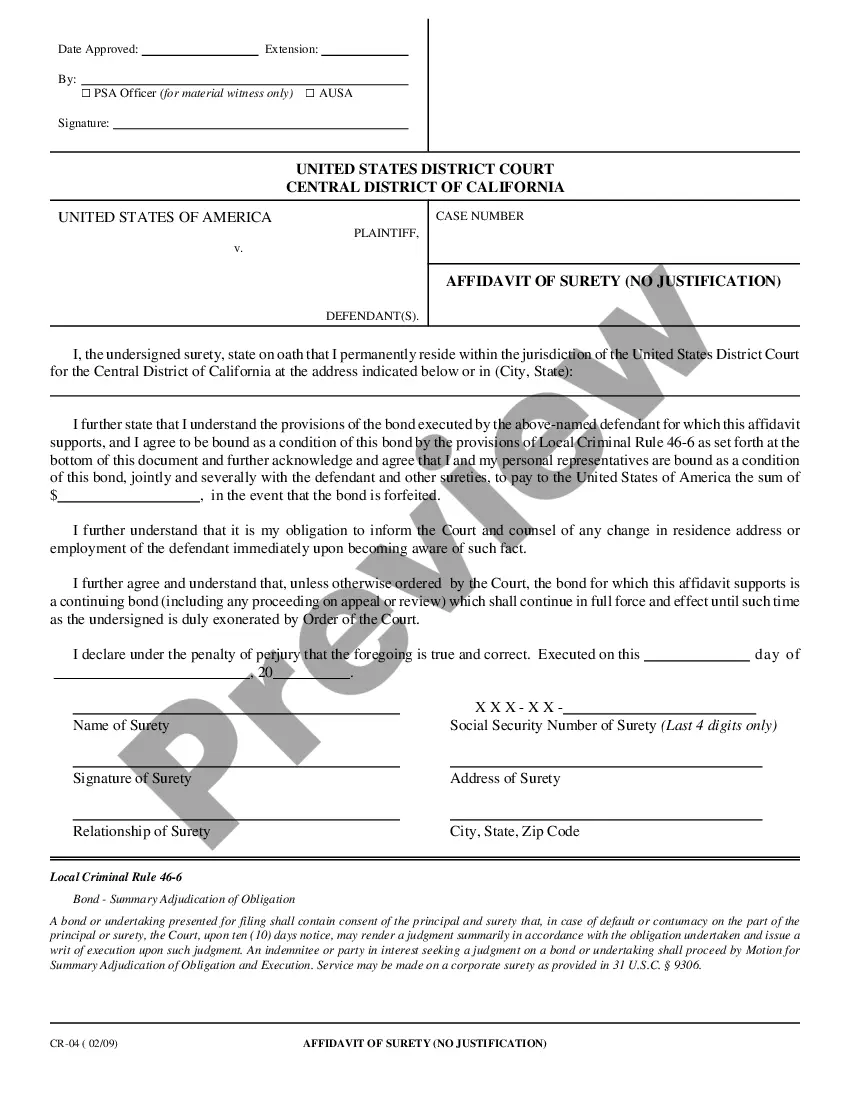

Certificate Of Trust Example

Description

How to fill out Certificate Or Memorandum Of Trust Agreement?

- If you're a returning user, simply log in to your account and click the Download button next to your document. Verify that your subscription is active, and renew it if necessary.

- For first-time users, start by browsing the extensive template library. Review the preview mode and detailed descriptions to ensure you select the correct Certificate of Trust that meets your legal requirements.

- If you don't find the right document, utilize the Search tab to look for alternatives. Once you identify the correct form, proceed to the next step.

- Purchase the selected document by clicking the Buy Now button. Choose a subscription plan that fits your needs and create an account for access to a wealth of resources.

- Complete your transaction by entering your payment details or using PayPal to finalize your subscription.

- Download the template to your device. You can access it anytime in the My Forms section of your profile.

By using US Legal Forms, you gain access to an extensive collection of over 85,000 customizable legal forms. This service not only empowers you to efficiently manage paperwork but also provides access to premium experts when you need help completing your documents.

In conclusion, obtaining a Certificate of Trust is a straightforward process with US Legal Forms. Embrace the simplicity and strength of this platform to safeguard your legal needs today!

Form popularity

FAQ

A trust document becomes legal when it adheres to state laws and includes all necessary elements, such as the grantor's intent and clear descriptions of trust assets. Proper execution is crucial, which typically entails the signatures of the grantor and witnesses, as well as notarization. Utilizing a certificate of trust example can illustrate the vital components that ensure your trust document meets legal standards.

Yes, a declaration of trust generally needs to be notarized to provide legal credibility. This process involves verifying identities and ensuring that the document is signed willingly by the involved parties. To protect yourself and your assets, refer to a certificate of trust example that incorporates notarization details as part of its structure.

One significant mistake parents make when setting up a trust fund is failing to fund the trust properly. They may create the trust without transferring any assets into it, which can render it ineffective for their beneficiaries. Ensuring that the trust is fully funded and reviewing a certificate of trust example can help avoid this pitfall, making sure it serves its intended purpose.

Yes, trust documents often require notarization to enhance their legality. This step helps verify the identities of those involved and ensures that the document is executed properly. By observing these legal standards, including using a certificate of trust example, you can provide assurance that the trust will be honored and upheld by the law.

In California, a deed of trust may be considered invalid for several reasons, such as failing to meet legal requirements or lacking proper signatures. If the trustor did not have the capacity to create the deed or if it did not comply with statutory regulations, it could also be voided. Moreover, an incomplete certificate of trust example can contribute to its invalidity if it fails to demonstrate the intent of the parties involved.

To file a certificate of trust, you’ll typically need to prepare the document and present it to your local jurisdiction, often the county clerk’s office. This process might involve filling out forms with specific trust information. Always ensure that you include a certificate of trust example that outlines the trust's terms clearly. Once filed, it serves to establish the trust's legal existence.

You should consider keeping certain assets outside of a trust. For example, retirement accounts like IRAs and 401(k)s often have their own beneficiary designations. Additionally, personal property that is not intended for transferring to beneficiaries, or assets that require direct management, may not be suitable. Using a certificate of trust example can help clarify which assets are best included.

Generally, banks do not keep copies of the entire trust documents. Instead, they may retain a certificate of trust example that provides the necessary details to manage accounts related to the trust. This practice maintains confidentiality while allowing banks to ensure proper account management.

Your bank may request a copy of your trust to verify its details and ensure proper management of your assets. Providing a certificate of trust example can help streamline this process, as it includes essential information without revealing the full trust document. This request helps banks comply with regulations and protect your interests.

A certificate of trust is often referred to as a trust certification or trust certificate. These terms describe a document that confirms the existence of a trust and summarizes its key provisions, similar to what a certificate of trust example provides. Understanding these terms can help in discussions with financial institutions and legal entities.