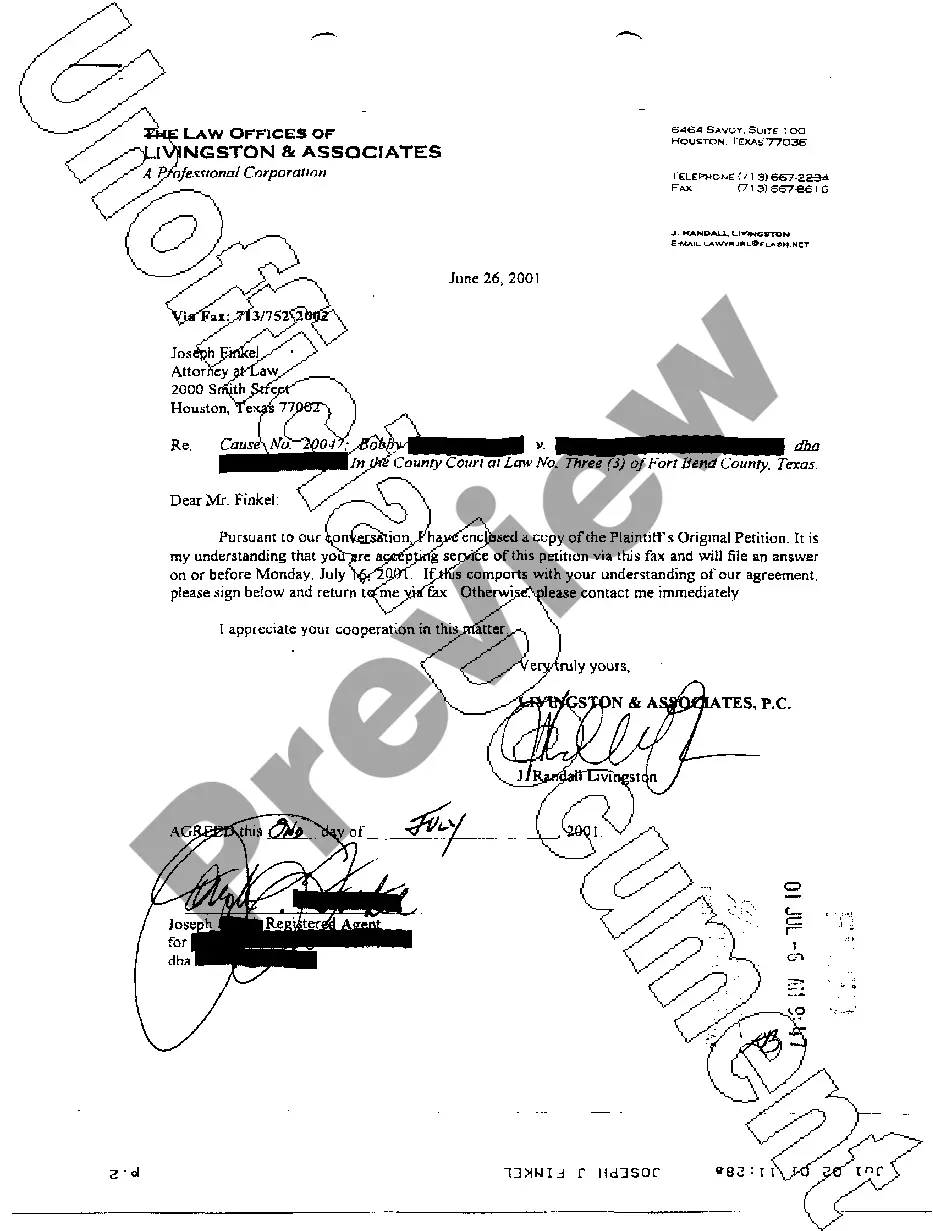

Mortgage Loan Default Letter Format

Description

How to fill out Notice Of Intent To Foreclose - Mortgage Loan Default?

Regardless of whether it's for corporate intentions or personal issues, everyone encounters legal matters at some stage in their life.

Completing legal paperwork requires meticulous care, starting with selecting the appropriate form template. For instance, if you choose an incorrect version of the Mortgage Loan Default Letter Format, it will be declined once submitted. Thus, it is crucial to have a reliable source of legal documents like US Legal Forms.

With an extensive US Legal Forms catalog available, you do not need to waste time searching for the correct template across the web. Utilize the library’s straightforward navigation to discover the right template for any circumstance.

- Locate the template you require by utilizing the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your circumstances, state, and county.

- Click on the form’s preview to inspect it.

- If it is the wrong document, return to the search feature to find the Mortgage Loan Default Letter Format example you need.

- Download the template when it corresponds to your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you don’t have an account yet, you may acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the file format you desire and download the Mortgage Loan Default Letter Format.

- Once saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

Here are some of the things mortgage experts recommend you include: The date you're writing the letter. The lender's name, mailing address, and phone number. Your full legal name and loan application number. Your explanation, with references to any supporting documents you're including. Your mailing address and phone number.

They payment due on ____Date____ , for $ ______________ has not been paid. Consequently, you are now in default on the said note. Please pay the amount due within the next seven days. If payment is not made within the specified period, we shall proceed to enforce our rights to collect the entire balance.

How Notices of Default Work The name and address of the borrower. The name and address of the lender. The legal address of the property. Full details on the nature of the default. What action is required to cure the default. The deadline and the intentions of the lender if the deadline is passed without a cure.

A notice of default is a public notice that a borrower is behind on their mortgage payments. (Also known as being in default on their loan.) It's typically filed with a court and regarded as the first step in the foreclosure process.

This is a letter your creditor sends to warn that you are behind on payments and your account may default. Creditors usually send a default notice after six months of missed or under payments. They will give you at least two weeks to make up missed payments. If you cannot pay in this time your account will default.