Court Debtor With A Regular Income

Description

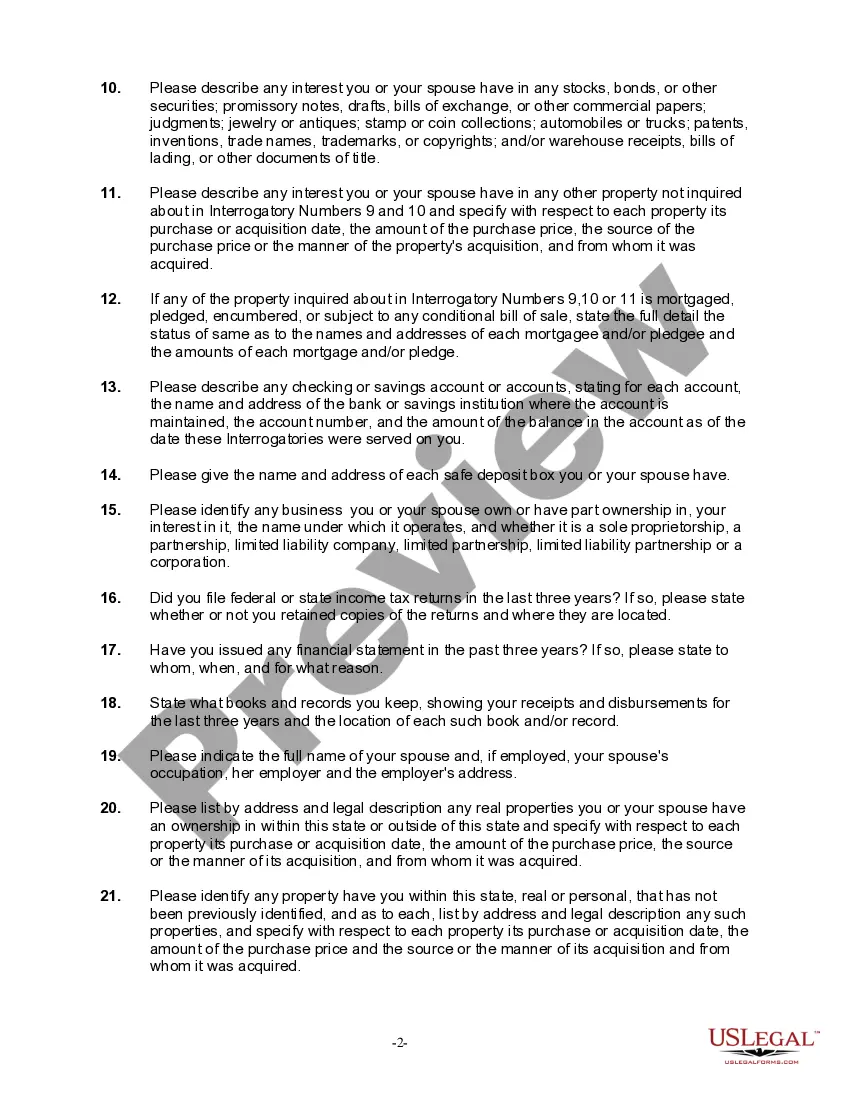

How to fill out Interrogatories In Federal Court To Judgment Debtor In General And?

Whether for business purposes or for personal matters, everyone has to deal with legal situations at some point in their life. Filling out legal papers demands careful attention, beginning from picking the proper form template. For example, when you choose a wrong edition of a Court Debtor With A Regular Income, it will be turned down once you send it. It is therefore essential to have a dependable source of legal papers like US Legal Forms.

If you have to get a Court Debtor With A Regular Income template, follow these simple steps:

- Get the sample you need by utilizing the search field or catalog navigation.

- Examine the form’s description to ensure it suits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong document, return to the search function to locate the Court Debtor With A Regular Income sample you need.

- Download the template if it matches your needs.

- If you already have a US Legal Forms account, click Log in to access previously saved documents in My Forms.

- If you don’t have an account yet, you may download the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the account registration form.

- Select your transaction method: use a credit card or PayPal account.

- Pick the document format you want and download the Court Debtor With A Regular Income.

- When it is downloaded, you are able to complete the form by using editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you do not need to spend time searching for the right sample across the web. Make use of the library’s simple navigation to get the proper form for any situation.

Form popularity

FAQ

Chapter 7 bankruptcy works well for low-income debtors with little or no assets or those who can protect all household belongings. If you don't have any assets to sell, creditors receive nothing.

What Does Debtor Mean? Debtors are individuals or businesses that owe money. Debtors can owe money to banks, or individuals and companies. Debtors owe a debt that must be paid at some time in the future.

You Must Have Sufficient Disposable Income. To qualify for Chapter 13, you will have to show the bankruptcy court that you will have enough income after subtracting certain allowed expenses and required payments on secured debts (such as a car loan or mortgage) to meet your repayment obligations.

A debtor must have enough income, after deducting allowable expenses, for all debt obligations. A debtor may include income from a working spouse even if the spouse has not filed jointly for bankruptcy, wages and salary, self-employment income, Social Security benefits, and unemployment benefits.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.