Charitable Nonprofit Exempt Form Ny

Description

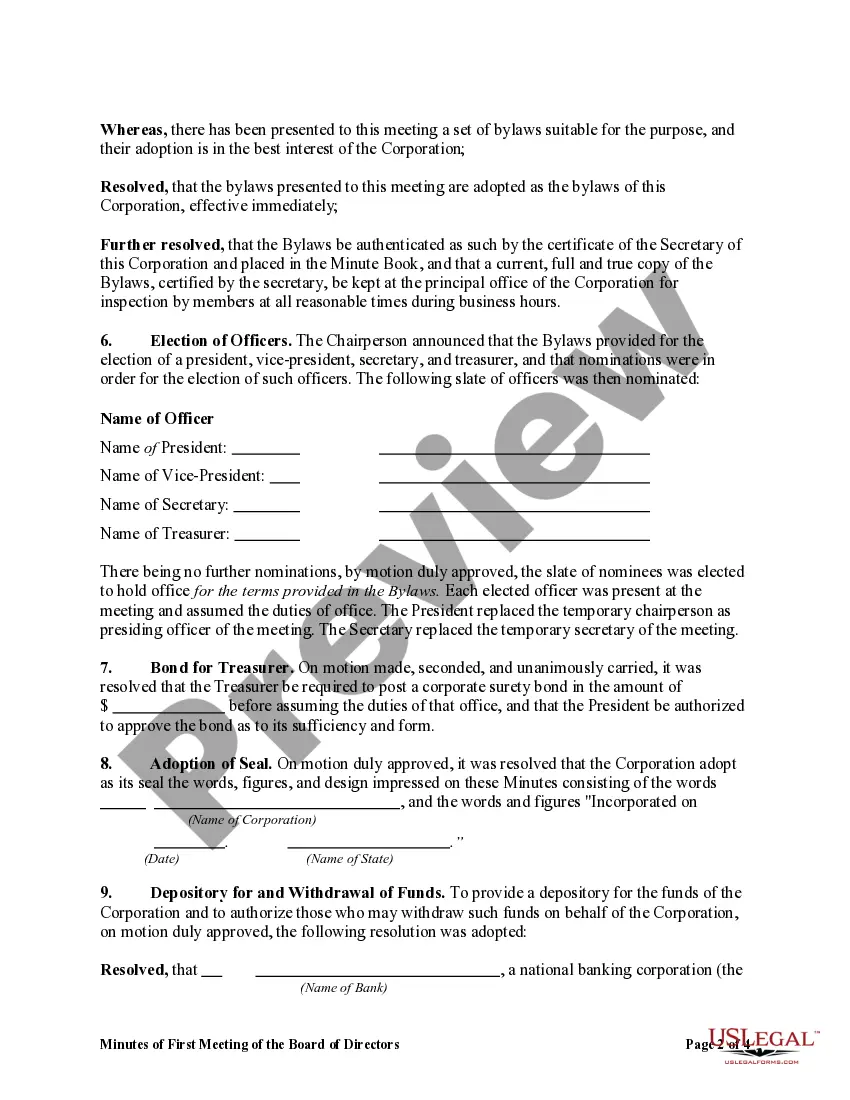

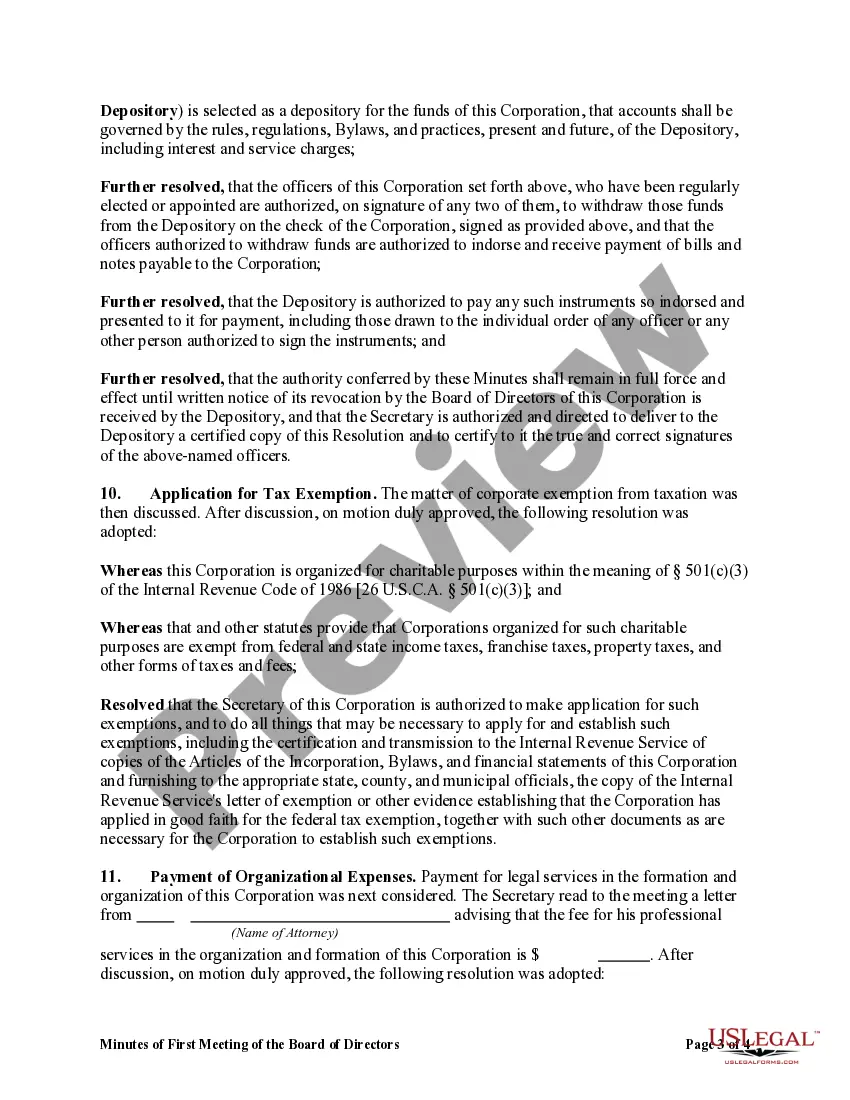

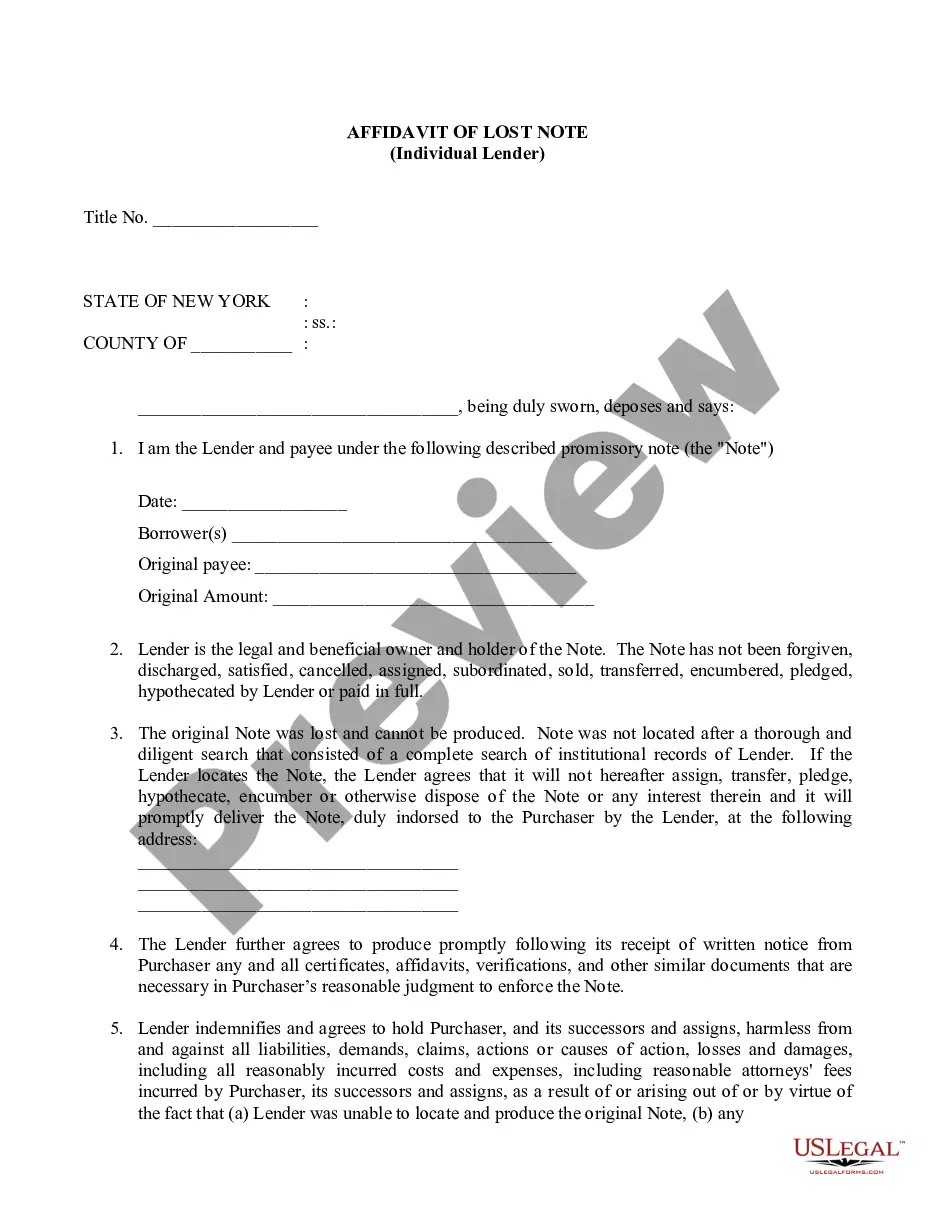

How to fill out Minutes Of First Meeting Of The Board Of Directors Of A Nonprofit Corporation?

Finding a go-to place to access the most current and appropriate legal samples is half the struggle of handling bureaucracy. Choosing the right legal papers demands precision and attention to detail, which explains why it is important to take samples of Charitable Nonprofit Exempt Form Ny only from reputable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and view all the information concerning the document’s use and relevance for the circumstances and in your state or county.

Consider the listed steps to finish your Charitable Nonprofit Exempt Form Ny:

- Make use of the catalog navigation or search field to locate your sample.

- Open the form’s information to see if it suits the requirements of your state and county.

- Open the form preview, if available, to make sure the template is definitely the one you are interested in.

