Donation Contract Template For Services

Description

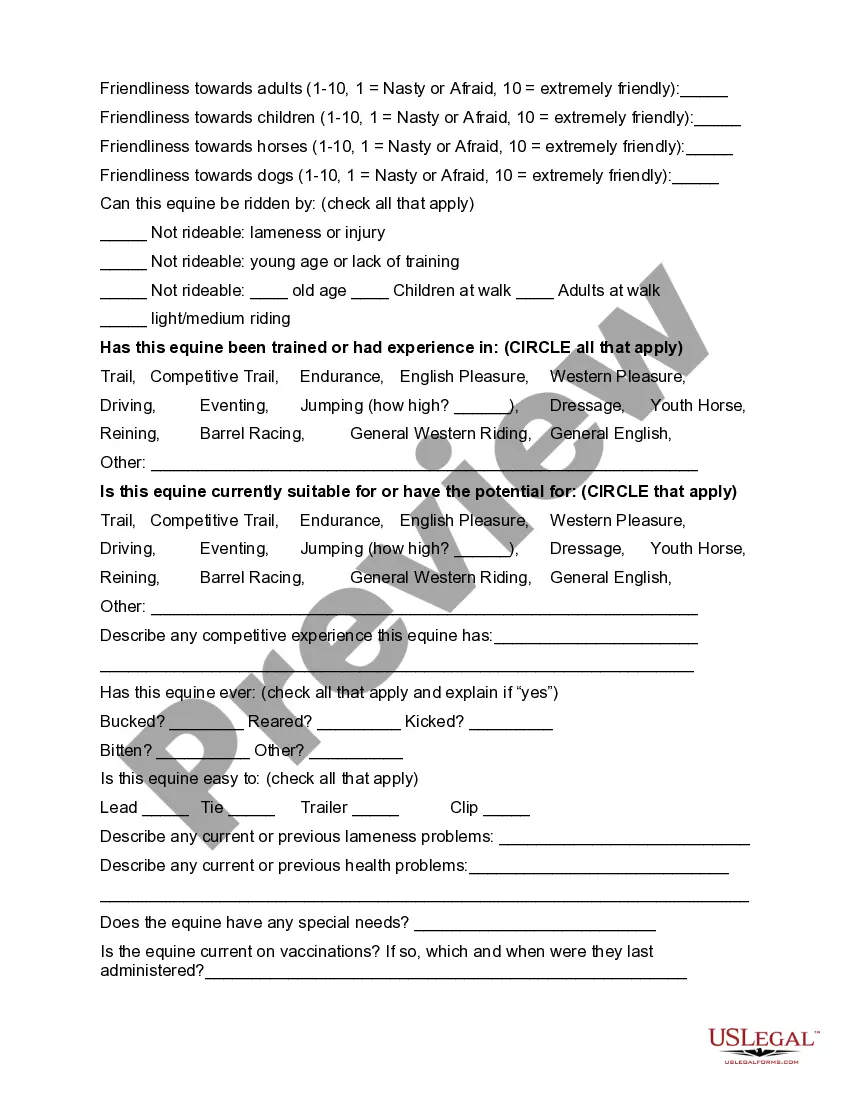

How to fill out Equine Or Horse Donation Contract?

Properly prepared formal documents are a key factor in preventing problems and legal disputes, yet acquiring them without assistance from a lawyer can be time-consuming.

Whether you’re seeking a current Donation Contract Template For Services or other forms relating to employment, family, or business matters, US Legal Forms is readily available to assist.

The process is even simpler for current users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and press the Download button next to the chosen file. Additionally, you can access the Donation Contract Template For Services at any time, as all documents ever obtained on the platform are stored within the My documents tab of your profile. Save time and money when preparing official documents. Explore US Legal Forms today!

- Ensure that the form matches your situation and location by reviewing the description and preview.

- Search for additional samples (if necessary) using the Search bar located in the page header.

- Click on Buy Now when you identify the suitable template.

- Choose the pricing plan, sign in to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Pick either PDF or DOCX file format for your Donation Contract Template For Services.

