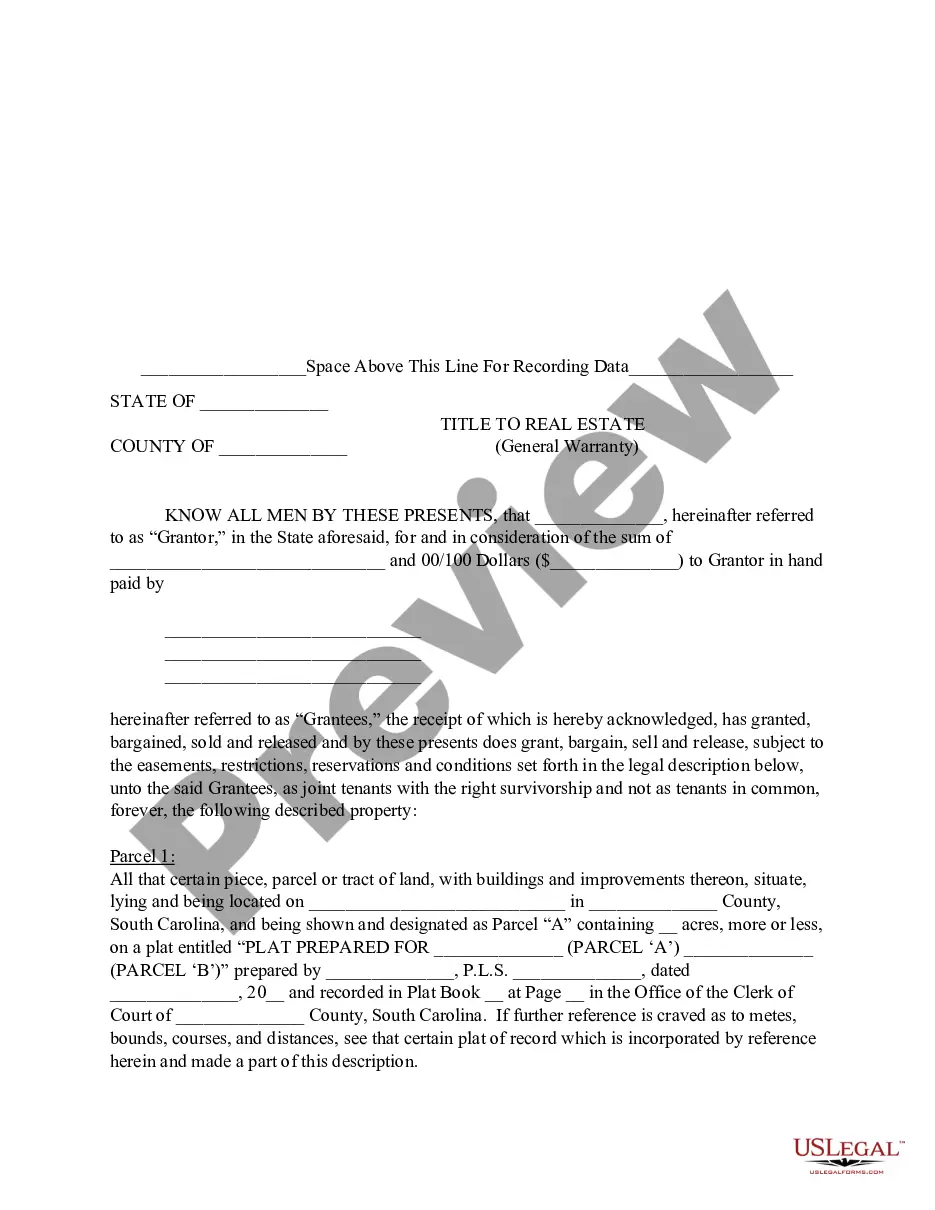

Examples Of Conveyance Documents

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Legal administration can be daunting, even for the most informed professionals.

When seeking Examples Of Conveyance Documents and lacking the opportunity to search for the appropriate and current version, the process can be stressful.

US Legal Forms caters to all requirements you may have, encompassing both personal and business documents, all in one location.

Employ advanced resources to complete and manage your Examples Of Conveyance Documents.

After acquiring the desired document, ensure to check that it is the right version by previewing it and reviewing its particulars.

- Tap into a valuable resource pool containing articles, guides, handbooks, and tools pertinent to your circumstances and needs.

- Conserve time and energy in finding the documents you require, utilizing US Legal Forms’ sophisticated search and Preview feature to locate Examples Of Conveyance Documents efficiently.

- If you maintain a monthly subscription, Log In to your US Legal Forms account, search for your form, and retrieve it.

- Access the My documents section to review prior downloads and organize your documents as desired.

- For first-time users of US Legal Forms, create an account for unlimited access to the library's advantages.

- Utilize a comprehensive online form repository that can significantly improve your ability to navigate these circumstances efficiently.

- US Legal Forms stands as a leader in the online legal document industry, providing over 85,000 state-specific legal forms at any moment.

- Access localized legal and organizational documents tailored to your needs.

Form popularity

FAQ

Examples of conveyance documents include quitclaim deeds, grant deeds, and lease agreements. Each document serves a unique purpose in the property transfer process, ensuring clarity and legal compliance. By utilizing the resources available at US Legal Forms, you can find suitable templates and instructions for creating the right conveyance documents for your needs.

If you are searching for a specific personal family trust, you should contact the county clerk's office where the personal family trust was established.

While that's a reasonable question, the fact is, trust documents generally avoid the court completely. As such, they are not matters of public record. This means that you likely will not be able to secure a copy of the trust from the Office of the County Clerk or the courthouse in the same way you would a will.

A living trust is a legal device used to manage real or personal property. The benefit of a trust is that your trust document determines what happens to your property, not your will. In a living trust, the person forming the trust, known as the settlor or grantor, places property in the control of a trustee.

If you are searching for a specific personal family trust, you should contact the county clerk's office where the personal family trust was established.

One of the benefits of a Trust is that it is private. There is no legal requirement to record a Trust in a public forum, such as a court or a state institution. This allows Settlors to manage their property discreetly, and eventually distribute their property as they choose to their beneficiaries.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.

Make a written demand for a copy of the Trust and its amendments, if any; Wait 60 days; and. If you do not receive a copy of the Trust within 60 days of making your written demand, file a petition with the probate court.