Probate Form 13100 For California

Description

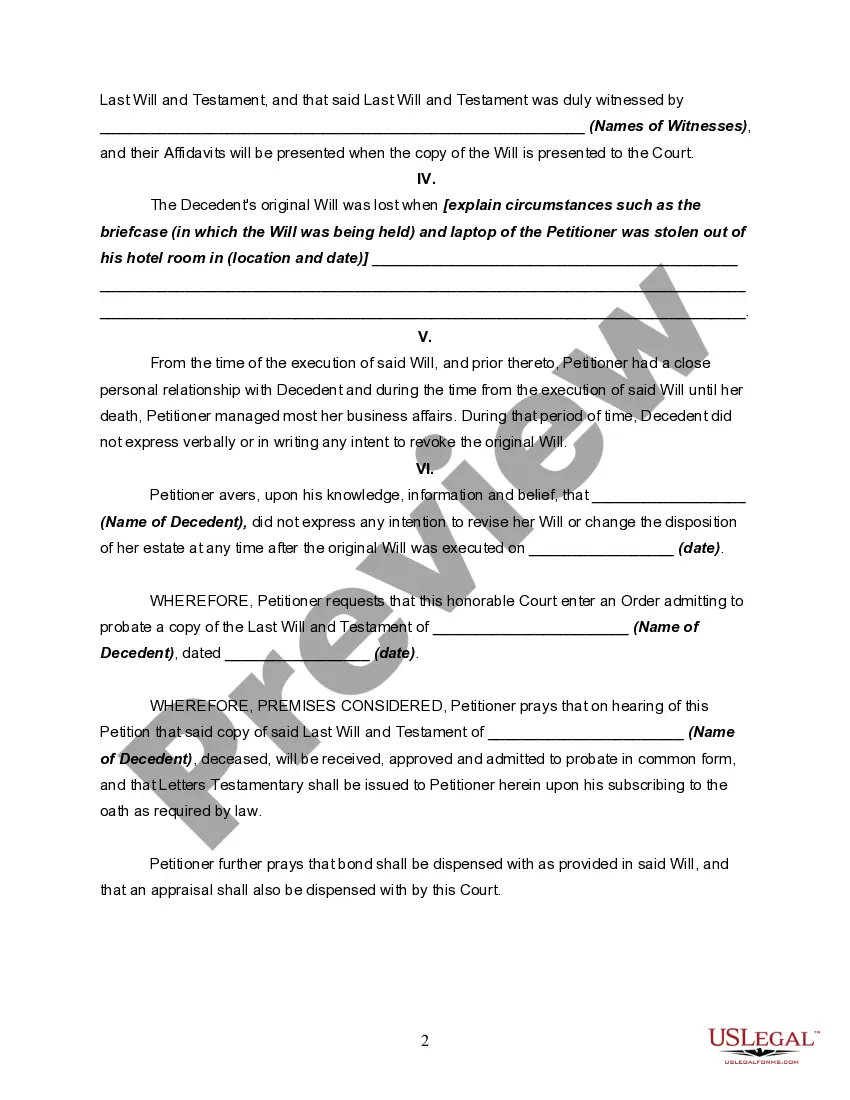