- Hit Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

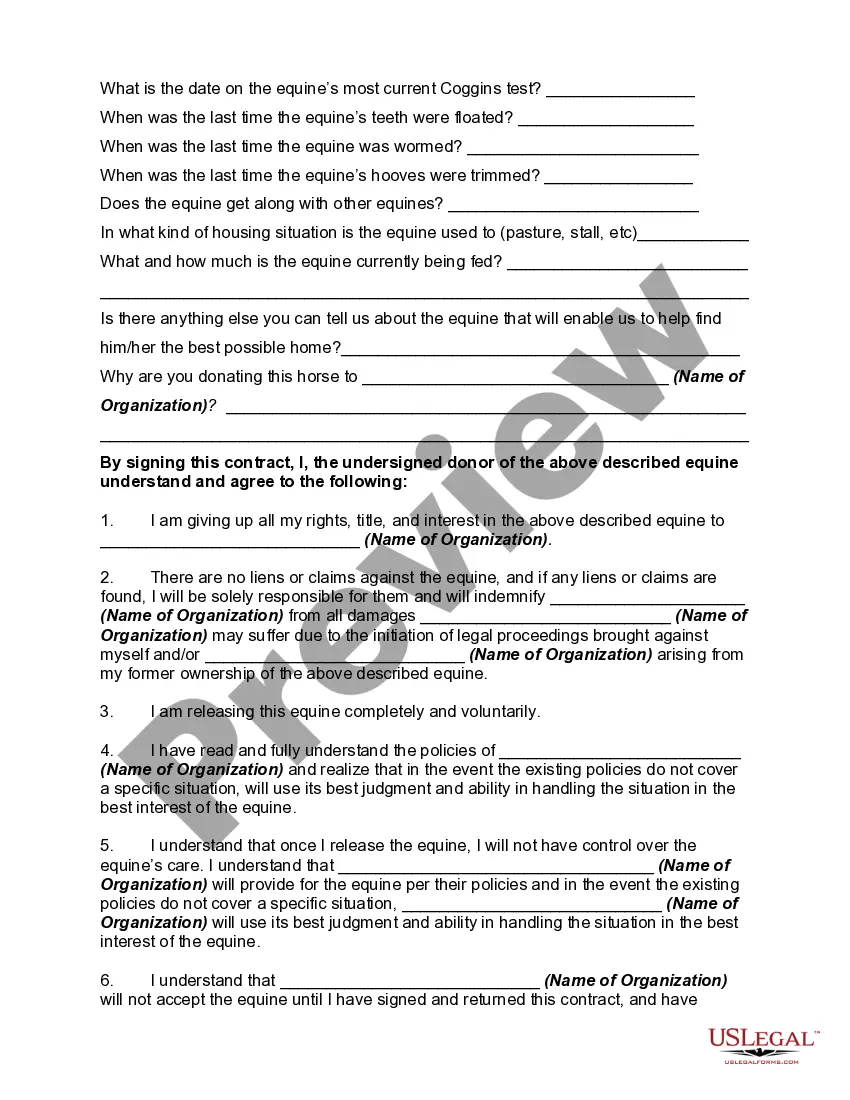

A donation agreement will include the names of the parties, a description of the donation, whether a receipt that was given, and possibly the intended use for the donation. The agreement should also include a revocability (whether the donation can be taken back) section and define expense responsibility.

The accepted way to record in-kind donations is to set up a separate revenue account but the expense side of the transaction should be recorded in its functional expense account. For example, revenue would be recorded as Gifts In-Kind Services, and the expense would be recorded as Professional Services.

When you record an in-kind donation, enter a sales receipt and create a bill for the donation, then mark the bill as cleared. Note: If you receive fixed assets (for example, vehicles, computers, or land) as an in-kind donation, use an expense or fixed asset account on the bill.

A Donation Agreement, also sometimes called a Charitable Gift Agreement, provides written proof for a donation, or gift, that has been given to a charitable organization in the United States.

If there is no acceptance, the donation cannot be formalized. Therefore, any donation contract is subject to these conditions: It is an act free and it is made voluntary. Cannot be done on future goods, i.e. the goods must be currently owned by the donor.