Notice Lien Owner For The Application

Description

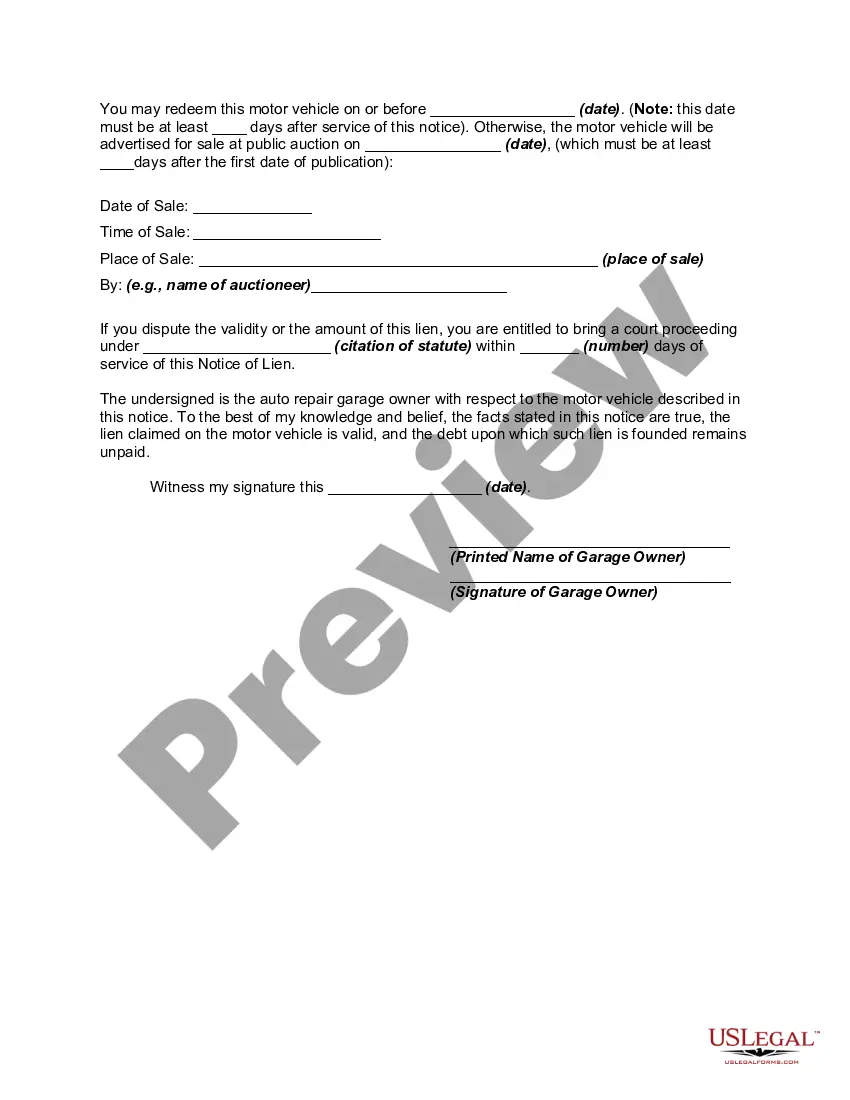

How to fill out Notice Of Lien By Owner Of Auto Or Car Repair Garage And Notice Of Sale?

- Log in to your US Legal Forms account if you're a returning user. Ensure that your subscription is active; if not, renew it as per your payment plan.

- If you're new to the service, start by previewing the form description to confirm it meets your needs and adheres to your local jurisdiction's requirements.

- If the selected template is not suitable, utilize the Search feature to find a more appropriate option.

- Once you have the right document, click the Buy Now button to select your desired subscription plan and create an account for access.

- Proceed to make your payment using a credit card or PayPal to finalize your purchase.

- Download the form to your device and navigate to the My Forms section in your profile for future access.

By utilizing US Legal Forms, you gain access to a vast library of over 85,000 legal documents, ensuring you find exactly what you need while saving time and effort.

Don't wait any longer to simplify your legal processes. Start your journey with US Legal Forms today!

Form popularity

FAQ

A lien can significantly impact your financial situation and your ability to manage your property. It restricts your ownership rights and can prevent you from selling or refinancing your property without settling the lien. Understanding your obligations becomes essential, as failing to resolve the lien can lead to further legal complications. Our platform enables you to effectively manage these issues by providing the necessary tools to notice lien owners for your application.

A notice of a lien filing serves as a serious warning to potential buyers or creditors. It indicates that a creditor has a legal claim against the property, which can complicate transactions. This situation may lead to delays in closing deals or a decrease in the property's value. Addressing this issue promptly is crucial, and using our platform can help you efficiently notify lien owners for your application.

No, notice to owner and notice of commencement serve different purposes. A notice to owner notifies a property owner about a claim or potential lien, while a notice of commencement signals the beginning of construction or renovations. Both notices play important roles in the management of property rights and responsibilities. The resources available on the US Legal platform can clarify these distinctions and guide you on your next steps.

A notice to owner serves as a legal communication that alerts property owners about potential liens or claims against their property. This notice provides homeowners with an opportunity to settle any outstanding obligations before a formal lien is filed. Understanding this process is key in protecting your rights as a property owner. If you're navigating this process, US Legal can assist you in ensuring all notifications are correctly prepared.

To obtain a lien release letter, start by contacting the creditor who filed the lien. Request the documentation once the payment has been made. It is vital that this letter be filed with the appropriate public office to ensure that your records are updated. Leveraging tools from US Legal can help you prepare the necessary documents and streamline the release process.

Yes, a lien can be placed on your house without a formal contract under certain circumstances. For example, unpaid taxes or judgments can result in a lien being filed against your property. However, it's critical to address any potential debts promptly to protect your home from such actions. The US Legal platform can guide you on how to determine any existing liens and how to properly respond.

The responsibility for filing a lien release typically falls on the creditor or the person holding the lien. Once the debt has been settled, they should submit the appropriate paperwork to the relevant authority. Remember, this process is essential as it officially removes the lien and updates public records. Consider using US Legal for assistance with your application to ensure all steps are correctly followed.

To obtain a copy of a lien release from the IRS, you should first contact the IRS directly. Request the release documentation by providing the necessary information, such as your Tax Identification Number. Additionally, keep in mind that the process may take some time, so it is important to be patient. Using the US Legal platform can streamline your experience, offering guidance on how to effectively navigate the application process.

A notice to owner claim of lien is a legal document filed to notify property owners that a lien may be claimed due to unpaid services or materials. This document serves to inform the property owner of your claim and the potential repercussions involved. Understanding this notice is vital for property owners to protect their interests. Our resources can help you navigate the legal landscape surrounding lien claims effectively.

To write a letter of intent for a lien, include your name, the property owner’s name, and a description of the lien's purpose. Clearly state the amount owed and any relevant dates. Ending the letter with your contact information encourages direct communication. For simplicity, consider using our prepared templates that guide you through this process step-by-step.