Distribution Assets Form For Tax

Description

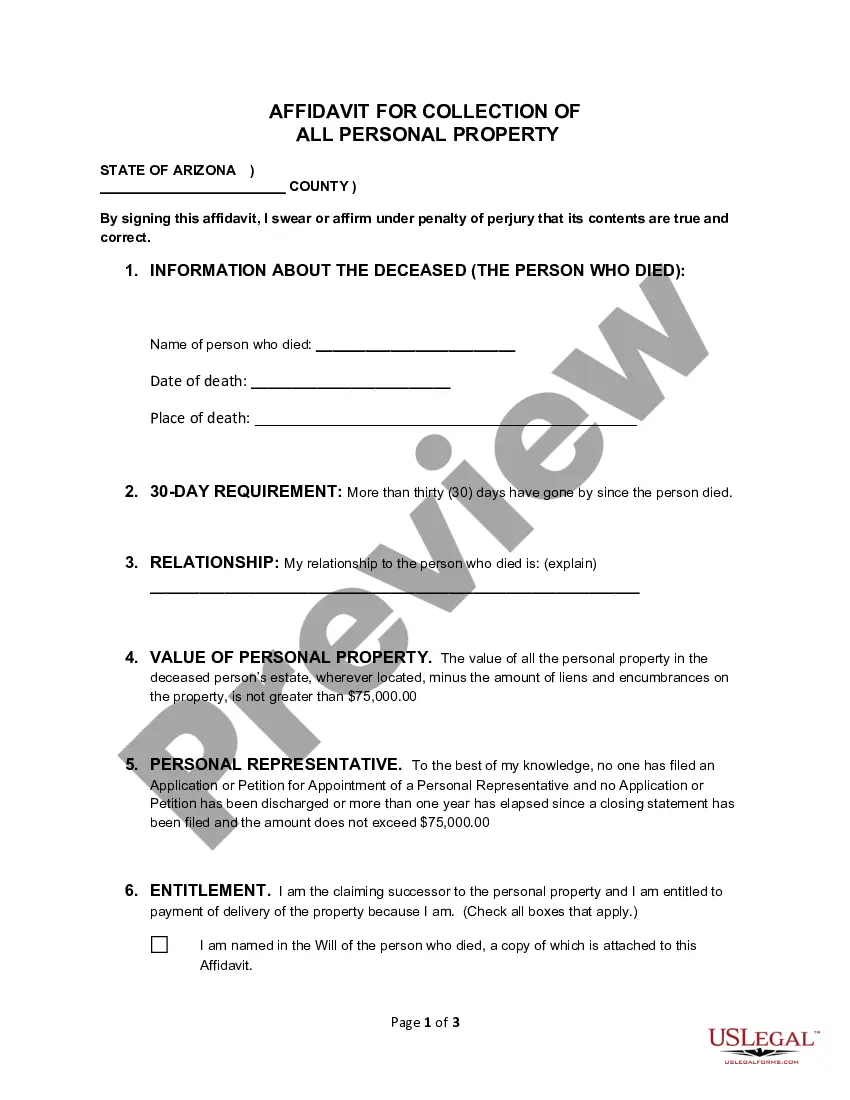

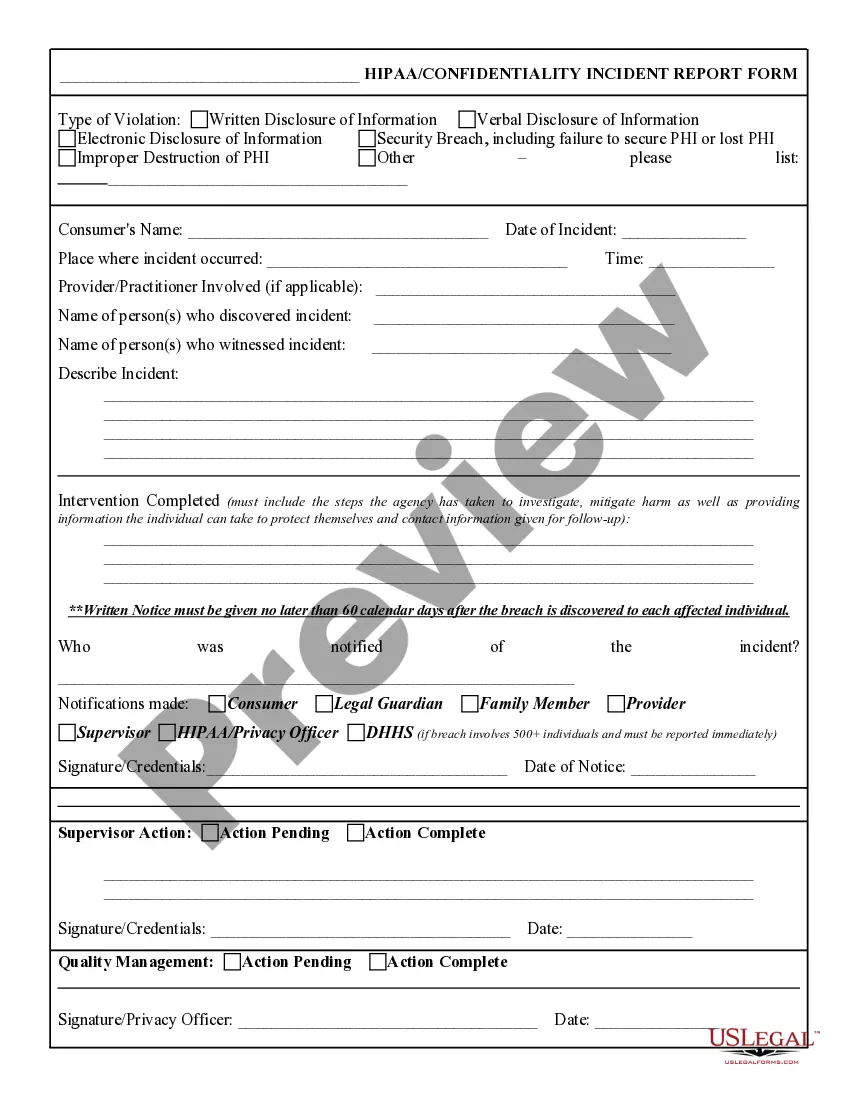

How to fill out Petition To Determine Distribution Rights Of The Assets Of A Decedent?

It’s obvious that you can’t become a law professional immediately, nor can you figure out how to quickly prepare Distribution Assets Form For Tax without the need of a specialized background. Creating legal forms is a long venture requiring a certain education and skills. So why not leave the preparation of the Distribution Assets Form For Tax to the pros?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court papers to templates for in-office communication. We know how important compliance and adherence to federal and local laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our platform and obtain the form you require in mere minutes:

- Find the form you need with the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to figure out whether Distribution Assets Form For Tax is what you’re looking for.

- Begin your search over if you need a different template.

- Register for a free account and select a subscription option to purchase the template.

- Choose Buy now. As soon as the transaction is through, you can get the Distribution Assets Form For Tax, complete it, print it, and send or send it by post to the designated people or organizations.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

There are additional pieces of information that your Form 8949 will require, such as the name of the stock, the number of shares you sold, the date of each purchase and sale, the amount you paid for each stock, the amount you sold it for, and all required adjustments to the gains and losses you report.

Distributions are a payout of your business's equity to you and other owners. That means they can come from the accumulated profits or from money that was previously invested in the business and are not factored into how much a business owner is taxed.

Form 1099-DIV is used by banks and other financial institutions to report dividends and other distributions to taxpayers and to the IRS.

You can take distributions from your IRA (including your SEP-IRA or SIMPLE-IRA) at any time. There is no need to show a hardship to take a distribution. However, your distribution will be includible in your taxable income and it may be subject to a 10% additional tax if you're under age 59 1/2.

Tax distributions are typically made at times to enable the partners to timely make their requisite estimated tax payments, and, generally, a single tax rate is assumed to apply to all the partners (even if a partner is a corporation). The drafting for the amounts of tax distributions presents many choices.