Certificate Of Trust Example With Answer

Description

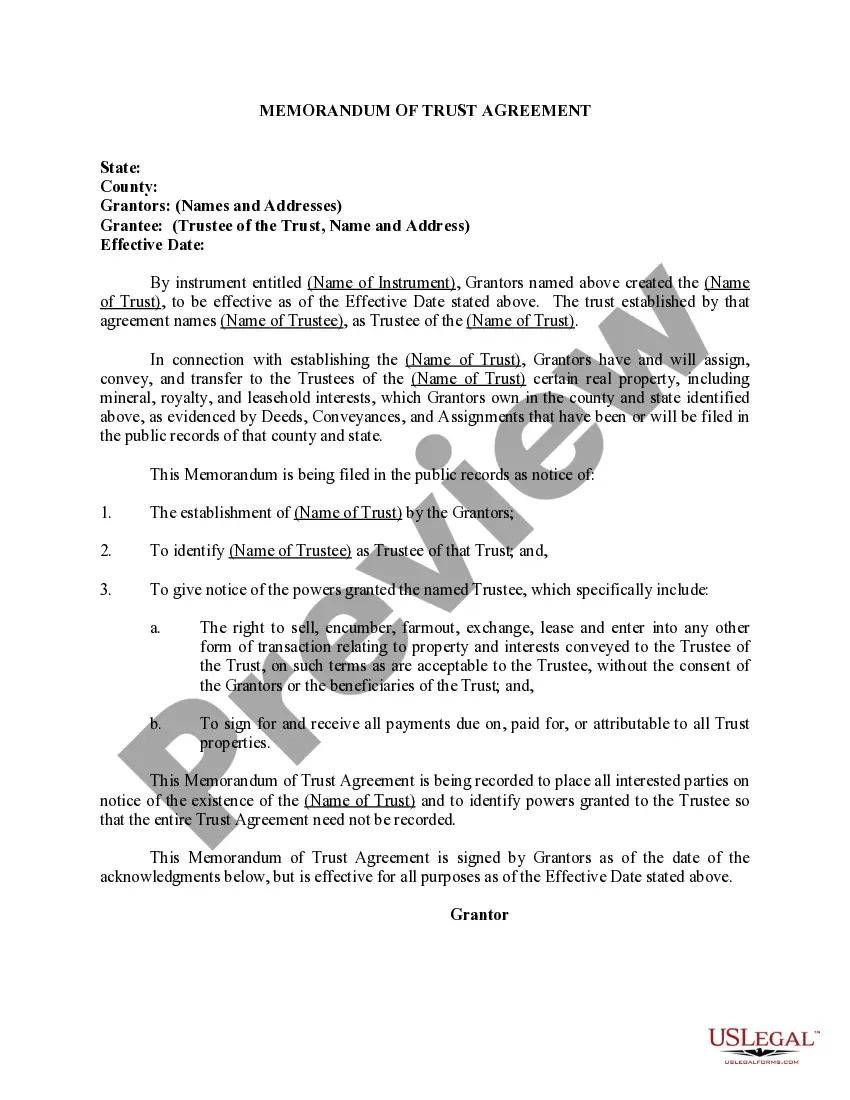

How to fill out Certificate Or Memorandum Of Trust Agreement?

Whether for professional reasons or personal issues, everyone must confront legal matters at some juncture in their life.

Completing legal paperwork requires meticulous attention, beginning with selecting the correct form template.

With an extensive US Legal Forms catalog available, you don’t need to waste time searching for the correct template online. Utilize the library's straightforward navigation to find the suitable form for any circumstance.

