Motion Order Contempt Form For Divorce

Description

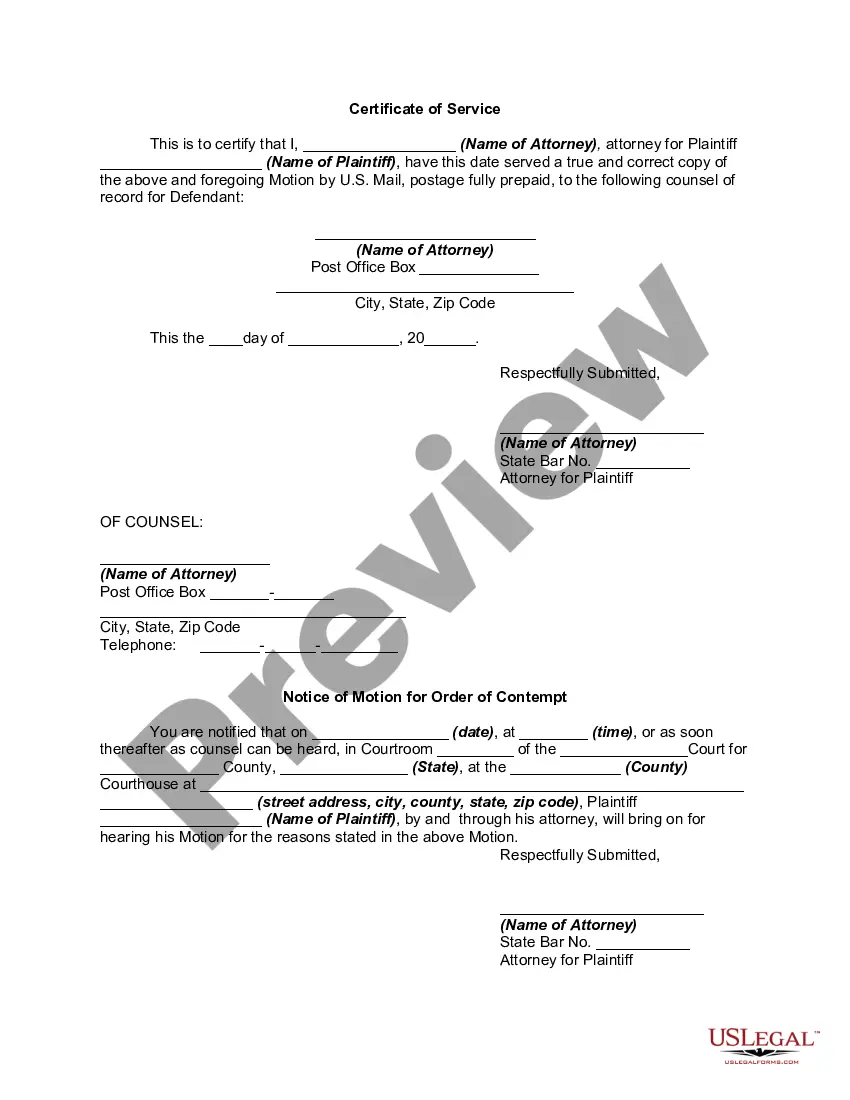

How to fill out Motion For An Order Of Contempt For Violation Of Injunction?

It’s common knowledge that you can't transform into a legal expert in a single night, nor can you effortlessly master how to swiftly prepare a Motion Order Contempt Form For Divorce without a professional background.

Drafting legal documents is a lengthy process that necessitates particular training and expertise.

So why not entrust the creation of the Motion Order Contempt Form For Divorce to the professionals.

You can regain access to your files from the My documents section at any time.

If you’re a current client, you can simply Log In and find and download the template from the same section. Regardless of the reasons behind your documentation—whether it’s financial and legal, or personal—our website has you covered. Try US Legal Forms today!

- Find the form you require by utilizing the search bar located at the top of the webpage.

- Examine it (if this option is available) and review the accompanying description to determine if the Motion Order Contempt Form For Divorce is what you're looking for.

- Reinitiate your search if you require a different document.

- Create a complimentary account and select a subscription plan to purchase the form.

- Click Buy now. Once the purchase is completed, you can download the Motion Order Contempt Form For Divorce, fill it out, print it, and send or mail it to the specified individuals or entities.

Form popularity

FAQ

At a high level, the steps for forming a C corp whenstarting a business are as follows: Register a unique business name. Appoint officers to the corporation (CEO, board of directors). Draft and file articles of incorporation with the secretary of state in your state. ... Write company bylaws. Issue stock?literally.

How to Start a corporation in Montana Choose a name for your business. ... Designate a Registered Agent in Montana. ... File Articles of Incorporation in Montana. ... Create your Corporate Bylaws. ... Appoint your Corporate Directors. ... Hold the First Meeting of the Board of Directors. ... Authorize the issuance of shares of stock.

Where does your state rank? State-RankCorporate tax rankIndividual income tax rank1. Wyoming112. South Dakota113. Alaska2814. Florida7122 more rows

To start a corporation in Montana, you must file Articles of Incorporation with the Secretary of State. You can file the document online. The Articles of Incorporation cost $35 to file. Once filed with the state, this document formally creates your Montana corporation.

Create an LLC in Montana Select a Name for the LLC. ... Designate a Montana Registered Agent. ... File Articles of Organization. ... Write a Montana LLC Operating Agreement. ... Get an Employer Identification Number from the IRS. ... File BOI Report to FinCEN. ... Open a Bank Account in Montana.

Montana LLC Formation Filing Fee: $35 It normally takes five days for the state to process your formation paperwork after they receive it, but the state also offers expedited processing for an added fee: 24-hour expedited state processing: $90. 1-hour expedited state processing: $170.

Advantage#1: The benefits of Incorporation or LLC formation Pass through taxation: If you register a new company in Montana as an S corporation then the corporation or firm will not pay any income tax. Instead, the income or loss of the corporation will be passed on to the stockholders.

To form a Montana corporation, you must file articles of incorporation with the Secretary of State and pay a filing fee, at which point a corporation's existence officially begins. At a minimum, the articles must include the following information: Name of the corporation. Names and addresses of incorporators.