Partnership Partner With Foreign

Description

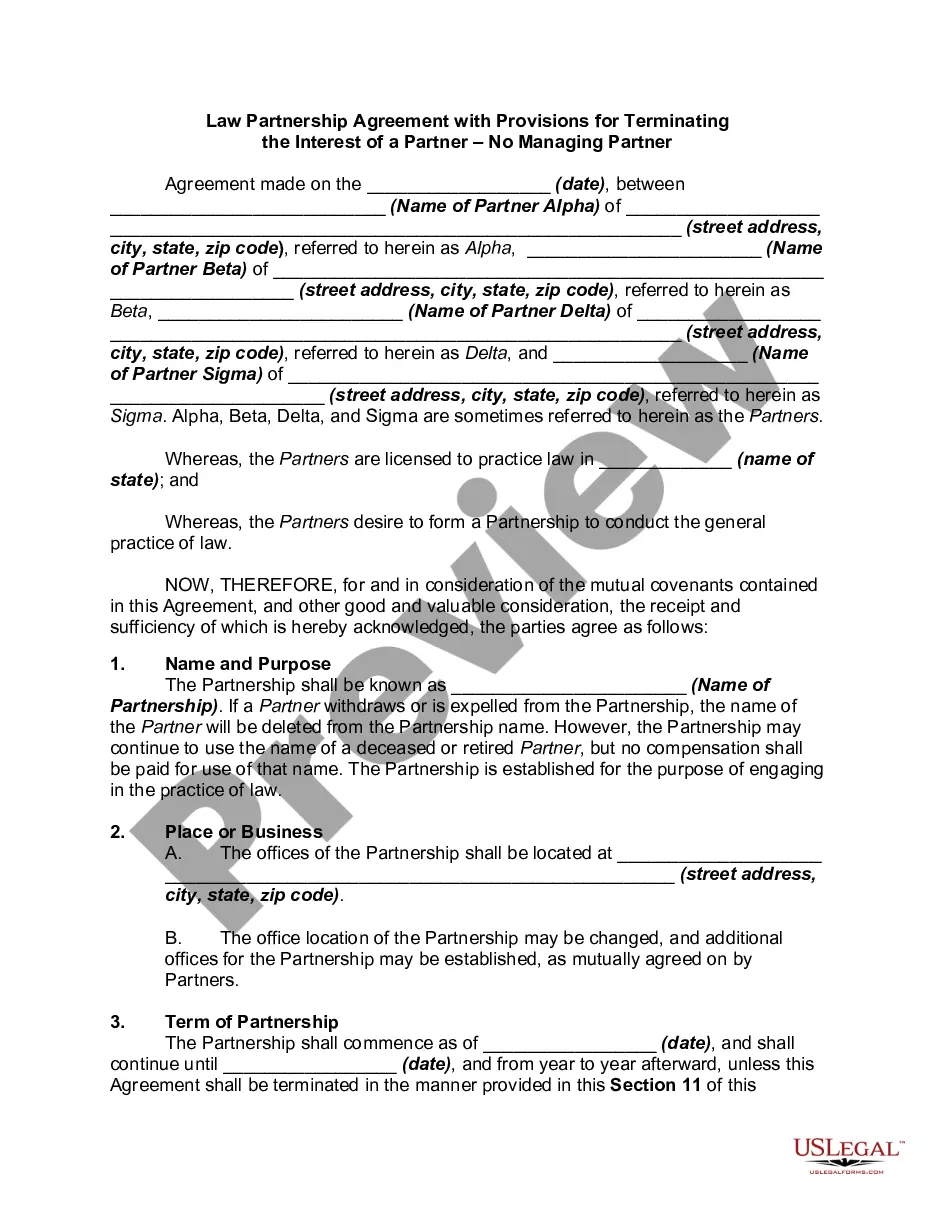

How to fill out Law Partnership Agreement With Provisions For The Death, Retirement, Withdrawal, Or Expulsion Of A Partner?

