Inheritance Tax Waiver Form For Missouri

Description

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

Creating legal documents from the ground up can occasionally be daunting.

Specific situations may require extensive research and significant financial investment.

If you are seeking a simpler and more cost-effective method of preparing the Inheritance Tax Waiver Form For Missouri or any other forms without dealing with unnecessary complications, US Legal Forms is readily available to assist you.

Our online collection of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal matters.

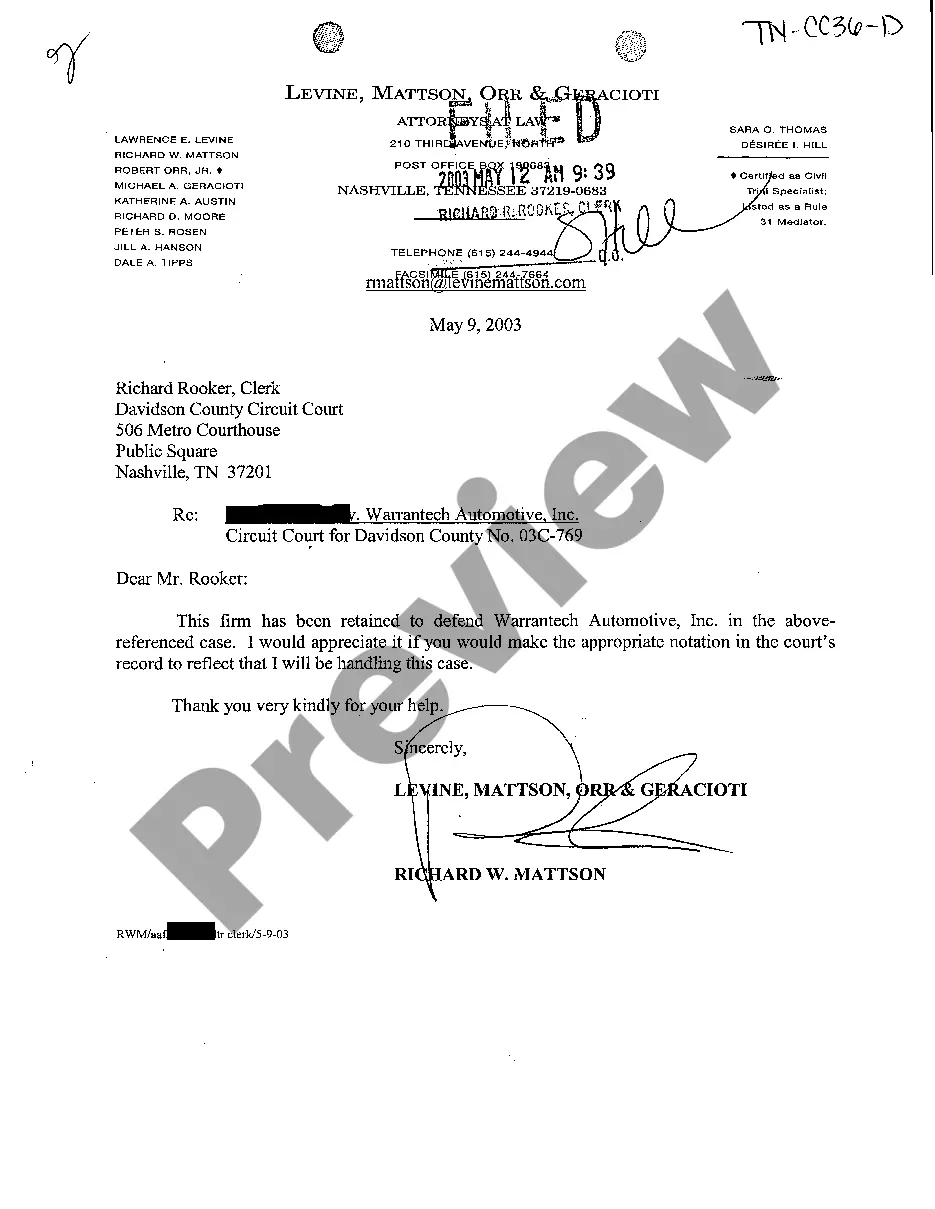

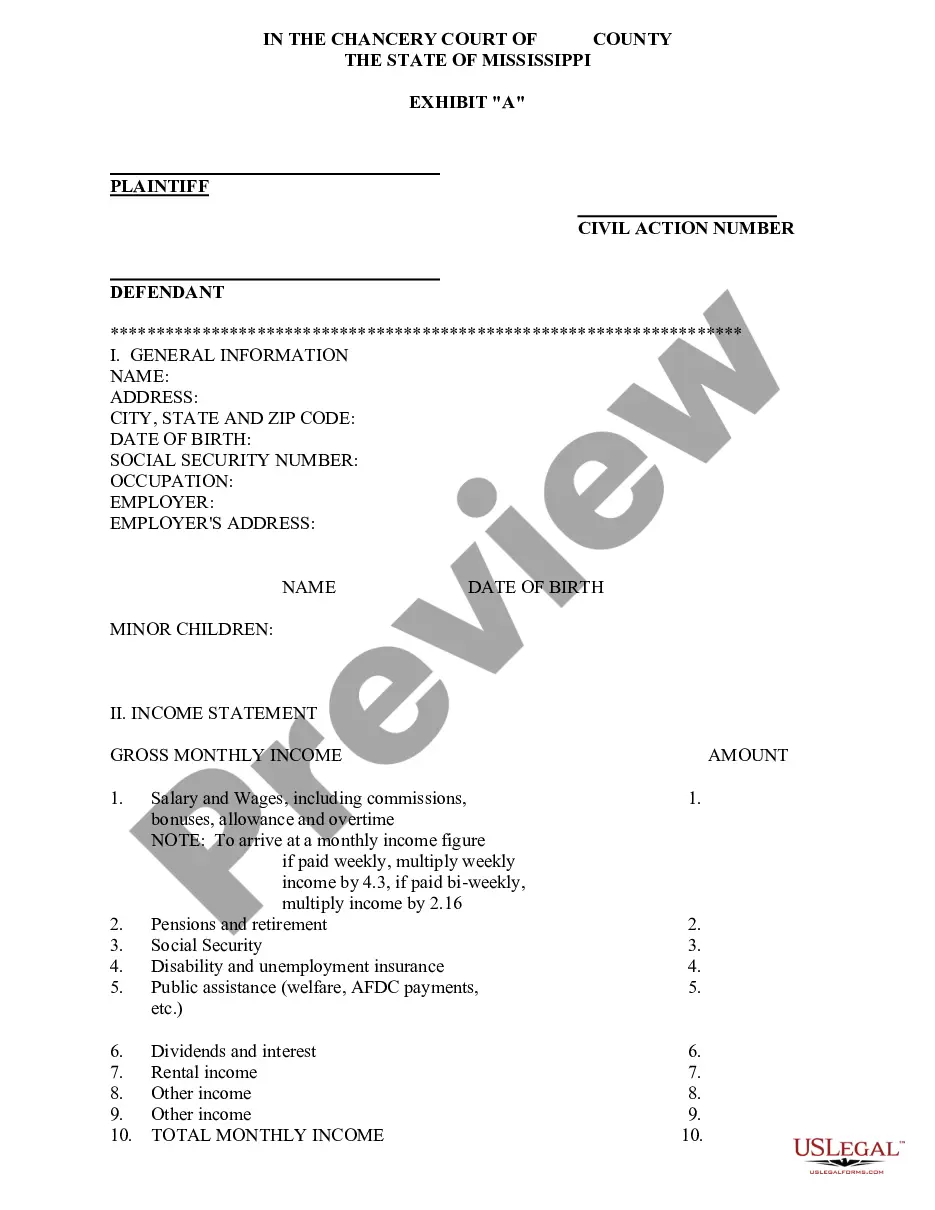

However, before racing straight to downloading the Inheritance Tax Waiver Form For Missouri, adhere to these suggestions: Review the document preview and descriptions to confirm that you have located the form you need. Verify that the template you select aligns with the requirements of your state and county. Choose the most appropriate subscription plan to acquire the Inheritance Tax Waiver Form For Missouri. Download the form, then fill it out, certify it, and print it. US Legal Forms enjoys an impeccable reputation and over 25 years of experience. Join us today and simplify your document completion process!

- With a few clicks, you can effortlessly obtain state and county-compliant forms meticulously crafted for you by our legal professionals.

- Utilize our platform whenever you require dependable services to swiftly find and obtain the Inheritance Tax Waiver Form For Missouri.

- If you’re familiar with our site and have an account, simply Log In to access your account, find the template, and download it, or fetch it again later from the My documents section.

- Not registered yet? No problem. Signing up takes only minutes and lets you explore the library.

Form popularity

FAQ

Becoming exempt from property taxes in Missouri typically involves meeting specific eligibility criteria, such as age, income, and disability status. Many seniors can apply for exemptions through local tax offices. For added assistance, the Inheritance tax waiver form for Missouri can guide you through the application process and help you understand your options.

Seniors do not stop paying taxes at a specific age in Missouri; rather, they may qualify for relief programs that reduce their tax obligations based on their financial situation. It is important for seniors to stay informed about available tax credits and exemptions. If you're looking for tools to help manage this process, the Inheritance tax waiver form for Missouri can be a useful resource.

