Arizona Certificate Of Trust Withdrawal

Description

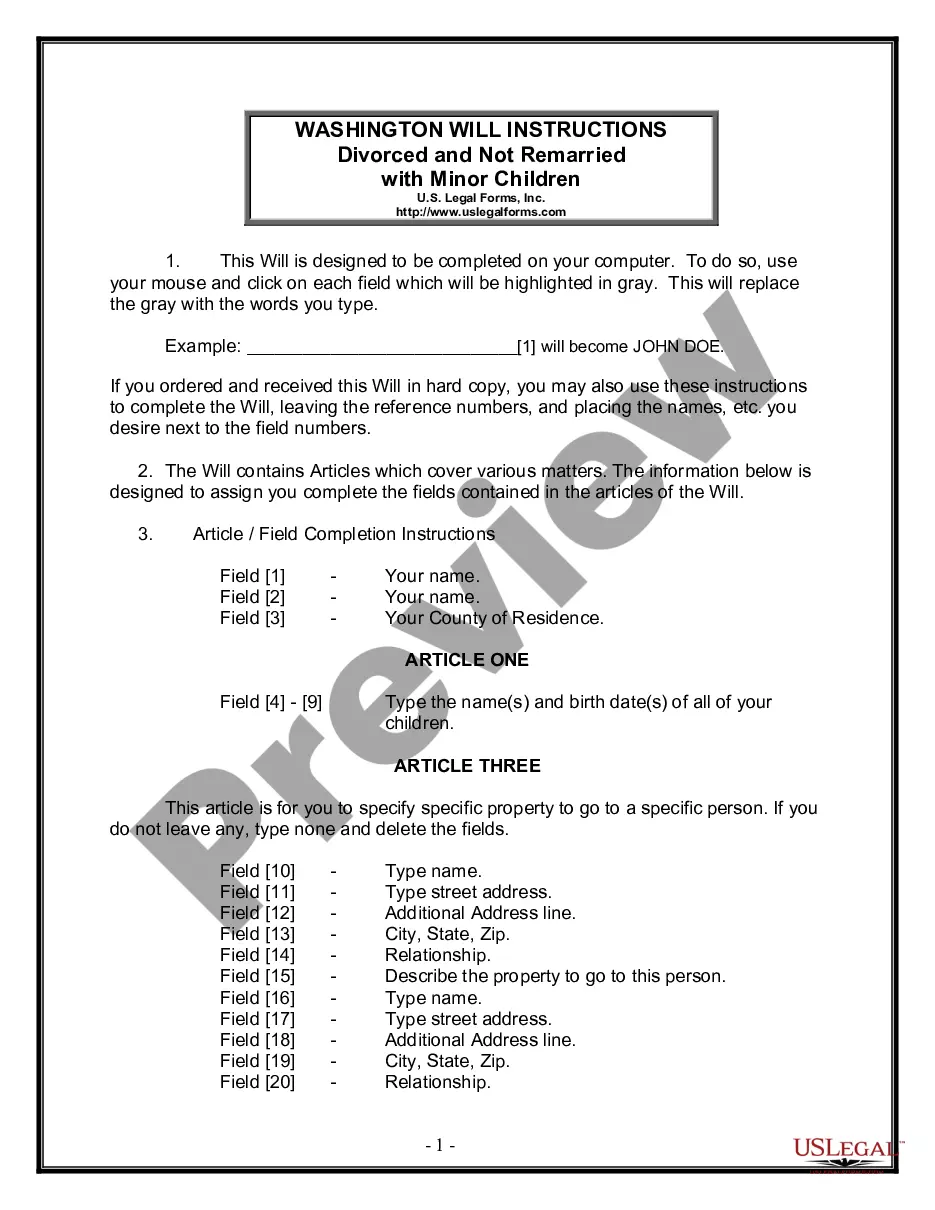

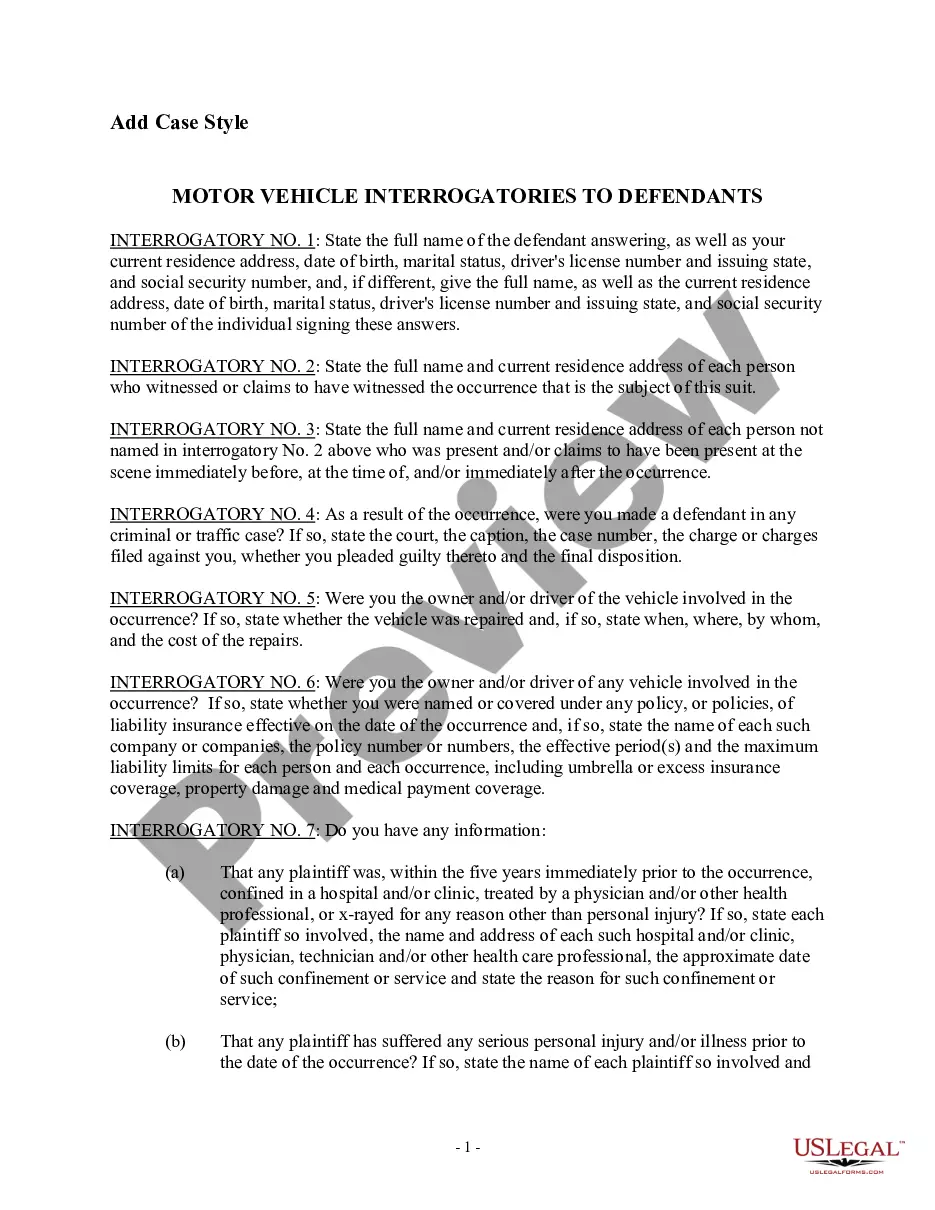

How to fill out Certificate Or Memorandum Of Trust Agreement?

Creating legal documents from the beginning can often be intimidating.

Certain cases may require extensive research and substantial financial investment.

If you’re seeking a more straightforward and cost-effective method of producing the Arizona Certificate Of Trust Withdrawal or other necessary forms without excessive complications, US Legal Forms is always accessible to you.

Our online database of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly obtain state- and county-compliant documents carefully prepared for you by our legal professionals.

US Legal Forms has an impeccable reputation and over 25 years of expertise. Join us today and make form completion a simple and efficient process!

- Utilize our platform whenever you require dependable services that enable you to effortlessly find and download the Arizona Certificate Of Trust Withdrawal.

- If you’re already familiar with our services and have established an account with us previously, simply Log In to your account, choose the form, and download it immediately or re-download it anytime from the My documents section.

- Don’t possess an account? No problem. Setting up an account and exploring the library takes minimal time.

- However, before immediately proceeding to download the Arizona Certificate Of Trust Withdrawal, please adhere to these suggestions.

- Examine the document preview and descriptions to confirm you have located the document you need.

Form popularity

FAQ

Compliance)? You must request the certificate directly from the Arizona Department of Revenue by completing their Tax Clearance Application form. You can access that form on their website, .azdor.gov, or request the form in writing from: Arizona Department of Revenue Special Collection Section 1600 W.

Foreign corporation registered in Arizona: If your foreign corporation has conducted business or issued stock in Arizona, provide the completed form, CF: 0025, Application for Withdrawal of Foreign Corporation and an exact copy to the Commission by mail, fax or in person.

The Certificate of Compliance tells the Court of Appeals that the brief does not exceed the word count or page limit set by the Arizona Rules of Civil Appellate Procedure.

The Arizona Department of Revenue's (ADOR) Education & Outreach District serves as a liaison between the department and the state's cities, towns and municipalities. Our division consists of three areas: City Services Team, Education Unit, Compliance Programs and Specialty Tax Program Teams.

A tax correction notice (TCN) is a correspondence letter sent by the Arizona Department of Revenue to inform taxpayers of important account matters or changes.