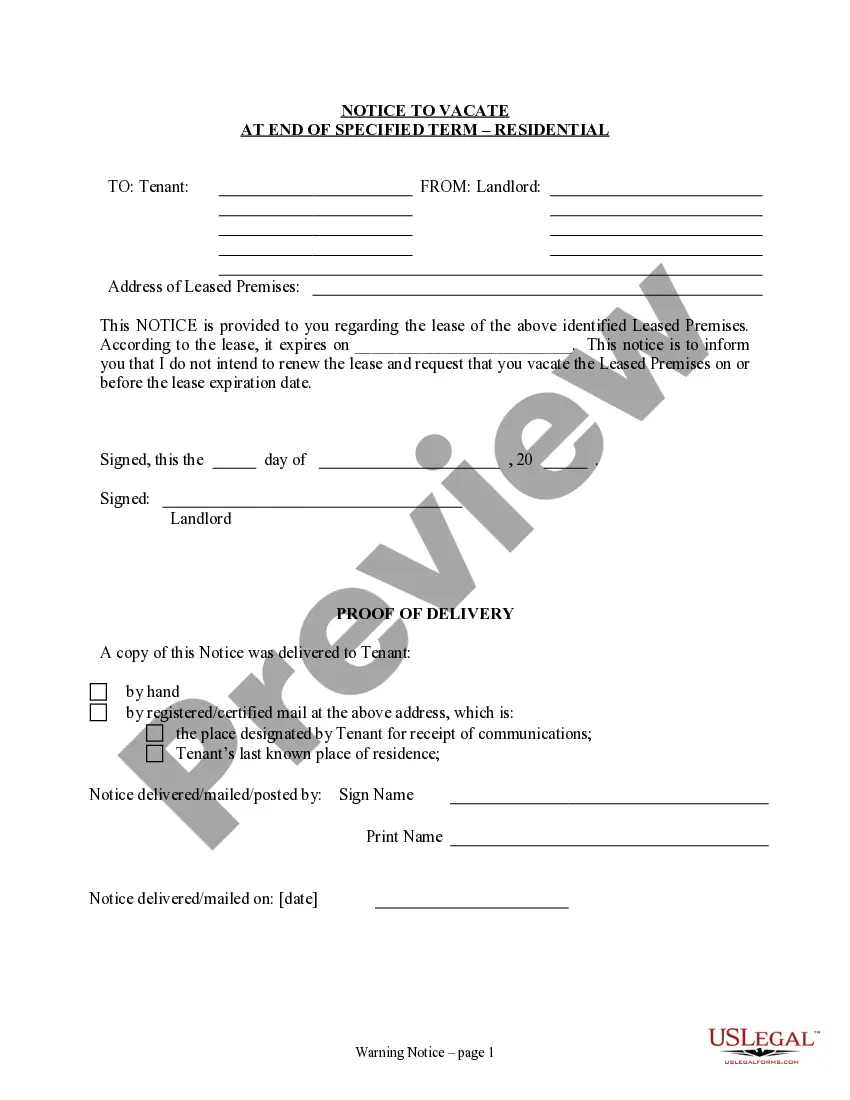

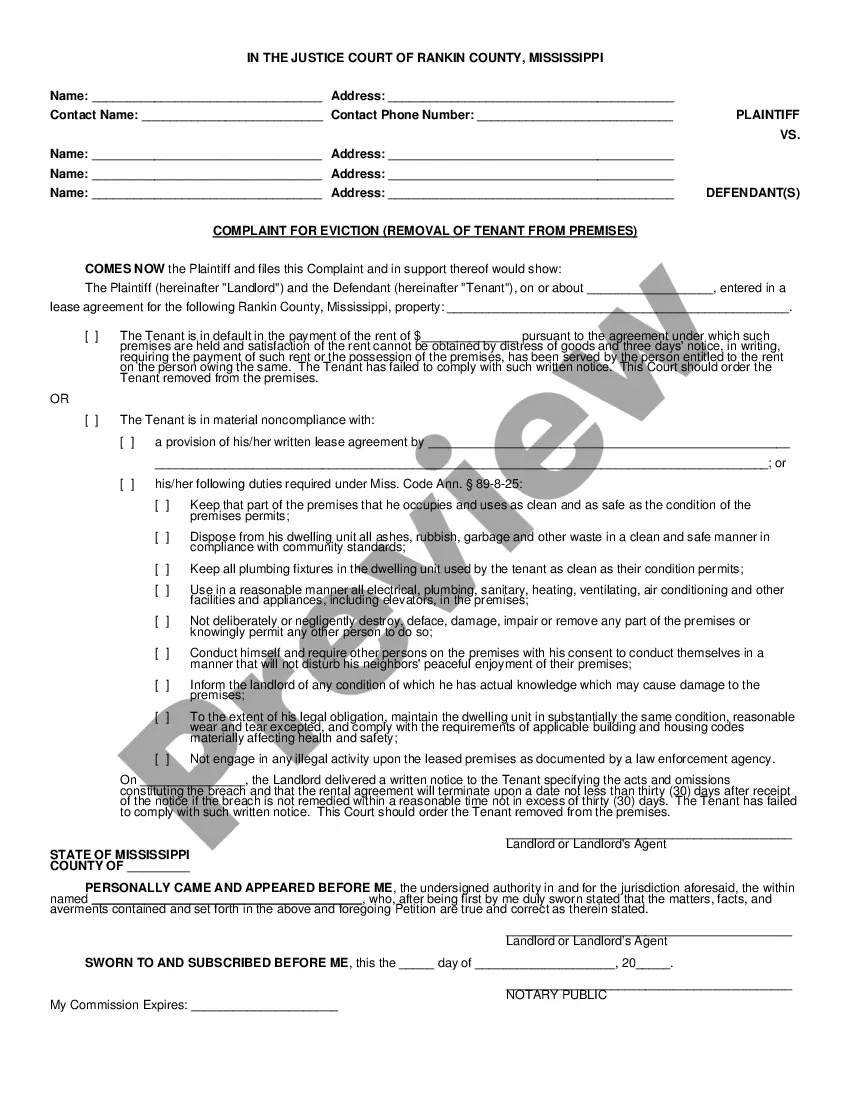

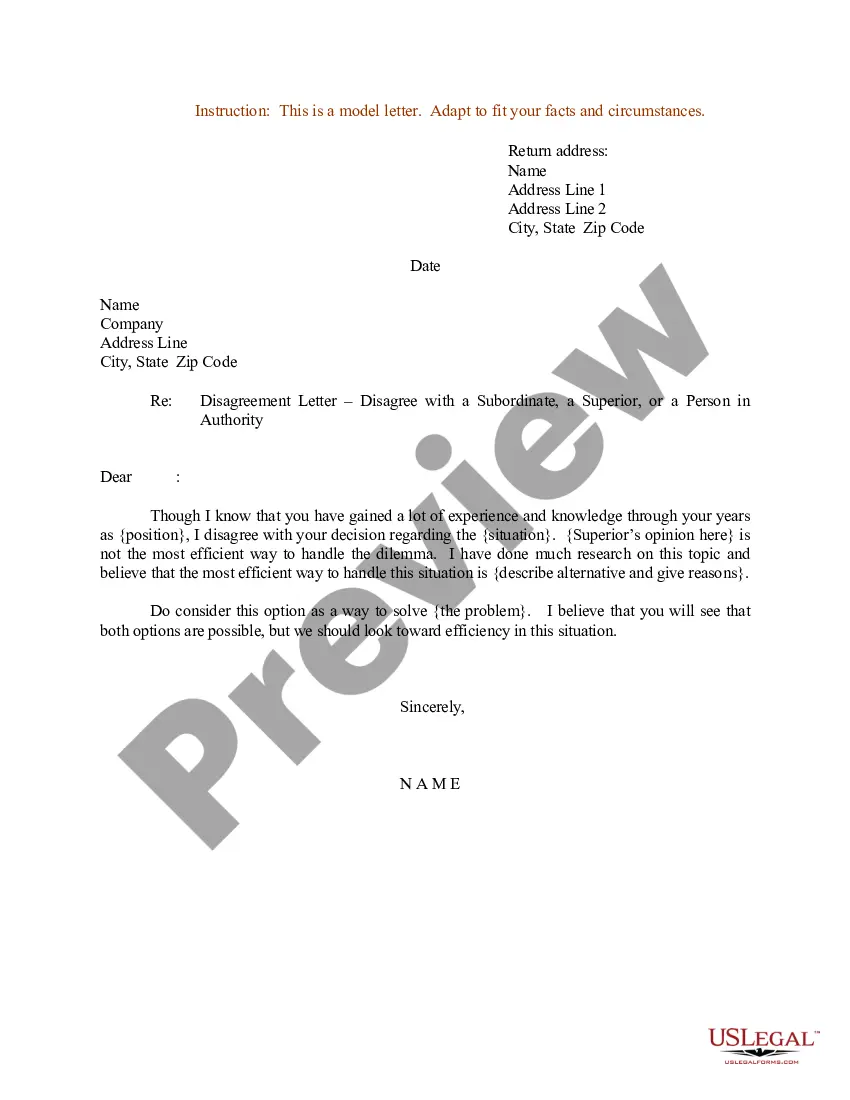

- Locate the template you require by utilizing the search box or catalog browsing.

- Examine the form's details to confirm it aligns with your situation, state, and locality.

- Select the form's preview to review it.

- If it is the wrong document, return to the search feature to find the Certificate Of Trust Example With Answer template you need.

- Download the template if it fits your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing choice.

- Complete the account registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the document format you prefer and download the Certificate Of Trust Example With Answer.

- Once it is downloaded, you can fill out the form using editing software or print it to complete manually.

Form popularity

FAQ

world example of trust might involve a family setting up an education trust for their children. This trust can ensure that funds are exclusively used for educational purposes, supporting the child's journey through school or college. To gain more perspective, check out a certificate of trust example with answer, which illustrates how such trusts can be structured.

The cost of creating a will in Montana can range from approximately $250 to $1000, while a trust typically costs anywhere between $900 and $3450. At Snug, any member can create a Power of Attorney and Health Care Directive for free.

An estate skips probate in Montana if it's less than $50,000. Avoiding the probate process could be beneficial for an estate's heirs, as the probate process in Montana can be long and expensive.

Your property can be transferred to your beneficiaries without entering probate, and this is possible in a few ways. Common methods include transferring your property to a living trust, gifting property before you pass on or making a beneficiary a joint owner of your property.

Under Montana's probate laws, you can distribute certain types of property and assets without a probate court's approval. They include: Accounts with a named beneficiary, such as life insurance policies and retirement funds. Assets and property that is held in a living trust.

Public Access to Court Electronic Records (PACER) You can contact the PACER Service Center at .pacer.uscourts.gov for registration information about obtaining a PACER account. The PACER Locator has the ability to search across multiple court units.

All that is necessary is an affidavit to be presented to the court, but the estate must be worth less than $50,000. Formal probate is lengthier and more complex, but it also has two categories: supervised and unsupervised. With supervised probate, the court will oversee all actions of the executor.

In Montana, the following assets are subject to probate: Solely-owned property: Any asset that was solely owned by the deceased person with no designated beneficiary is subject to probate. This could include bank accounts, cars, houses, personal belongings, and business interests.

One of the protections offered by a living trust in Montana is privacy. The terms of the trust, including the assets in the trust and the names of the beneficiaries, do not become public record and do not have to go through a court process. Wills, in contrast, are public record and require a court process.