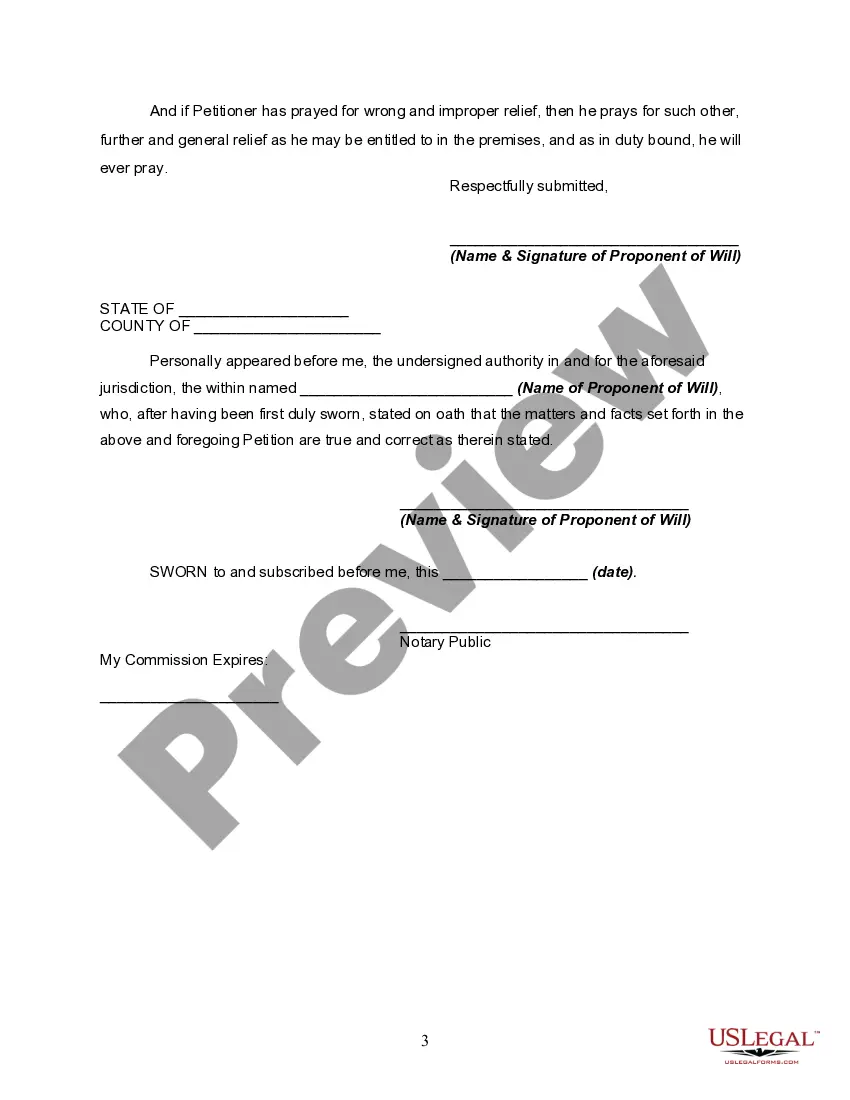

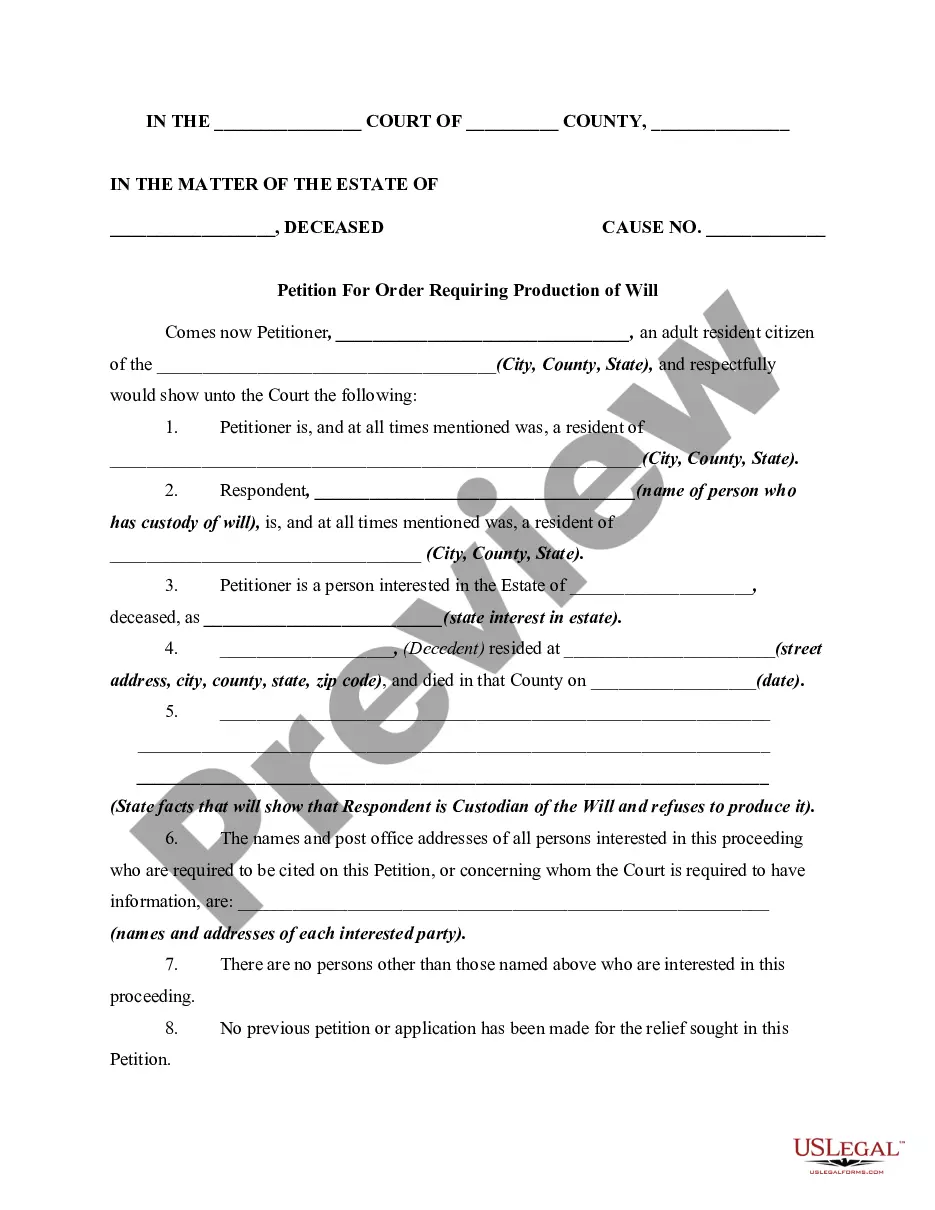

