State Garnishment Garnishee With A Decision

Description

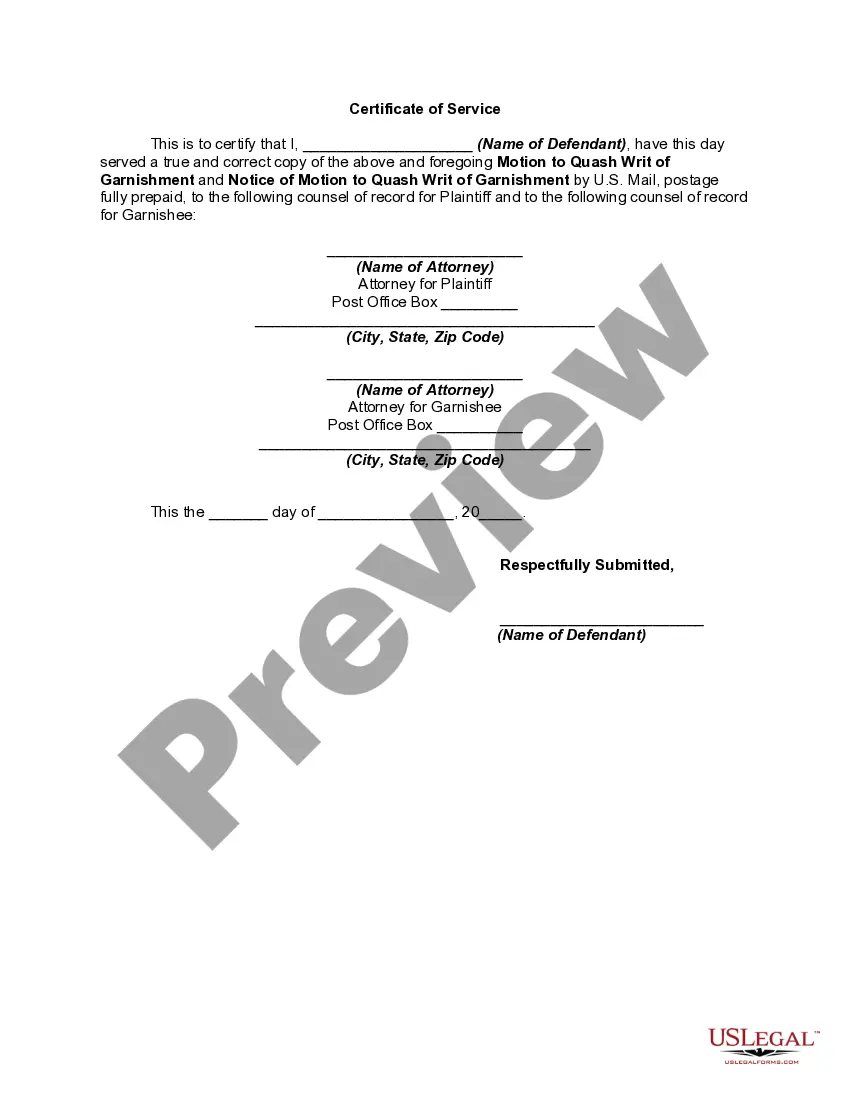

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment For Failure To Serve Copy Of Writ On Defendant And Notice Of Motion?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active; renew it as necessary prior to downloading any forms.

- If this is your first time using the service, start by browsing the extensive library. Check the form description and preview mode to confirm it meets your needs and local jurisdiction requirements.

- If you encounter any discrepancies or need additional forms, use the search feature to locate the correct template that fits your situation.

- Once you've found the appropriate document, click the Buy Now button. Choose a subscription plan and create an account to access the library's full resources.

- Proceed to checkout by entering your payment details via credit card or PayPal, securing your subscription.

- Finally, download your chosen form and save it on your device. You can also access it anytime through the My Forms section in your account.

In conclusion, US Legal Forms simplifies the process of managing legal documents, making it easier for individuals to handle their legal needs confidently. With over 85,000 forms available and expert assistance at your fingertips, you can ensure your documents are completed accurately.

Start today and streamline your legal process with US Legal Forms!

Form popularity

FAQ

Wage garnishment can occur out of state if the garnishment is initiated and upheld according to the laws of the state where the creditor filed. Even if you move, creditors can pursue garnishment based on the original court decision. It's crucial to be aware of both states' garnishment laws to effectively address any issues that arise. For practical legal assistance, uslegalforms offers necessary resources to help navigate this process.

Typically, the maximum amount that can be garnished from your paycheck is 25% of your disposable income or the amount that exceeds 30 times the federal minimum wage, whichever is less. The state garnishment garnishee with a decision follows specific guidelines, but this percentage can vary based on your circumstances. To manage potential garnishment, it’s important to stay informed about your financial obligations.

Yes, your wages can be garnished even if you live in a different state than where the debt originated. The state garnishment garnishee with a decision generally applies to your employer, regardless of your residency. However, some states have particular laws that may affect the garnishment process. Always consult local regulations to understand how this may affect you.

To write a letter to stop garnishment, start by including your contact information and the details of your debt. Clearly articulate your reasons for requesting the end of garnishment, and be sure to date the letter. Additionally, attach any supporting documents and send it to the creditor or the court overseeing your case. Uslegalforms provides templates that can help you draft a professional and effective letter.

Some states have strict laws that limit or do not allow wage garnishment at all. For instance, states like Texas and Florida have strong protections against garnishment for certain types of debt. However, federal law still applies in many situations, including child support and tax obligations. It’s vital to check your state's laws concerning state garnishment garnishee with a decision to understand your protections.

Filling out a wage garnishment exemption form requires you to provide personal details and the reason for claiming an exemption. You will need to outline your financial situation, including income and necessary expenses. Providing accurate and comprehensive information is crucial, as this can help you retain more of your wages. For guidance, consider using uslegalforms as a resource for templates and instructions.

When you want to challenge a garnishment, you must complete the appropriate challenge to garnishment form accurately. This typically involves providing your personal information, details about the garnished funds, and your reasons for the challenge. Be sure to submit these documents before the deadline indicated in your garnishment notice to ensure your rights are protected. Using uslegalforms can simplify this process with accessible templates.

In New Jersey, state garnishment garnishee with a decision allows creditors to take a portion of your wages to repay debts, but there are specific rules in place. Generally, a creditor can garnish up to 10% of your disposable income. However, if you are earning less than the federal poverty level, you may be exempt from garnishment. It’s essential to understand these rules to protect your income.

In Michigan, state garnishment garnishee with a decision is governed by specific laws that limit how much can be deducted from wages. Generally, the maximum amount garnished cannot exceed 25% of disposable earnings. It’s essential to be aware of both state and local regulations, as they can impact how garnishments are enforced against you.

The maximum amount deducted from your paycheck for a state garnishment garnishee with a decision varies. Federal law allows garnishment up to 25% of your disposable income, but Michigan, for instance, has different regulations that might limit it further. Knowing these limits helps you plan your finances better, ensuring you remain compliant with state laws.