement Outline Services Provided. The contractor agreement should list all services the contractor will provide. ... Document Duration of the Work. Specify the duration of the working relationship. ... Outline Payment Terms. ... Outline Confidentiality Agreement. ... Consult with a Lawyer.