- Return to the search and find the right document if the Charitable Nonprofit Exempt Form Ny does not fit your requirements.

- If you are positive about the form’s relevance, download it.

- When you are a registered customer, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have an account yet, click Buy now to get the template.

- Pick the pricing plan that suits your needs.

- Go on to the registration to finalize your purchase.

- Complete your purchase by selecting a transaction method (credit card or PayPal).

- Pick the document format for downloading Charitable Nonprofit Exempt Form Ny.

- Once you have the form on your device, you can change it using the editor or print it and finish it manually.

Get rid of the hassle that accompanies your legal paperwork. Check out the comprehensive US Legal Forms library where you can find legal samples, examine their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

All 501c3 organization that would like to be exempt from New York State sales tax must submit Form ST-119.2, Application for Exempt Organization Certificate. Attach your IRS determination letter if you have one, a statement of activities, a statement of expenses and a statement of assets and liabilities.

To claim exemption from New York State and City withholding taxes, you must certify the following conditions in writing: You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and.

Name Your Organization. ... Choose a Nonprofit Corporation Structure. ... Recruit Incorporator(s) and Initial Directors. ... Appoint a Registered Agent. ... Obtain New York Agency Approval. ... Prepare and File Articles of Incorporation. ... File Initial Report. ... Obtain an Employer Identification Number (EIN)

Tax exempt status may be granted by New York State to any not-for-profit corporation, association, trust or community chest, fund, foundation, or limited liability company organized and operated exclusively for religious, charitable, scientific, literary or educational purposes, testing for public safety, fostering ...

To claim exemption from New York State and City withholding taxes, you must certify the following conditions in writing: You must be under age 18, or over age 65, or a full-time student under age 25 and. You did not have a New York income tax liability for the previous year; and.