Overtime Labor Standards With Pay

Description

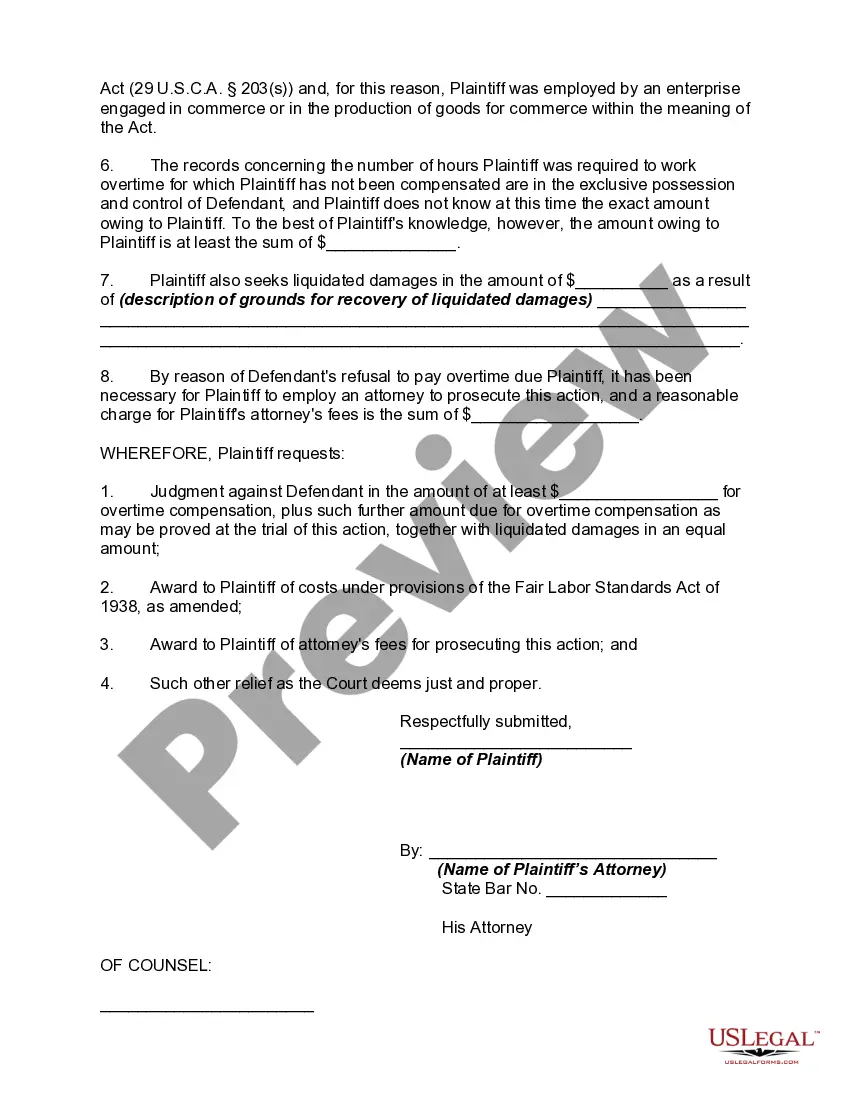

How to fill out Complaint To Recover Overtime Compensation Or Wages In State Court Under Section 16(b) Of Fair Labor Standards Act?

Creating legal documents from the ground up can occasionally feel quite daunting.

Certain scenarios may require extensive research and considerable financial resources.

If you’re looking for a more straightforward and economical approach to preparing Overtime Labor Standards With Pay or any other documentation without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters.

But before diving straight into downloading Overtime Labor Standards With Pay, consider these guidelines: Review the form preview and descriptions to ensure you’ve located the correct form. Verify that the template you choose adheres to the laws and regulations of your state and county. Select the appropriate subscription plan to acquire the Overtime Labor Standards With Pay. Download the document, then complete, certify, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us now and make form execution a breeze!

- With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously crafted for you by our legal professionals.

- Utilize our website whenever you require trusted and dependable services through which you can promptly locate and download the Overtime Labor Standards With Pay.

- If you’re already familiar with our website and have set up an account with us previously, just Log In, choose the template, and download it or re-download it any time from the My documents section.

- Don’t have an account? No problem. It only takes a few minutes to register and browse the catalog.

Form popularity

FAQ

Overtime labor standards with pay can be complex for salaried employees. Generally, if you are classified as a non-exempt employee, you are entitled to overtime pay for every hour worked beyond 40 in a week. It’s important to note that the rules vary depending on your job duties and the state you work in. To ensure you receive fair compensation, consider using resources like USLegalForms, which can help you understand your rights under overtime labor standards with pay.

There is technically no maximum number of hours a salaried employee can work, but overtime labor standards with pay ensure you are compensated for exceeding the 40-hour workweek, if classified as non-exempt. Companies may expect long hours, but it is essential to understand your rights regarding overtime pay. Monitoring your hours can help you maintain a healthy work-life balance while ensuring fair compensation.

If you are on a salary, whether you receive overtime pay depends on your job classification. Salaried employees classified as non-exempt must receive overtime pay for any hours worked over 40 in a week under overtime labor standards with pay. Understanding your classification can help you navigate the intricacies of your compensation effectively.

As of now, the minimum salary threshold to qualify as exempt from overtime labor standards with pay is $684 per week, which equates to about $35,568 annually. This means if you earn below this amount, you generally qualify for overtime pay, regardless of your job title. Keeping abreast of the latest regulations can help you understand your rights and protections in the workplace.

To calculate overtime from salary, first determine your regular hourly rate by dividing your annual salary by the number of hours you ordinarily work. Then, multiply this hourly rate by 1.5 to find your overtime rate. Overtime labor standards with pay require that you receive this higher rate for hours worked beyond 40 in a week, ensuring you are compensated fairly for your extra efforts.

Overtime labor standards with pay apply differently depending on your role and salary. If you are salaried and classified as non-exempt, you are entitled to receive overtime pay for hours worked beyond 40 in a workweek. It's important to know that not all salaried positions qualify for overtime, so reviewing your classification can be beneficial.

Yes, under the overtime labor standards with pay, most employees are entitled to receive compensation for overtime work. This means you should receive time and a half for every hour worked beyond 40 hours in a workweek. Some exceptions exist, such as certain salaried roles, but generally, employers are required to compensate employees for extra hours. If you believe your rights are being violated, U.S. Legal Forms can help you understand your options and rights.

To claim for overtime pay, you should first gather your work records, including hours worked and your pay stubs. Next, determine whether your situation falls under the overtime labor standards with pay set by federal or state regulations. You can file a complaint with the Department of Labor if your employer has violated these standards. Additionally, consider using the U.S. Legal Forms platform to access the necessary documents and guidance for your claim.