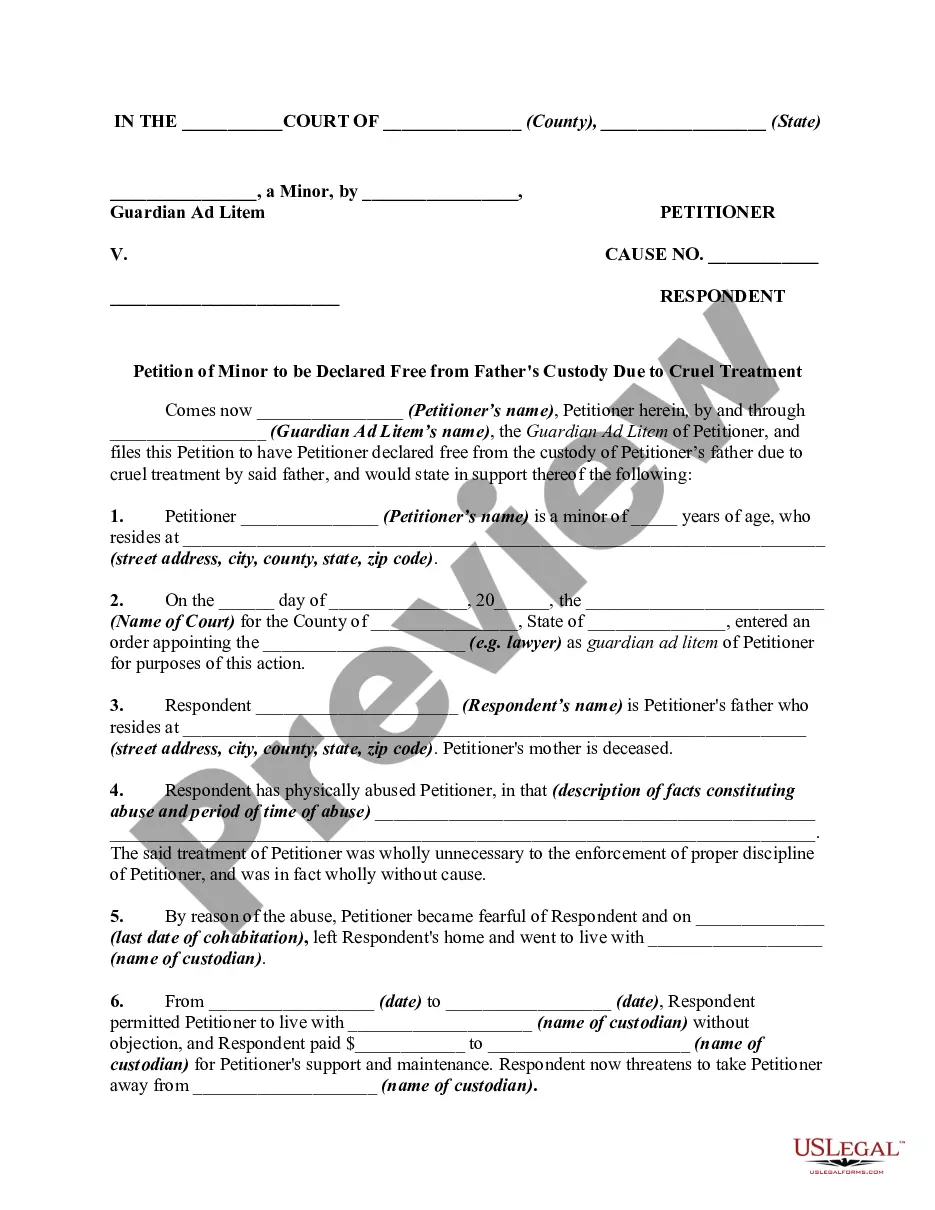

How to fill out Petition To Probate Lost Will?

