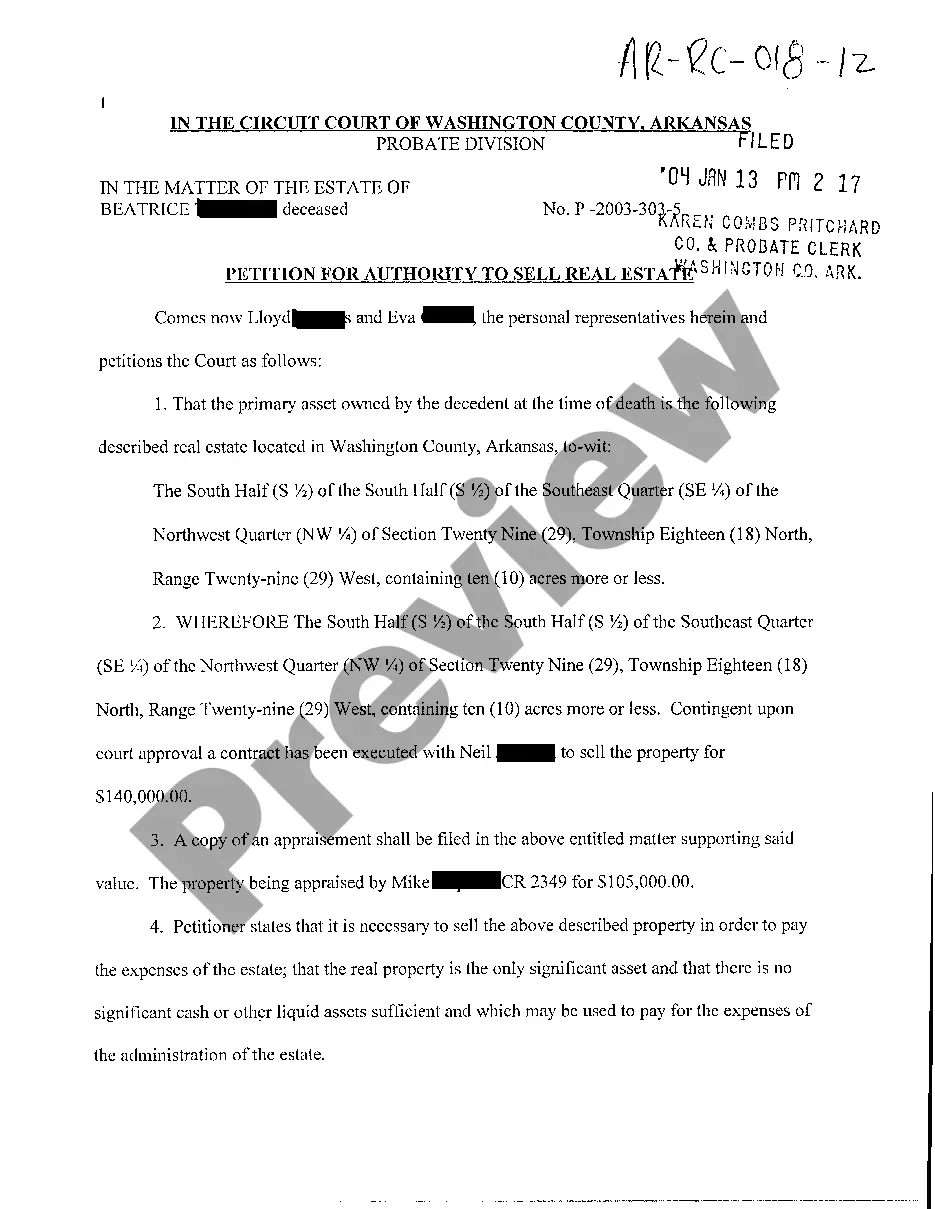

Stop Work Letter Sample For Mortgage

Description

How to fill out Stop Work Order By Letter?

Getting a go-to place to take the most recent and appropriate legal samples is half the struggle of handling bureaucracy. Choosing the right legal files demands accuracy and attention to detail, which is the reason it is vital to take samples of Stop Work Letter Sample For Mortgage only from reputable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You may access and check all the details regarding the document’s use and relevance for the situation and in your state or region.

Consider the following steps to complete your Stop Work Letter Sample For Mortgage:

- Utilize the library navigation or search field to locate your template.

- View the form’s description to see if it suits the requirements of your state and region.

- View the form preview, if available, to ensure the form is the one you are interested in.

- Get back to the search and find the proper template if the Stop Work Letter Sample For Mortgage does not suit your needs.

- If you are positive regarding the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have an account yet, click Buy now to obtain the form.

- Select the pricing plan that fits your requirements.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (bank card or PayPal).

- Select the file format for downloading Stop Work Letter Sample For Mortgage.

- Once you have the form on your gadget, you can change it using the editor or print it and complete it manually.

Remove the inconvenience that accompanies your legal documentation. Check out the extensive US Legal Forms collection where you can find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

How to explain employment gaps Be honest. ... Don't include your entire work history. ... Downplay smaller gaps by leaving out the month. ... Explain employment gaps in your cover letter. ... Highlight what you did accomplish while out of work.

A letter of explanation for a mortgage is a document that provides further details about a borrower's credit or financial circumstances. The letter of explanation might describe why you were unemployed for a period of time, for example, or why there's an unpaid balance on your credit report.

Your hardship letter should include the following essential steps: Write an introduction. ... Detail your hardship. ... Highlight how you're being proactive about your financial situation. ... State your request. ... Provide assurance of financial recovery. ... Submit supporting documentation.

Here are some of the things mortgage experts recommend you include: The date you're writing the letter. The lender's name, mailing address, and phone number. Your full legal name and loan application number. Your explanation, with references to any supporting documents you're including. Your mailing address and phone number.

Yes. You are required to let your lender know if you lost your job as you will be signing a document stating all information on your application is accurate at the time of closing. You may worry that your unemployment could jeopardize your mortgage application, and your job loss will present some challenges.