Writ Statement Of Claim

Description

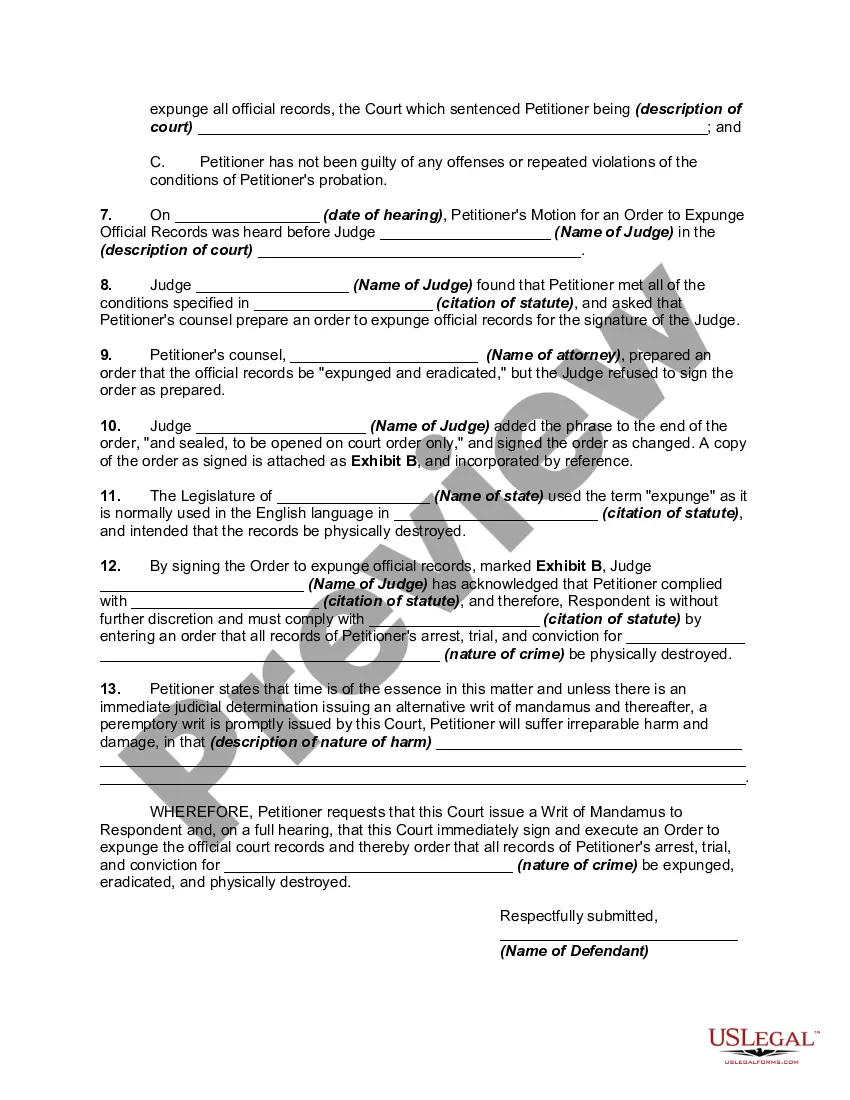

How to fill out Petition For Writ Of Mandamus Or Mandate To Compel Court To Expunge Record Of Arrest, Trial, And Conviction - Expungement?

It’s evident that one cannot transform into a legal expert instantly, nor can one understand how to swiftly compose a Writ Statement Of Claim without possessing a distinct set of competencies.

Formulating legal documents is a lengthy undertaking necessitating specific education and abilities. Therefore, why not delegate the drafting of the Writ Statement Of Claim to the experts.

With US Legal Forms, one of the most extensive legal template repositories, you can discover anything from judicial paperwork to templates for intra-office correspondence.

You can regain access to your documents from the My documents section at any time. If you are an existing client, you can simply Log In, and find and download the template from the same section.

Regardless of the intent behind your documents-whether they are financial, legal, or personal-our website has you covered. Explore US Legal Forms today!

- Identify the document you require by utilizing the search bar located at the top of the page.

- Examine it (if this feature is available) and review the descriptive information to ascertain whether the Writ Statement Of Claim is what you’re looking for.

- If you need another form, begin your search anew.

- Sign up for a complimentary account and select a subscription plan to purchase the template.

- Click Buy now. Once the payment is finalized, you can obtain the Writ Statement Of Claim, complete it, print it, and send or mail it to the relevant individuals or organizations.

Form popularity

FAQ

When the Supreme Court denies a writ, it typically means that the lower court's ruling stands without further review. This decision can effectively close the case without allowing for additional arguments or evidence. It's important to recognize how the denial may affect your writ statement of claim and the overall resolution of your legal matter.

Apply online You can complete your application for an EIN online: This is the fastest way to get your EIN. The site will validate your information and issue the EIN immediately.

You can file for your EIN before forming your LLC, but it is not recommended. If you do not have your LLC registered before applying for an EIN, your application might get rejected by the IRS because it cannot be validated against any state databases.

Apply Online at .irs.gov The Internet EIN application is the preferred method for customers to apply for and obtain an EIN.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

Apply for an EIN with the IRS assistance tool . It will guide you through questions and ask for your name, social security number, address, and your "doing business as" (DBA) name. Your nine-digit federal tax ID becomes available immediately upon verification.

Applying for an Employer Identification Number (EIN) is a free service offered by the Internal Revenue Service.

How much does it cost to get an EIN? Applying for an EIN for your California LLC is completely free. The IRS doesn't charge any service fees for the EIN online application.