Seniors in Missouri may qualify for certain discounts on personal property taxes based on their income and age. While there is not a universal discount, there are programs designed to offer tax credit relief for eligible seniors. Utilizing the Inheritance tax waiver form for Missouri can help you ascertain your eligibility and access potential benefits.

To obtain a tax waiver in Missouri, individuals typically need to meet specific eligibility criteria, such as income thresholds. The most effective way to apply for such waivers is to complete relevant forms like the Inheritance tax waiver form for Missouri. This form helps you navigate the requirements and submit necessary documentation to gain tax relief.

No, property taxes are not frozen at age 65 in Missouri, but seniors do have options for tax relief. Those aged 65 and older can apply for various benefits, including property tax credits based on income levels. For detailed information on potential waivers, you may want to explore the Inheritance tax waiver form for Missouri.

In Missouri, seniors can apply for property tax relief programs starting at age 65. While seniors do not stop paying property taxes automatically, they may qualify for a property tax credit or exemption, depending on their income and the type of property they own. For assistance, consider the Inheritance tax waiver form for Missouri, which may guide you through any applicable relief options.

In Missouri, since there is no inheritance tax, you do not need to worry about avoiding taxes on inherited property. You can inherit real estate without financial penalties at the state level. It is important, however, to ensure that property is properly titled to avoid any complications down the line.

Missouri does not have an inheritance tax, so the concept of an inheritance tax waiver does not apply here. This policy allows heirs to fully benefit from their inheritances without the burden of state taxes. Always verify with a trusted financial advisor for the most current regulations regarding estates.

Since Missouri does not impose an inheritance tax, you do not need to take specific steps to avoid it. Understanding how to manage the estate and ensuring that all assets are correctly allocated is essential. Consider asking a legal expert for guidance on effectively handling your inheritance matters.

Yes, you can obtain a Missouri tax waiver application online. Various state resources provide access to the necessary forms digitally. Additionally, platforms such as USLegalForms offer convenient online solutions, allowing you to fill out and submit the inheritance tax waiver form for Missouri from the comfort of your home.