Creating legal documents from the ground up can occasionally be intimidating.

Certain situations may require extensive research and substantial financial investment.

If you seek a more straightforward and cost-effective method for producing Partnership Partner With Foreign or any other forms without the hassle, US Legal Forms is ready to assist you.

Our online repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal matters.

Examine the form preview and descriptions to ensure you have located the correct document.

- Utilize our platform whenever you need dependable and trustworthy assistance to locate and download the Partnership Partner With Foreign.

- If you are familiar with our offerings and have previously registered with us, just Log In to your account, find the form, and download it or retrieve it anytime later in the My documents section.

- Not registered yet? No worries. It requires minimal time to sign up and explore the library.

- Before proceeding to download Partnership Partner With Foreign, consider these recommendations.

Form popularity

FAQ

The IRS defines a partnership as an association of two or more individuals or entities to conduct business together, sharing profits and losses. Partnerships can take various forms, including general partnerships and limited partnerships, each with their unique characteristics. If you're exploring the concept of a partnership partner with foreign, understanding these definitions will help you navigate your responsibilities and opportunities effectively.

A foreign partner refers to an individual or entity that is not considered a U.S. person by the IRS. This includes individuals residing abroad, foreign corporations, and other non-U.S. entities engaged in the partnership. Identifying a foreign partner is crucial for tax compliance and structuring your partnership effectively, especially if you aim to have a partnership partner with foreign.

When a partnership makes distributions to foreign partners, it is typically subject to a withholding tax. The rate generally stands at 30% on effectively connected income and may vary based on tax treaties between the U.S. and the foreign partner’s home country. For those who are partnership partners with foreign, navigating these taxes can be complex, but platforms like uslegalforms can provide helpful resources.

The IRS defines a foreign person as anyone who is not a U.S. citizen or a U.S. resident alien. This includes individuals, foreign corporations, foreign partnerships, and other entities located outside the United States. Understanding this classification is essential for a partnership partner with foreign, as it determines the applicable tax rules and regulations.

In general, any individual or legal entity can be a partner in a partnership as long as they meet legal requirements and agree to the partnership terms. This includes individuals over the age of 18, corporations, and even other partnerships. When considering a partnership partner with foreign individuals or entities, ensure that all parties understand their rights and obligations. Resources like US Legal Forms can provide the necessary templates and guidance to facilitate this process smoothly.

A foreign partner in a partnership is typically an individual or entity that resides outside the United States but has an ownership interest in the partnership. These foreign partners may contribute capital, expertise, or resources to the partnership. If you are forming a partnership partner with foreign investors, it's essential to recognize their status and comply with applicable tax obligations. Utilizing platforms like US Legal Forms can guide you through the necessary documentation.

Certain individuals cannot legally be partners in a partnership. Generally, minors, individuals deemed legally incompetent, and those who are currently bankrupt are ineligible to become partners. Understanding these limitations is vital, especially when forming a partnership partner with foreign, as it adds another layer of legal considerations. Consulting legal advice can clarify these restrictions and help you navigate them effectively.

To successfully fill out a partnership agreement, begin by clearly defining the roles and responsibilities of each partner involved. It's crucial to include terms related to profit sharing, decision-making processes, and dispute resolution. If you are considering a partnership partner with foreign entities, ensure to comply with relevant regulations and laws. You may find using resources like US Legal Forms helpful, as they provide templates specifically designed for diverse partnership scenarios.

Yes, you can have a business partner from another country. Engaging with a partnership partner with foreign backgrounds can enrich your business opportunities and perspectives. When pursuing this, consider consulting legal resources to navigate the regulations involved.

The IRS defines a foreign partner as an individual or entity that is not a US citizen or resident and holds an interest in a US partnership. This classification is important for tax reporting and obligations. Understanding the IRS definition of a partnership partner with foreign entities can help you manage compliance and tax responsibilities effectively.