Counselling Form Format

Description

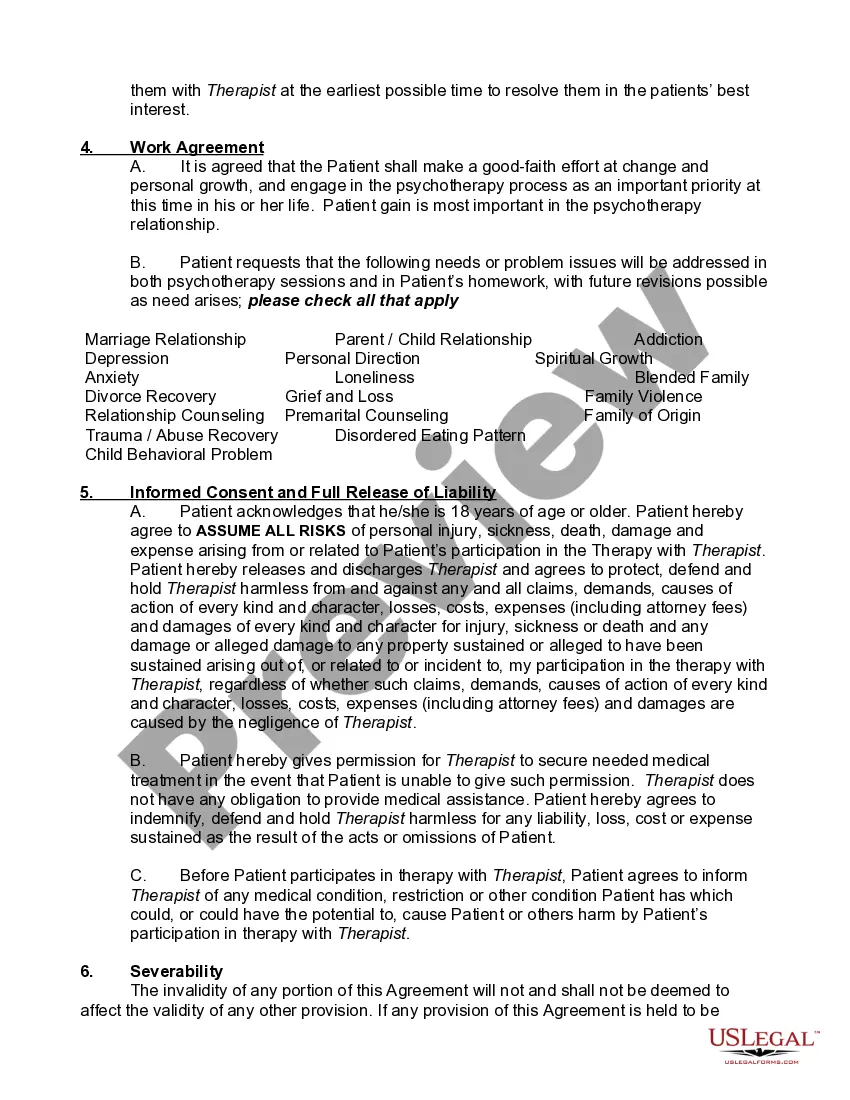

How to fill out Agreement For Psychotherapy Services?

The Counseling Form Template presented on this page is a versatile legal document crafted by expert attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has offered individuals, companies, and lawyers access to more than 85,000 validated, state-specific documents for any business or personal scenario.

Subscribe to US Legal Forms to have authenticated legal templates for every aspect of life at your fingertips.

- Search for the document you require and evaluate it.

- Examine the file you searched for and either preview it or read the form description to ensure it meets your needs. If it doesn't, use the search bar to locate the appropriate one. Click 'Buy Now' once you find the template you need.

- Register and Log In.

- Choose the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already have an account, Log In and check your subscription to continue.

- Obtain the editable template.

- Select the format you desire for your Counseling Form Template (PDF, Word, RTF) and download the sample onto your device.

- Complete and sign the documents.

- Print out the template for manual completion. Alternatively, utilize an online multifunctional PDF editor to quickly and accurately fill out and sign your form with a valid signature.

- Redownload your documents as necessary.

- Access the same document again whenever required. Go to the 'My documents' section in your profile to redownload any forms you've previously acquired.

Form popularity

FAQ

The basic structure of counseling generally includes several stages such as intake, assessment, intervention, and termination. Each stage is crucial for developing a comprehensive understanding of the client’s needs. Following a consistent counseling form format throughout these stages enhances clarity and effectiveness in the counseling process.

Making counseling notes involves documenting essential details discussed during sessions. Start by summarizing the client’s concerns, the methods used, and any action plans developed. A structured counseling form format can aid in organizing your notes, ensuring you capture crucial information consistently and effectively.

To change your address with the IRS, you may complete a Form 8822, Change of Address (For Individual, Gift, Estate, or Generation-Skipping Transfer Tax Returns) and/or a Form 8822-B, Change of Address or Responsible Party ? Business and send them to the address shown on the forms.

Code § 30-5-2-7. "Power of attorney" means a writing or other record that grants authority to an attorney in fact or agent to act in place of a principal, whether the term "power of attorney" is used.

If you file your return with the wrong address, that can't really be undone. You'll need to contact the IRS directly to update your address (you can use their toll-free number: 1-800-829-1040). If your return(s) are rejected by the IRS, you can simply change your address before resending your tax return.

The agent must be a mentally competent adult. You can name co-agents (this can be a good way to designate a successor agent in case the first agent becomes unavailable). The POA typically must be in writing and notarized ? or signed with two witnesses present.

Update your mailing address for Automatic Taxpayer Refunds Go to INTIME at intime.dor.in.gov to complete the change of address process. A user guide is available at the bottom of the landing page to guide you through the process (login required).

Please note that Indiana law has very specific requirements for a Power of Attorney to be valid. The member's signature must be witnessed and attested to by a Notary Public. The Notary Public must also sign the document along with their printed name and the notarial seal.

A change of address with the IRS must be submitted on paper, but it doesn't take long. You can print and fill out Form 8822 from the IRS website. The second page of the form will tell you what address you should mail it to, based on your previous address.

Yes, the power of attorney must be notarized by notary public. In India, Power of attorney (POA) must be executed on a non-judicial stamp paper. Executant, attorney, and witnesses should sign the POA in front of a notary.