Overtime Labor Standards Withholding

Description

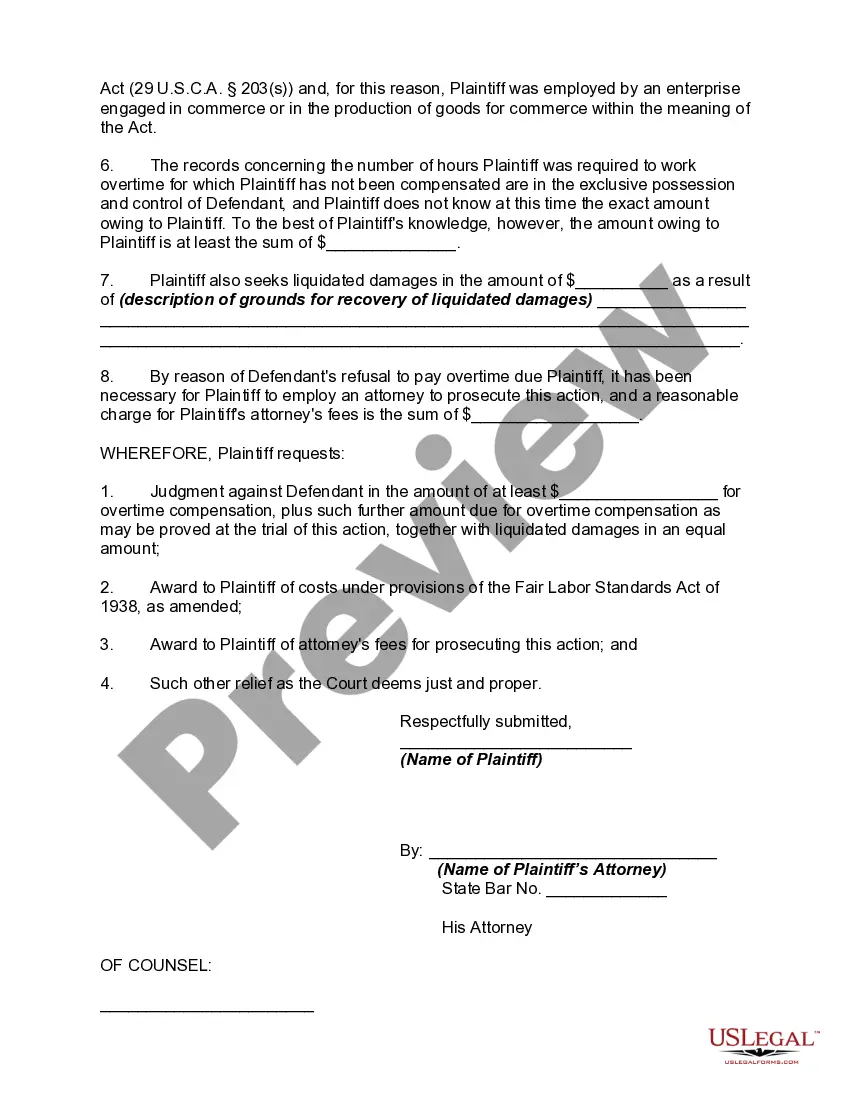

How to fill out Complaint To Recover Overtime Compensation Or Wages In State Court Under Section 16(b) Of Fair Labor Standards Act?

Creating legal documents from the ground up can occasionally be daunting.

Some situations may require extensive research and significant expenses.

If you’re looking for a more straightforward and budget-friendly method of preparing Overtime Labor Standards Withholding or any other forms without unnecessary complications, US Legal Forms is readily available.

Our online collection of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal affairs.

However, before you rush into downloading the Overtime Labor Standards Withholding, consider these recommendations: Verify the document preview and descriptions to confirm you’ve located the correct document. Ensure the form you choose meets the standards of your state and county. Select the most appropriate subscription plan to purchase the Overtime Labor Standards Withholding. Download the form, then fill it out, sign it, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and make document completion a straightforward and efficient process!

- With a few simple clicks, you can swiftly access state- and county-specific templates carefully crafted for you by our legal professionals.

- Utilize our website whenever you require a dependable service to easily locate and download the Overtime Labor Standards Withholding.

- If you're familiar with our services and have created an account before, just Log In to your account, find the form, and download it or re-download it anytime from the My documents section.

- Not an account holder? No problem. Setting it up and exploring the library only takes a few minutes.

Form popularity

FAQ

To claim for overtime, you should first track your hours worked and identify any unpaid overtime. After gathering documentation, approach your employer directly to discuss the issue. If your employer does not resolve the situation, consider filing a claim with the Department of Labor or using resources like US Legal Forms, which can help guide you through the process of claiming your rightful overtime labor standards withholding.

Overtime is when you pay your employees 1.5 times their normal rate, while double time is when you pay your employees twice their normal rate. For instance, if an employee regularly earns $17, their overtime rate is $25.5 per hour, while their double time rate is $34 per hour.

So, how does one decide if an employee is exempt vs. non exempt? Pay rate, job duties and responsibilities are all key factors in determining if an employee is exempt or non-exempt, not the type of clothes they wear or their work environment.

Ing to the FLSA, the formula for calculating overtime pay is the nonexempt employee's regular rate of pay x 1.5 x overtime hours worked. This calculation may differ in states that have requirements, such as double time, which are more favorable to the employee.

Ing to the FLSA, the formula for calculating overtime pay is the nonexempt employee's regular rate of pay x 1.5 x overtime hours worked. This calculation may differ in states that have requirements, such as double time, which are more favorable to the employee.

Under the fluctuating workweek method, which is explained at 29 CFR 778.114, nonexempt employees receive a set weekly salary no matter how many hours they work, plus additional overtime pay when they work more than 40 hours in one workweek.