Seller Limit Order For Short Sell

Description

How to fill out Notice To Merchant Seller Of Limitation Of Time For Rejection Of Additional Terms?

It's evident that you cannot transform into a legal expert instantly, nor can you swiftly learn how to draft a Seller Limit Order For Short Sell without possessing a specialized skill set.

Assembling legal documents is a labor-intensive process demanding specific training and expertise.

So why not entrust the creation of the Seller Limit Order For Short Sell to the professionals.

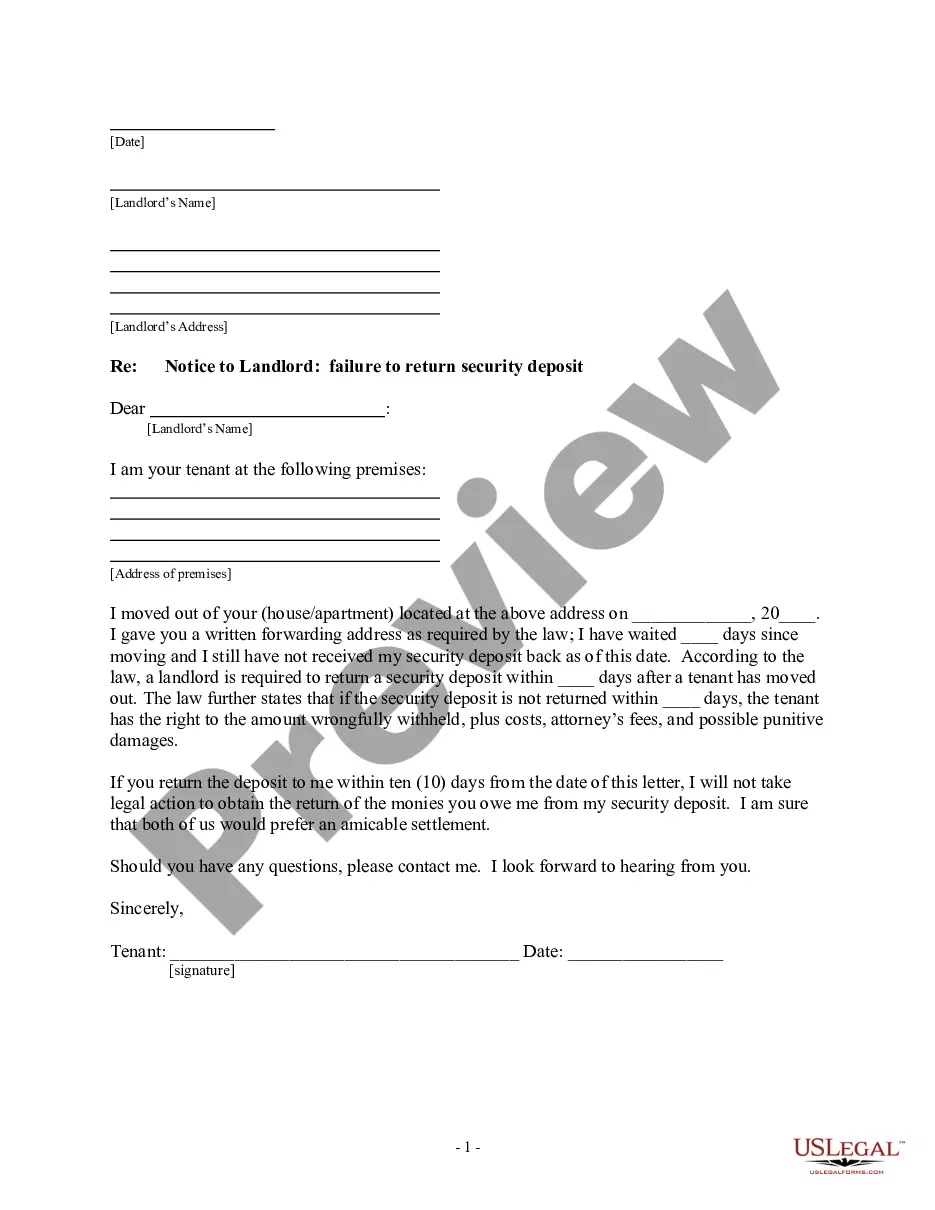

Preview it (if this option is available) and review the accompanying description to verify whether the Seller Limit Order For Short Sell is what you're after.

Restart your search if you require any other template. Create a complimentary account and choose a subscription plan to buy the form.

- With US Legal Forms, one of the most extensive legal template repositories, you can discover everything from court documents to templates for inter-office correspondence.

- We understand the importance of maintaining compliance with federal and state laws and regulations.

- That’s why, on our platform, all documents are region-specific and current.

- Here’s how to begin with our website and acquire the document you need in just a few minutes.

- Locate the form you seek using the search bar at the top of the page.

Form popularity

FAQ

How Do You Place a Buy Limit Order? To place a buy limit order, you will first need to determine your limit price for the security you want to buy. The limit price is the maximum amount you are willing to pay to buy the security. If your order is triggered, it will be filled at your limit price or lower.

So you would use a sell-limit order to open the short position (or short-limit depending on what terminology your broker uses) once the price goes above 22.50, and a buy-stop order to cover your short position if the price goes above the limit price.

A sell limit order executes at the given price or higher. The order only trades your stock at the given price or better. But a limit order will not always execute. Your trade will only go through if a stock's market price reaches or improves upon the limit price.

A limit can be placed on either a buy or a sell order: A buy limit order will be executed only at the limit price or a lower price. A sell limit order will be executed only at the limit price or a higher one.

A buy stop-limit order covers the short sale when a particular price is reached, at which point the order converts into a limit order. The buy stop-limit order will only be executed at the specified limit price or better, similar to the sell stop-limit order.