Debt Collection Warrant Without Notification

Description

How to fill out Assignment Of Debt?

Locating a reliable source for obtaining the most up-to-date and suitable legal templates is a significant part of navigating bureaucracy. Selecting the appropriate legal documents requires precision and meticulousness, which is why it is crucial to obtain samples of Debt Collection Warrant Without Notification solely from trustworthy sources, such as US Legal Forms. An incorrect template can squander your time and prolong the issue at hand. With US Legal Forms, you have minimal concerns. You can access and review all the details regarding the document’s applicability and significance for your situation and in your specific state or locality.

Follow these outlined steps to complete your Debt Collection Warrant Without Notification.

Once you have the form on your device, you can modify it with the editor or print it and complete it manually. Alleviate the challenges associated with your legal documentation. Explore the extensive US Legal Forms repository where you can discover legal templates, evaluate their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to locate your sample.

- Check the form’s description to ensure it meets the specifications of your state and county.

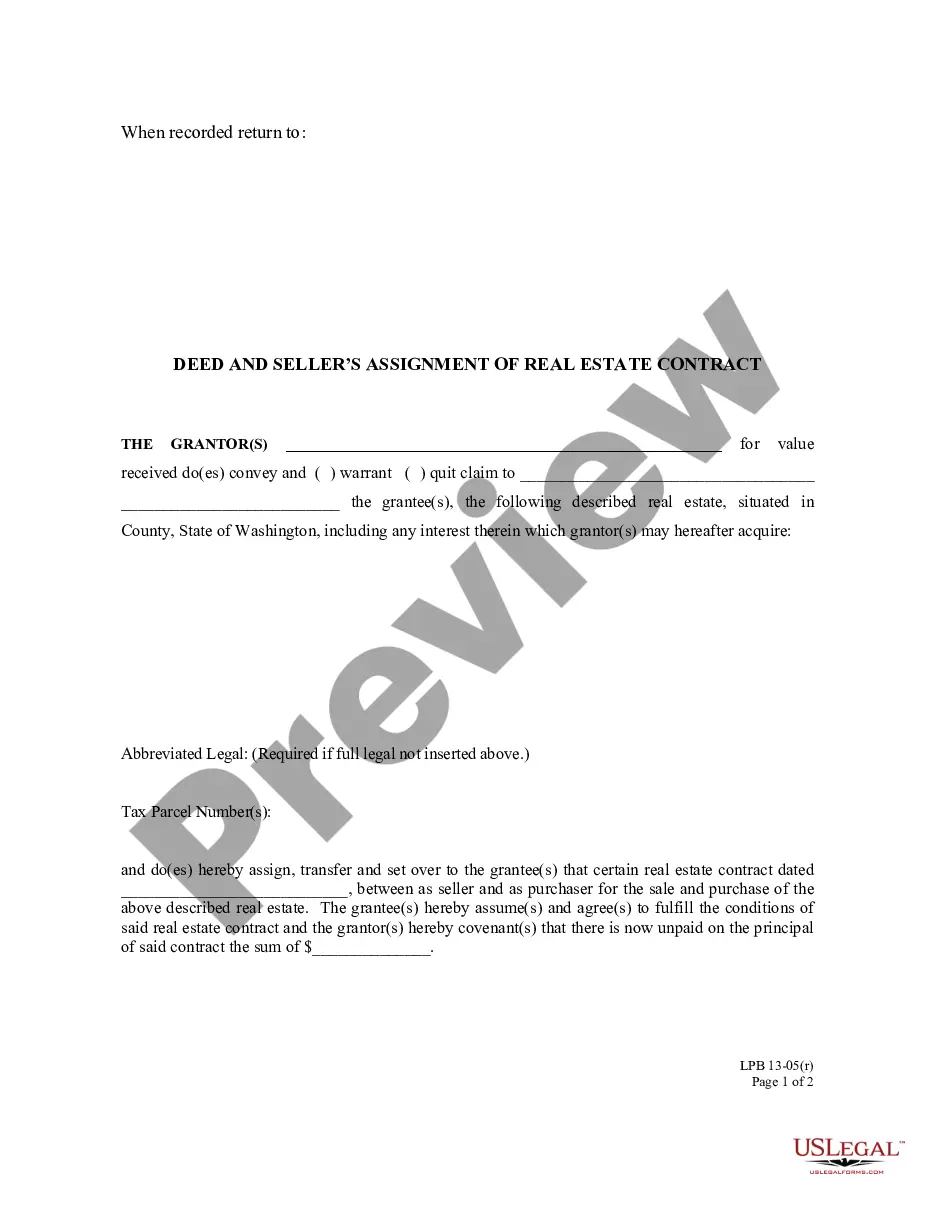

- Examine the form preview, if available, to confirm the form is indeed what you need.

- Return to the search to find the appropriate template if the Debt Collection Warrant Without Notification does not satisfy your requirements.

- When you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you do not possess an account yet, click Buy now to acquire the template.

- Select the pricing plan that aligns with your needs.

- Proceed with the registration to finalize your purchase.

- Complete your transaction by selecting a payment option (credit card or PayPal).

- Choose the document format for downloading Debt Collection Warrant Without Notification.

Form popularity

FAQ

Yes, it is possible to be sent to collections without prior notification. Creditors may initiate a debt collection warrant without informing you first. This can be unsettling, but staying vigilant about your debts can prevent surprises. Utilizing tools and resources available on the US Legal Forms platform can help you navigate these situations effectively.

In most cases, creditors are not required to notify you before sending your account to collections. They may choose to inform you, but a debt collection warrant without notification can still be issued. Understanding your rights and obligations will empower you to address any collection issues promptly. You can consult resources on the US Legal Forms platform for more guidance on this matter.

You can find out if you've been sent to collections by checking your credit report. Credit reports include information about debts in collections, which can help you identify any debts you were unaware of. Additionally, if a debt collection warrant without notification has been issued against you, it may appear on your report. Regularly monitoring your credit can help you stay informed about your financial status.

However, they're required to send a debt validation letter within five days of first contacting you. If you don't receive a debt validation letter within 10 days of initial contact, you can submit a complaint to the Consumer Financial Protection Bureau.

Within five days after a debt collector first contacts you, it must send you a written notice, called a "validation notice," that tells you (1) the amount it thinks you owe, (2) the name of the creditor, and (3) how to dispute the debt in writing.

Responding to a debt collection letter depends on the type of debt your creditors are claiming you owe. If you feel the amount of the proposed debt is correct and you can afford to pay it, do so. This will be a sufficient form of response and should halt any collection activity.

Pay the original creditor Pay the full balance immediately to the original creditor. Set up a series of monthly payments to the original creditor to repay the entire debt. Offer to pay less than the full balance due to the original creditor. Pay the collection agency.