Assignment Of Judgment Debt

Description

How to fill out Assignment Of Judgment To Attorney For Collection?

Whether you manage documents frequently or you need to submit a legal report occasionally, it is crucial to have a resource where all the examples are connected and up to date.

One thing you should ensure with an Assignment Of Judgment Debt is that it is the latest version, as it determines whether it can be submitted.

If you wish to streamline your hunt for the most recent document examples, look for them on US Legal Forms.

Use the search bar to find the necessary form.

- US Legal Forms is a collection of legal documents that includes nearly every sample you might need.

- Search for the templates you need, evaluate their relevance immediately, and learn more about their application.

- With US Legal Forms, you have access to approximately 85,000 form templates across various fields.

- Locate the Assignment Of Judgment Debt examples in just a few clicks and save them anytime in your account.

- A US Legal Forms account will enable you to access all the forms you need conveniently and with less effort.

- You simply have to click Log In in the header of the website and go to the My documents section where all the forms you require are at your fingertips, eliminating the need to spend time looking for the most suitable template or checking its applicability.

- To obtain a form without an account, follow these steps.

Form popularity

FAQ

Proof of assignment of debt refers to documentation that confirms a specific debt has been transferred from one creditor to another. This proof typically includes an assignment agreement, which details the original creditor, the new creditor, and the terms of the transfer. In cases of assignment of judgment debt, having this documentation is vital for the new creditor to collect payments legally. Always retain this proof for your records to protect your interests.

An assignment of a debt occurs when a creditor transfers their rights to receive payment from a debtor to another party. This process is common in financial agreements and can involve various types of debts. In the context of assignment of judgment debt, the judge's ruling regarding a debt is passed on to a new creditor, who then assumes the right to collect the debt. Understanding this process can help you navigate your obligations more effectively.

Typically, a creditor has a limited time frame to collect a debt after judgment, often ranging from 5 to 20 years, depending on your state laws. It’s vital to understand this timeframe, as it can affect your financial decisions. Creditors may take legal actions to collect during this period, so staying informed about your rights is essential. You can explore resources like US Legal Forms for guidance on managing assignment of judgment debt effectively.

Proof of debt assignment refers to the documentation that confirms the transfer of debt rights to a new creditor. This involves not only the letter of assignment but also any agreements or communications that support this transfer. By providing clear proof of debt assignment, you can ensure that your rights are enforceable, making the collection process smoother.

A letter of assignment of debt formally transfers the rights to collect a debt from one party to another. This document outlines the details of the assignment, including the amount due and any relevant terms. Properly executing this letter is crucial in asserting your rights regarding the assignment of judgment debt.

When proving assignment of judgment debt, ensure to include essential documents such as the original contract, any amendments, and the judgment itself. Detailed records of payments made and a ledger of outstanding amounts also provide clarity. Including accurate dates and signatures will strengthen your claim, providing solid evidence of the debt.

Yes, you can negotiate a debt even after a judgment has been issued. Many creditors are open to settling for a reduced amount or establishing a payment plan. Engaging in negotiation often leads to a more favorable outcome, allowing you to manage your finances better while resolving the assignment of judgment debt.

To defend yourself in a debt lawsuit, it is crucial to gather all relevant documents, including any communications and agreements related to the debt. You can contest the validity of the debt, the amount claimed, or the creditor’s right to collect it. Consulting with a legal expert, such as those found on US Legal Forms, can provide guidance tailored to your specific situation and strengthen your defense.

An example of assignment of judgment debt occurs when a creditor, who has won a court ruling, assigns their rights to collect that debt to a debt collection agency. In this scenario, the agency then acquires the right to pursue the debtor for payment. This arrangement allows the original creditor to focus on their business while the agency handles the collection process.

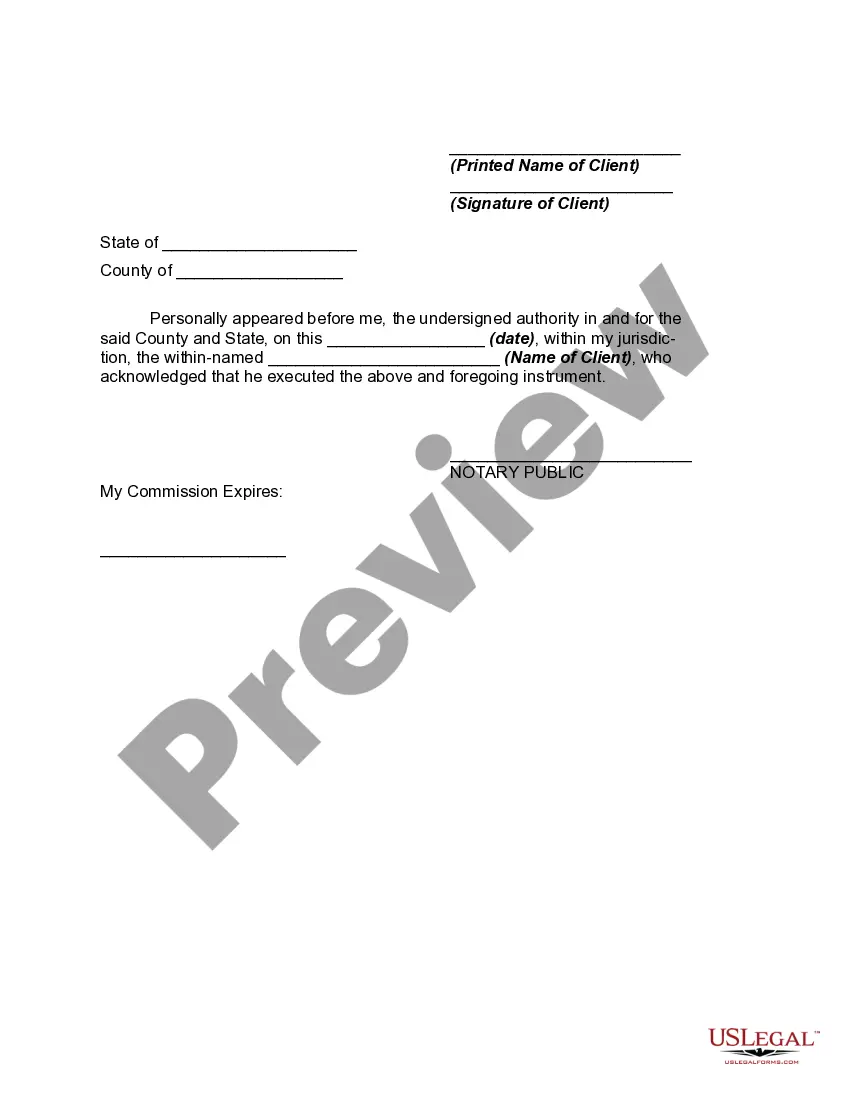

Yes, an assignment of judgment debt should be in writing to be legally binding. This written agreement helps clarify the terms of the assignment and provides a record for both parties involved. Without a written document, proving the transfer of rights can become complicated and may lead to disputes.