Distribution Decedent With Estate

Description

How to fill out Petition To Determine Distribution Rights Of The Assets Of A Decedent?

Drafting legal documents from scratch can sometimes be daunting. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for a more straightforward and more affordable way of creating Distribution Decedent With Estate or any other paperwork without jumping through hoops, US Legal Forms is always at your disposal.

Our online collection of over 85,000 up-to-date legal documents covers virtually every element of your financial, legal, and personal matters. With just a few clicks, you can quickly access state- and county-specific forms diligently prepared for you by our legal professionals.

Use our platform whenever you need a trustworthy and reliable services through which you can easily locate and download the Distribution Decedent With Estate. If you’re not new to our website and have previously set up an account with us, simply log in to your account, locate the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No problem. It takes minutes to set it up and explore the library. But before jumping straight to downloading Distribution Decedent With Estate, follow these tips:

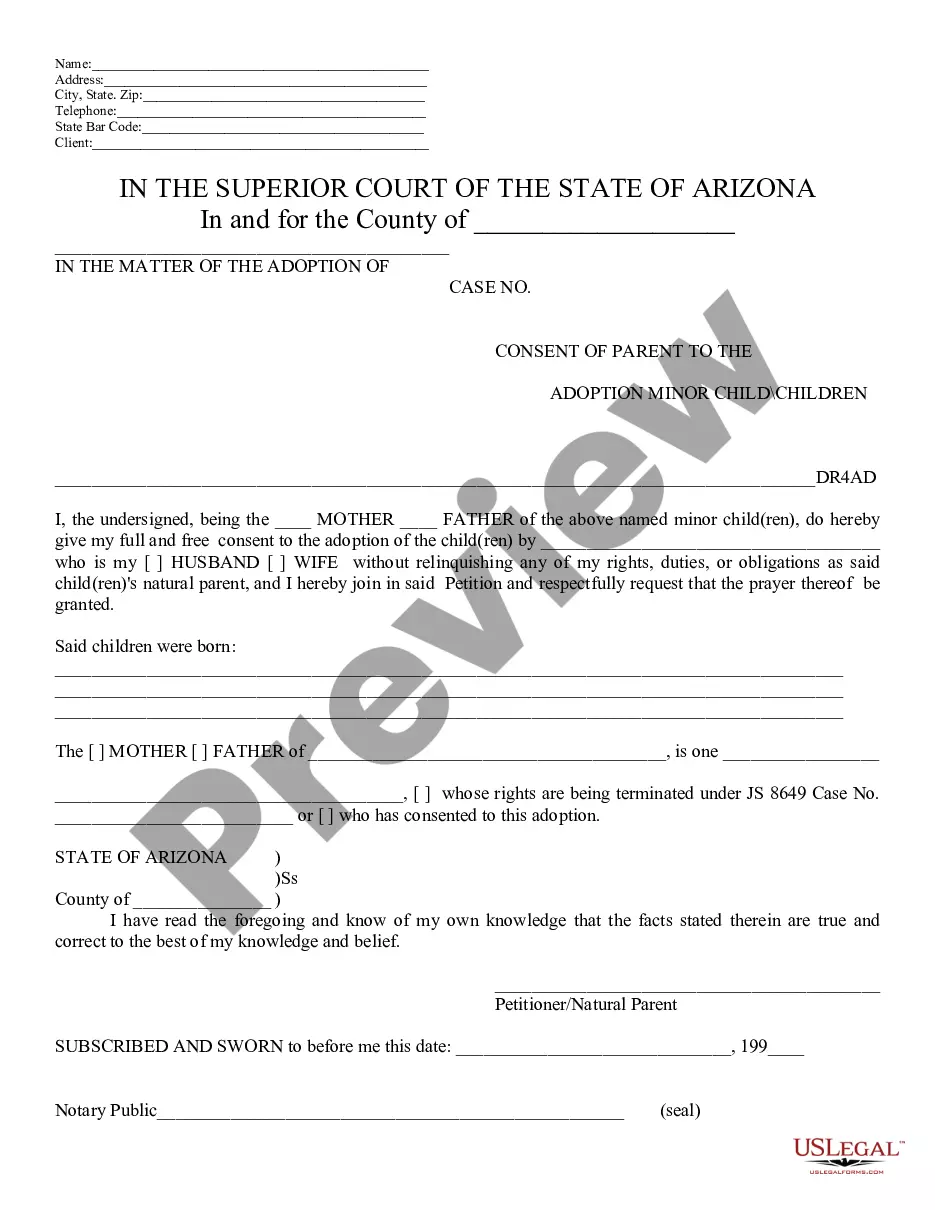

- Review the form preview and descriptions to make sure you are on the the document you are looking for.

- Make sure the template you select conforms with the regulations and laws of your state and county.

- Pick the best-suited subscription option to buy the Distribution Decedent With Estate.

- Download the form. Then complete, sign, and print it out.

US Legal Forms boasts a good reputation and over 25 years of expertise. Join us now and transform form completion into something easy and streamlined!

Form popularity

FAQ

As an administrator, you can transfer the funds by simply providing the bank with a copy of the death certificate. The decedent can name a payable on death (POD) beneficiary who will receive the funds upon the decedent's death. The decedent does this by signing a beneficiary form with the bank.

This is when courts transfer the ownership of assets to beneficiaries or heirs. The final distribution only occurs when the estate is settled, meaning all creditors and taxes have been paid, all disputes have been resolved, and the judge gives final approval.

Phase Five, the distribution phase, involves distributing the assets to beneficiaries ing to the terms of the will or pursuant to state intestacy laws if there is no will. This phase may also include preparing and executing any necessary deeds or documents to transfer assets to the beneficiaries.

Every state sets the priority ing to which claims must be paid. The estate's beneficiaries only get paid once all the creditor claims have been satisfied. Usually, estate administration fees, funeral expenses, support payments, and taxes have priority over other claims.

To begin the inheritance distribution process, you must submit the will through probate. After the probate court reviews the will, it's authorized to an executor, and the executor then legally transfers all assets?again, after settling taxes and debts.