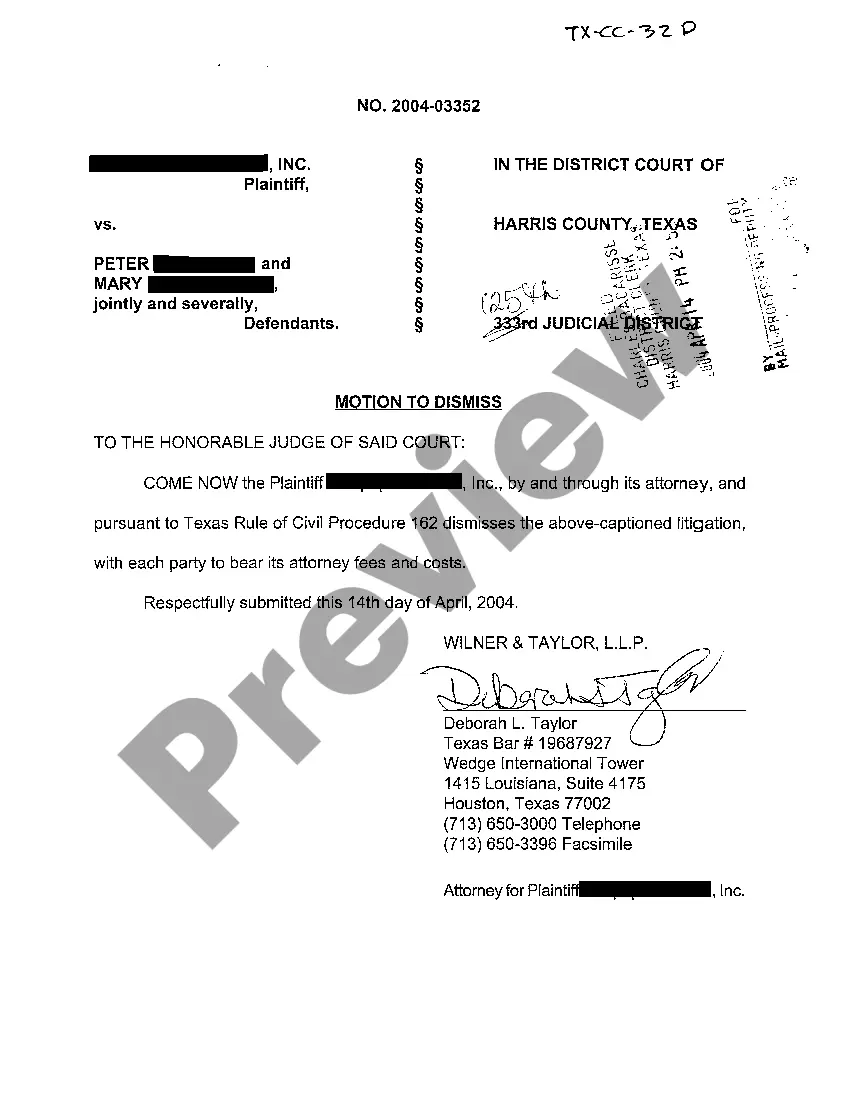

Pistol Permit Reference Letter With Resume

Description

How to fill out Character Reference In Support Of Application For Pistol Permit?

The Pistol Permit Reference Document With Resume you observe on this page is a reusable legal template created by qualified attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, entities, and lawyers with more than 85,000 validated, state-specific documents for any professional and personal situation. It’s the quickest, easiest, and most reliable way to secure the documentation you require, as the service assures the utmost level of data protection and anti-malware security.

Subscribe to US Legal Forms to have validated legal templates for all of life’s circumstances available at your fingertips.

- Search for the document you require and assess it.

- Browse the sample you searched and preview it or evaluate the form description to verify it meets your requirements. If it does not, utilize the search bar to find the suitable one. Click Buy Now when you have located the template you desire.

- Subscribe and Log In.

- Choose the pricing option that fits you and set up an account. Use PayPal or a credit card to make a swift payment. If you already have an account, Log In and examine your subscription to proceed.

- Obtain the fillable template.

- Select the format you prefer for your Pistol Permit Reference Document With Resume (PDF, Word, RTF) and save the document on your device.

- Fill out and sign the paperwork.

- Print the template to finish it by hand. Alternatively, use an online versatile PDF editor to promptly and accurately complete and sign your document with an eSignature.

- Re-download your paperwork.

- Use the same document again whenever needed. Open the My documents tab in your profile to retrieve any previously saved documents.

Form popularity

FAQ

Case law recognizes three exceptions to liability for independent contractors: Negligent selecting, instructing, or supervising: This exception goes to whether you adequately vetted and instructed an independent contractor.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

In California, an employer is vicariously liable for the negligent and wrongful acts of his employees that are committed within the scope of employment.

How do I create an Independent Contractor Agreement? State the location. ... Describe the type of service required. ... Provide the contractor's and client's details. ... Outline compensation details. ... State the agreement's terms. ... Include any additional clauses. ... State the signing details.

Even given the general rule that an employer is not responsible for the acts of independent contractors, companies are expected to carefully choose who they will use as contract workers. Otherwise, they may be exposed to liability for negligent hiring.

A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences between the two. For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

Negligent Hiring Liability Even given the general rule that an employer is not responsible for the acts of independent contractors, companies are expected to carefully choose who they will use as contract workers. Otherwise, they may be exposed to liability for negligent hiring.

By misclassifying workers as independent contractors, employers shift the financial burden of payroll taxes onto workers that employers ordinarily cover, and they avoid paying workers' compensation and unemployment premiums on workers' behalf.