Final Accounting For Probate

Description

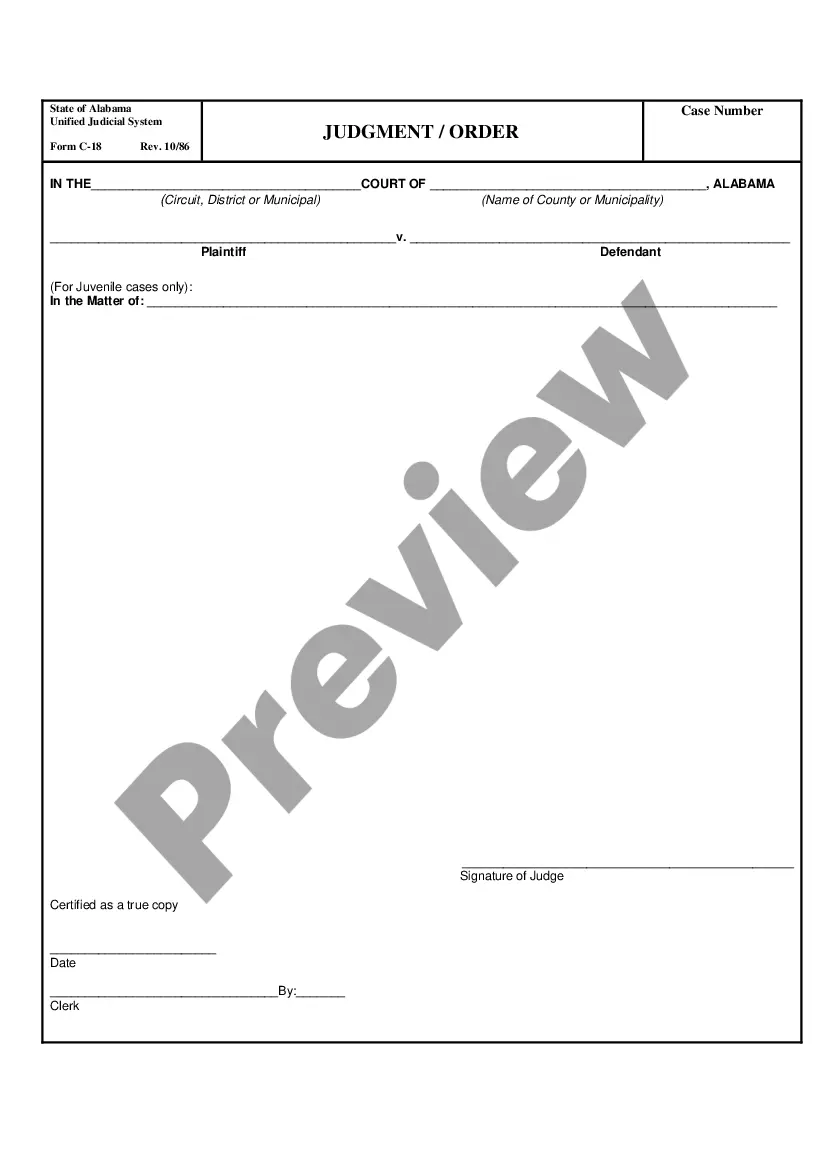

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Managing legal documents can be exasperating, even for experienced professionals.

If you are looking for a Final Accounting For Probate and lack the time to search for the correct and updated version, the processes can be challenging.

US Legal Forms meets any requirements you might have, from personal to business documentation, all in one location.

Utilize sophisticated tools to complete and manage your Final Accounting For Probate.

Here are the steps to follow after accessing the form you need: Confirm it is the correct form by previewing it and reviewing its description. Ensure the sample is valid in your state or county. Select Buy Now when you are ready. Choose a monthly subscription plan. Find the file format you desire, and Download, complete, eSign, print, and submit your documents. Take advantage of the US Legal Forms online library, supported by 25 years of experience and reliability. Streamline your daily document management into a simple and user-friendly process today.

- Access a valuable repository of articles, guides, and materials relevant to your situation and requirements.

- Save time and effort in locating the documents you need, and use US Legal Forms' advanced search and Preview feature to find Final Accounting For Probate and obtain it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and get it.

- Check the My documents tab to view the documents you have previously saved and to manage your folders as desired.

- If this is your first time using US Legal Forms, create an account and gain unlimited access to all the resources available in the library.

- A comprehensive online form library can be transformative for anyone wishing to handle these situations efficiently.

- US Legal Forms is an industry leader in online legal documents, offering over 85,000 state-specific legal forms available to you at any time.

- With US Legal Forms, you can access state or county-specific legal and organizational forms.

Form popularity

FAQ

Any assets that are titled in the decedent's sole name, not jointly owned, not payable-on-death, don't have any beneficiary designations, or are left out of a Living Trust are subject to probate. Such assets can include: Bank or investment accounts. Stocks and bonds.

Final Accounting Once all matters of the probate estate have been finalized or are at the point of distribution of remainder to the beneficiaries, an accounting is required to be filed with the court and it is set for hearing. A copy of the accounting must be sent to all beneficiaries of the estate.

What Is the Final Accounting? ing to Florida Probate Rule 5.346, a final accounting must include ?all cash and property transactions since the date of the last accounting or, if none, from the commencement of administration, and a schedule of assets at the end of the administration period.?

What is Probate Accounting? Probate accounting is the detailed accounting of all the transactions undertaken by an estate within a particular reporting period. Trust accounting is often required by law when a trustee is appointed, terminated, or changed.

A Final Account is a complete record detailing the assets, receipts, and disbursements made during a probate administration.