Finding a reliable source for obtaining the latest and most pertinent legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal documents requires accuracy and meticulousness, which highlights the importance of obtaining samples of Probate Form 13100 For California exclusively from trustworthy sources, such as US Legal Forms. An incorrect template can lead to wasted time and prolong your current situation. With US Legal Forms, you have minimal concerns.

Eliminate the stress that comes with your legal documentation. Explore the comprehensive US Legal Forms catalog, where you can locate legal templates, verify their suitability for your situation, and download them instantly.

- Use the library navigation or search bar to locate your sample.

- Examine the form’s description to verify if it meets the standards of your state and area.

- Check the form preview, if accessible, to confirm that the template is the one you require.

- Return to the search to find the suitable document if the Probate Form 13100 For California does not fit your needs.

- If you are certain of the form’s pertinence, download it.

- If you are a registered user, click Log in to verify your identity and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Select the pricing option that best meets your requirements.

- Proceed to the registration to complete your purchase.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Probate Form 13100 For California.

- After obtaining the form on your device, you can modify it using the editor or print it out and fill it out by hand.

Form popularity

FAQ

Yes, property can be transferred without probate in California under certain circumstances, particularly when it involves small estates. The use of forms like probate form 13100 simplifies this process, allowing heirs to claim assets quickly. By following the guidelines set forth in the probate code, families can avoid lengthy legal proceedings. If you require assistance, platforms like US Legal Forms provide necessary resources and forms needed for a smooth transfer.

The 13101 probate form is designed for individuals who need to file a declaration regarding the transfer of property under California's small estate rules. Unlike the probate form 13100, the 13101 form may be used in other specific circumstances or for different purposes regarding estate administration. This form helps ensure that the transfer aligns with state laws to avoid legal complications. Utilizing the proper form is vital for a seamless estate resolution.

Probate form 13100 is a critical document utilized in California to facilitate the transfer of property when a deceased person's estate meets certain criteria. This form allows eligible heirs to claim assets without going through the formal probate process. It simplifies the transfer of property for small estates, thus saving time and reducing legal costs. Using probate form 13100 for California can make settling an estate much more manageable.

In California, an estate must be valued at $166,250 or less to potentially avoid probate. If the estate falls within this limit, heirs might use the Probate form 13100 for California to collect assets without formal probate procedures. However, it is crucial to carefully assess the estate's total value and consult with legal resources to ensure compliance.

Section 13100 of the Probate Code provides a streamlined method for heirs to collect personal property in small estates. It allows beneficiaries to bypass the lengthy probate process and quickly access property left by the deceased. Understanding this section can greatly assist you, and utilizing the Probate form 13100 for California enables a smoother claim process.

An affidavit for collection of personal property under California probate code 13100 is a legal document allowing a small estate's heirs to access and gather the deceased’s assets. By using this affidavit, heirs can skip formal probate and quickly claim their inheritance. The process becomes more manageable with the appropriate forms, such as the Probate form 13100 for California.

Excluded property under section 13050 includes certain types of assets that do not require probate. This can include property held in joint tenancy or designated beneficiaries on accounts. Understanding these exclusions is important as it can impact the approach you take, potentially involving the Probate form 13100 for California.

Section 13100 of the California probate code allows heirs to collect certain personal property without formal probate proceedings. This section is particularly useful for estates qualifying under the small estate threshold. The use of the Probate form 13100 for California facilitates the collection of assets, simplifying the process for beneficiaries.

To calculate probate fees in California, begin by determining the value of the estate. Fees typically include statutory fees based on a percentage of the estate's value, and additional attorney fees may apply. Understanding the nuances of these costs can be tricky, so using resources like the Probate form 13100 for California or consulting a legal professional can provide clarity and help streamline the process.

Yes, you can file probate yourself in California, though it requires knowledge of legal procedures. You will need to complete the necessary forms, potentially including the Probate form 13100 for California if your estate qualifies. However, be aware that navigating the probate process can be complex, so seeking guidance or using a helpful platform like US Legal Forms might be beneficial.