Promissory Note Sample With Collateral

Description

How to fill out Checklist - Items To Consider For Drafting A Promissory Note?

How to locate professional legal documents that adhere to your state's regulations and create the Promissory Note Sample With Collateral without hiring a lawyer.

Numerous online services offer templates to address various legal situations and formalities.

However, it may require time to determine which of the accessible samples meet both your needs and legal criteria.

Download the Promissory Note Sample With Collateral using the related button next to the file name.

- US Legal Forms is a trustworthy platform that assists you in finding formal documents drafted in line with the latest state law amendments and helps save on legal expenses.

- US Legal Forms is distinctive from a typical web library.

- It boasts a collection of over 85,000 verified templates for diverse business and personal circumstances.

- All documents are organized by area and state to expedite your search process and enhance convenience.

- Moreover, it collaborates with powerful solutions for PDF editing and electronic signing, enabling users with a Premium subscription to fill out their forms online effortlessly.

- It requires minimal effort and time to acquire the necessary documentation.

- If you already possess an account, Log In and ensure your subscription is active.

Form popularity

FAQ

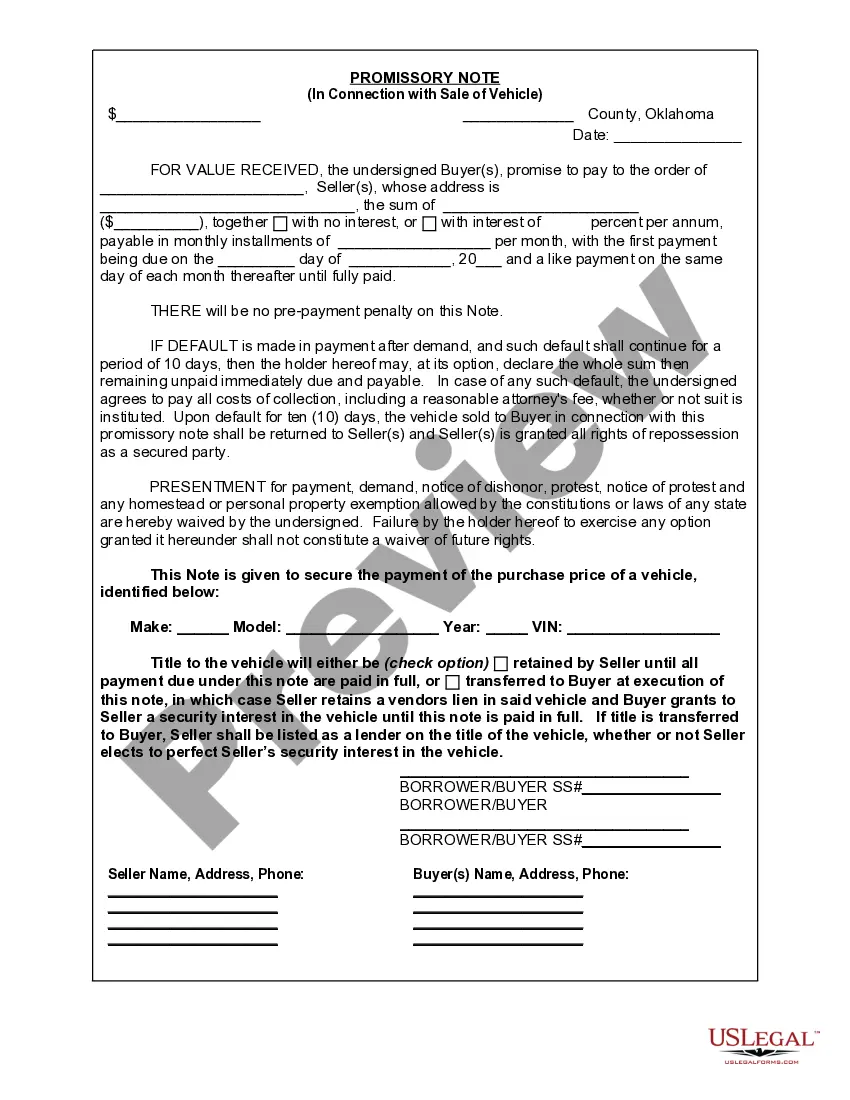

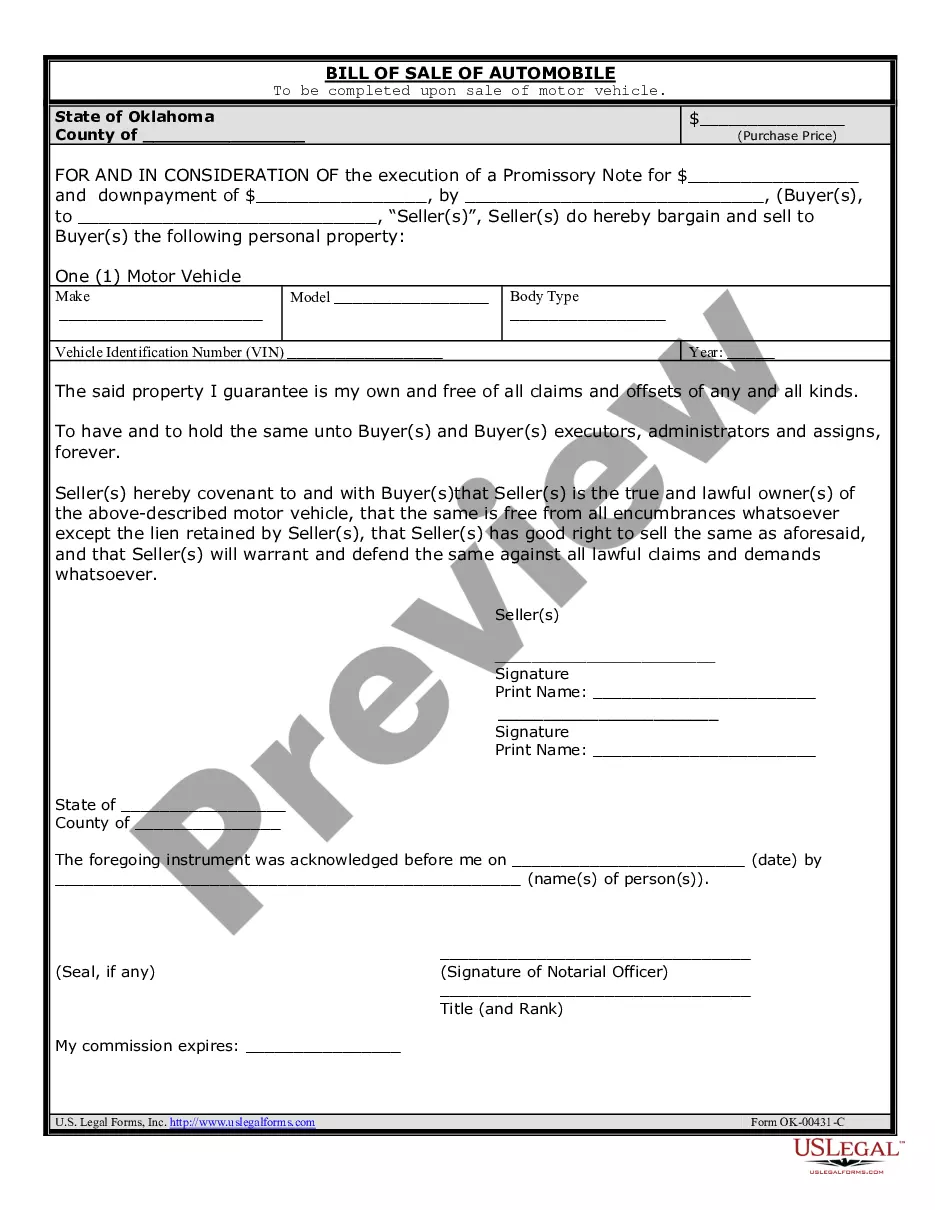

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A secured promissory note should clearly identify the collateral backing the loan. For example, if collateral is being secured by business vehicles, the note should provide their vehicle identification numbers. A small business that is extending credit should also verify collateral is worth enough to cover the debt.

Secured Promissory NotesThe property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.