Complaint Wages File With Irs

Description

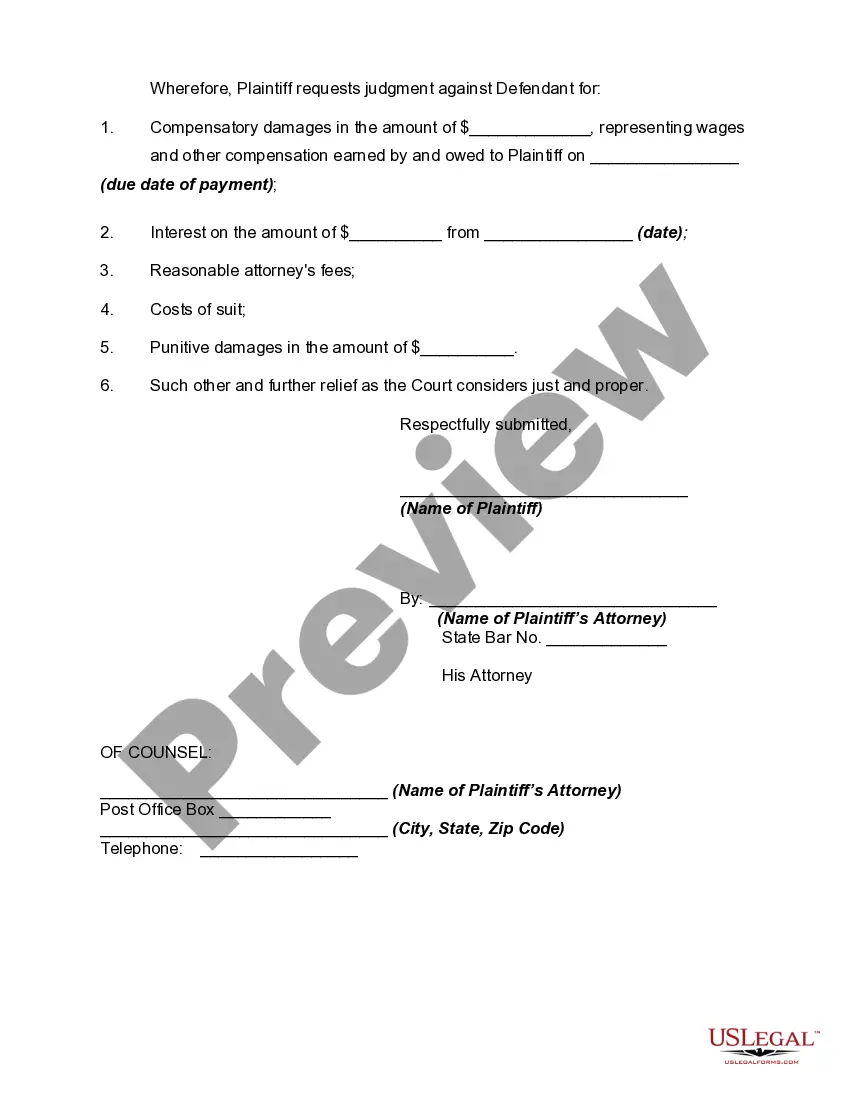

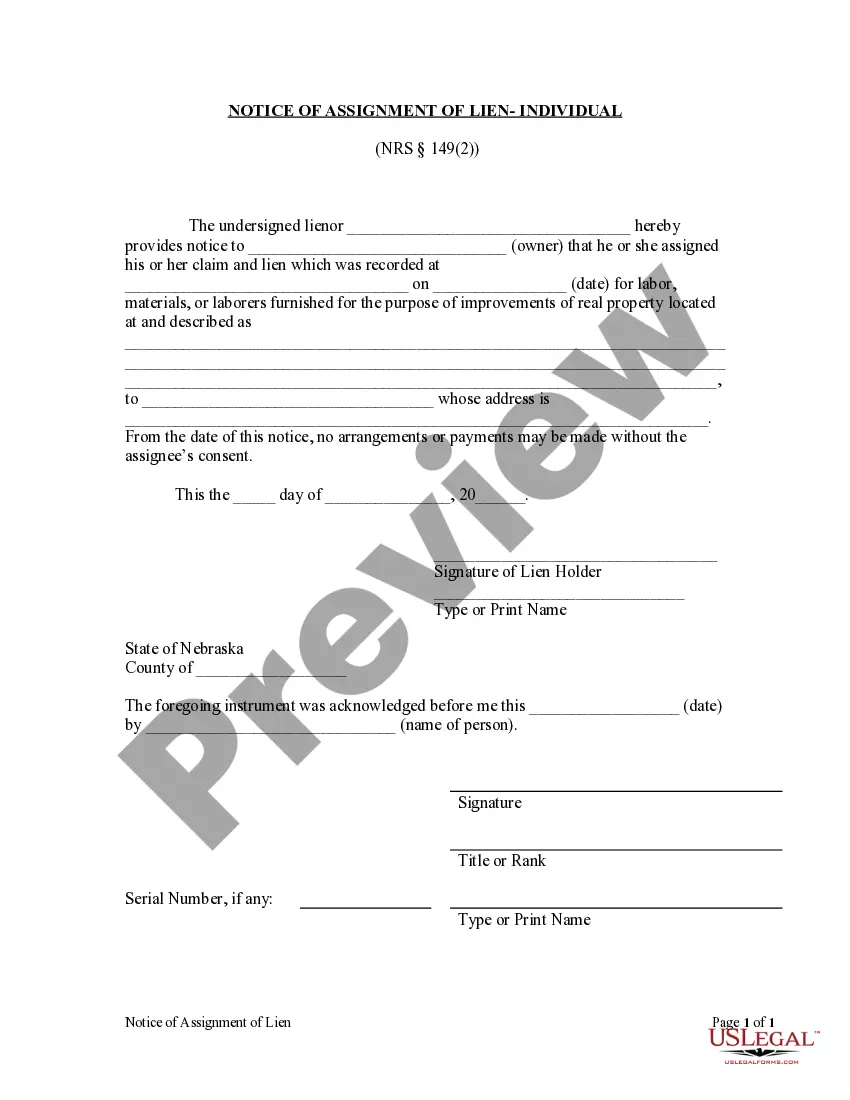

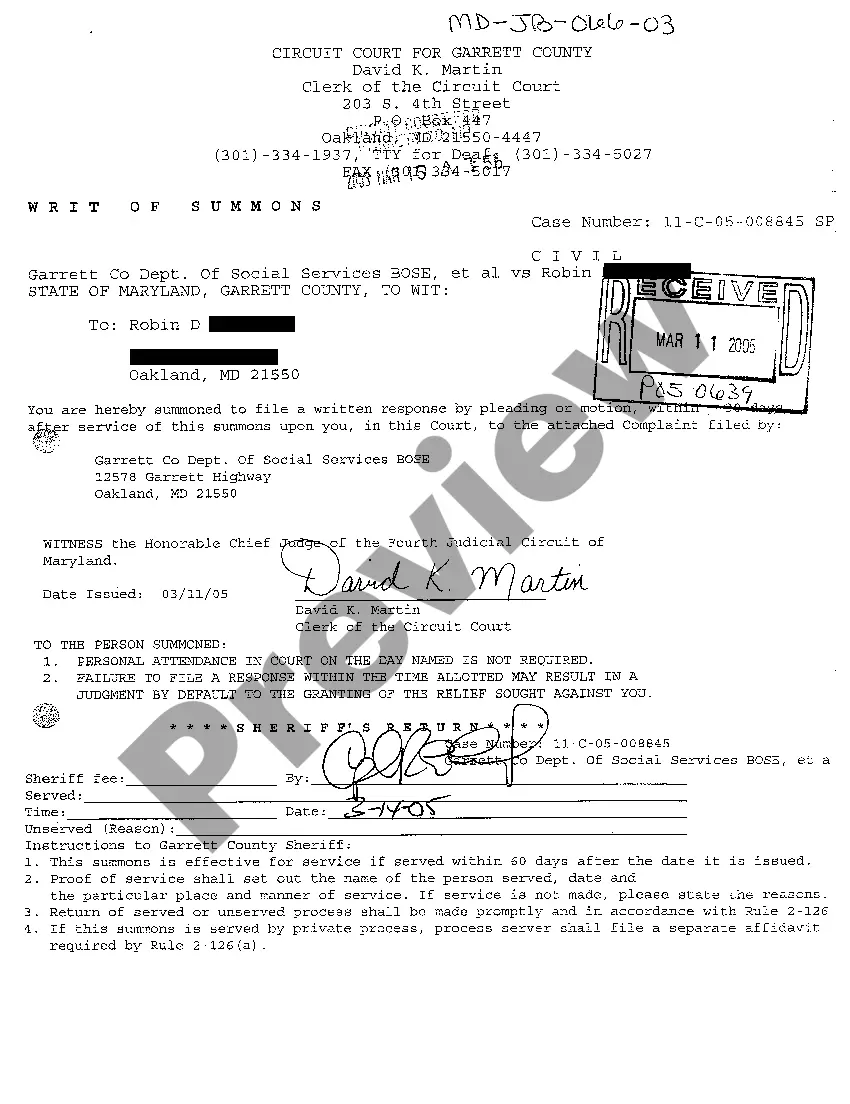

How to fill out Complaint For Recovery Of Unpaid Wages?

Whether for business purposes or for individual matters, everybody has to manage legal situations at some point in their life. Filling out legal paperwork needs careful attention, beginning from selecting the appropriate form template. For instance, when you select a wrong edition of the Complaint Wages File With Irs, it will be turned down once you submit it. It is therefore important to get a dependable source of legal documents like US Legal Forms.

If you need to get a Complaint Wages File With Irs template, follow these simple steps:

- Find the template you need using the search field or catalog navigation.

- Examine the form’s information to make sure it suits your case, state, and region.

- Click on the form’s preview to examine it.

- If it is the incorrect form, get back to the search function to locate the Complaint Wages File With Irs sample you need.

- Download the template when it matches your needs.

- If you have a US Legal Forms profile, simply click Log in to access previously saved templates in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the profile registration form.

- Select your transaction method: you can use a credit card or PayPal account.

- Pick the document format you want and download the Complaint Wages File With Irs.

- After it is downloaded, you are able to complete the form with the help of editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you don’t have to spend time searching for the appropriate template across the web. Utilize the library’s simple navigation to get the appropriate form for any occasion.

Form popularity

FAQ

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more. ... You may need to make estimated tax payments.

Use Form 14157-A if (1) a tax return preparer filed a Form 1040 series tax return or altered your Form 1040 series tax return information without your knowledge or consent AND (2) you are seeking a change to your tax account.

Use the Form 3949-A, Information Referral if you suspect an individual or a business is not complying with the tax laws. You can submit Form 3949-A online or by mail. We don't take tax law violation referrals over the phone.

If you have a general complaint about an IRS employee, contact the Treasury Inspector General for Tax Administration (TIGTA).

Report Fraud, Waste and Abuse to Treasury Inspector General for Tax Administration (TIGTA), if you want to report, confidentially, misconduct, waste, fraud, or abuse by an IRS employee or a Tax Professional, you can call 800-366-4484 (800-877-8339 for TTY/TDD users). You can remain anonymous.