Trust Accounting Form For Trust

Description

How to fill out Qualified Income Miller Trust?

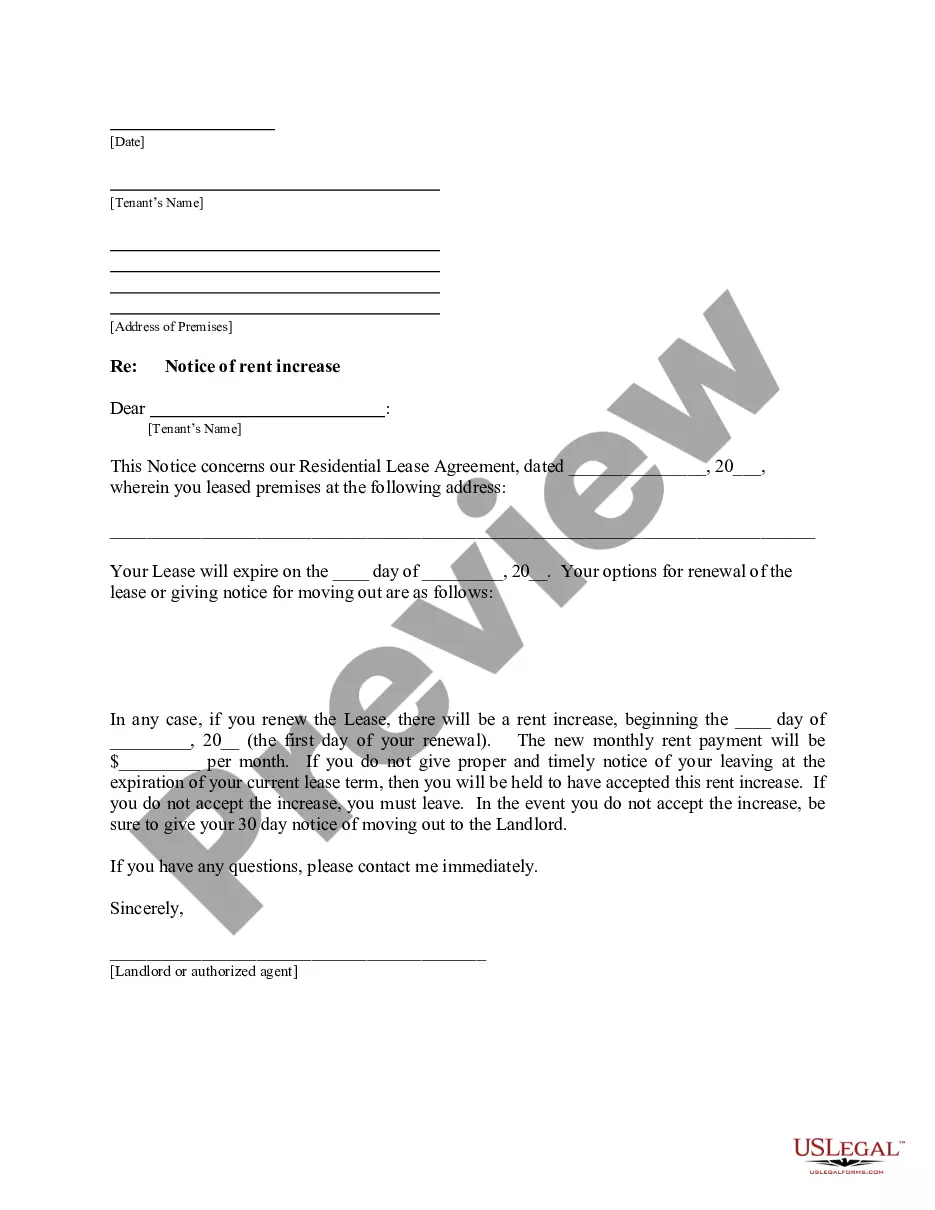

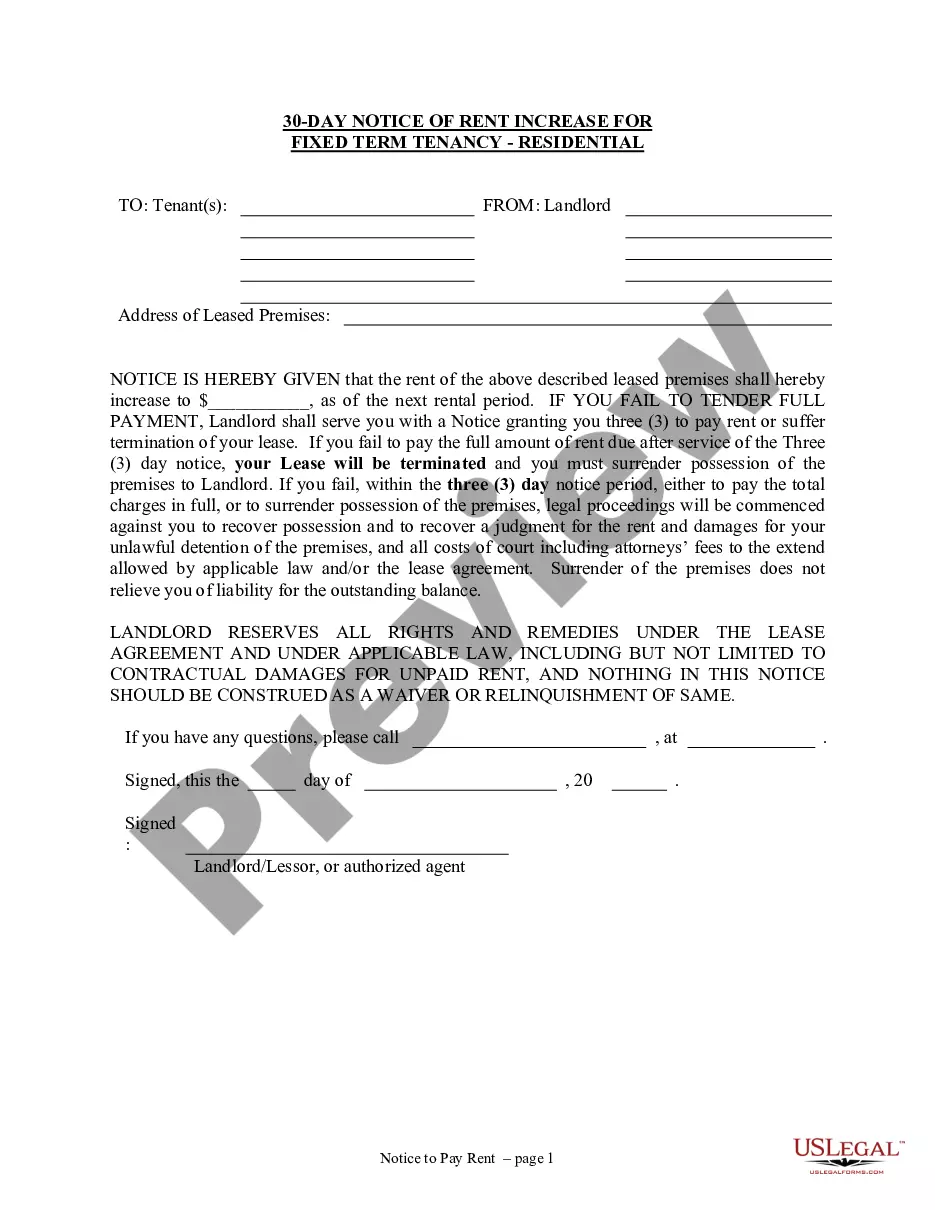

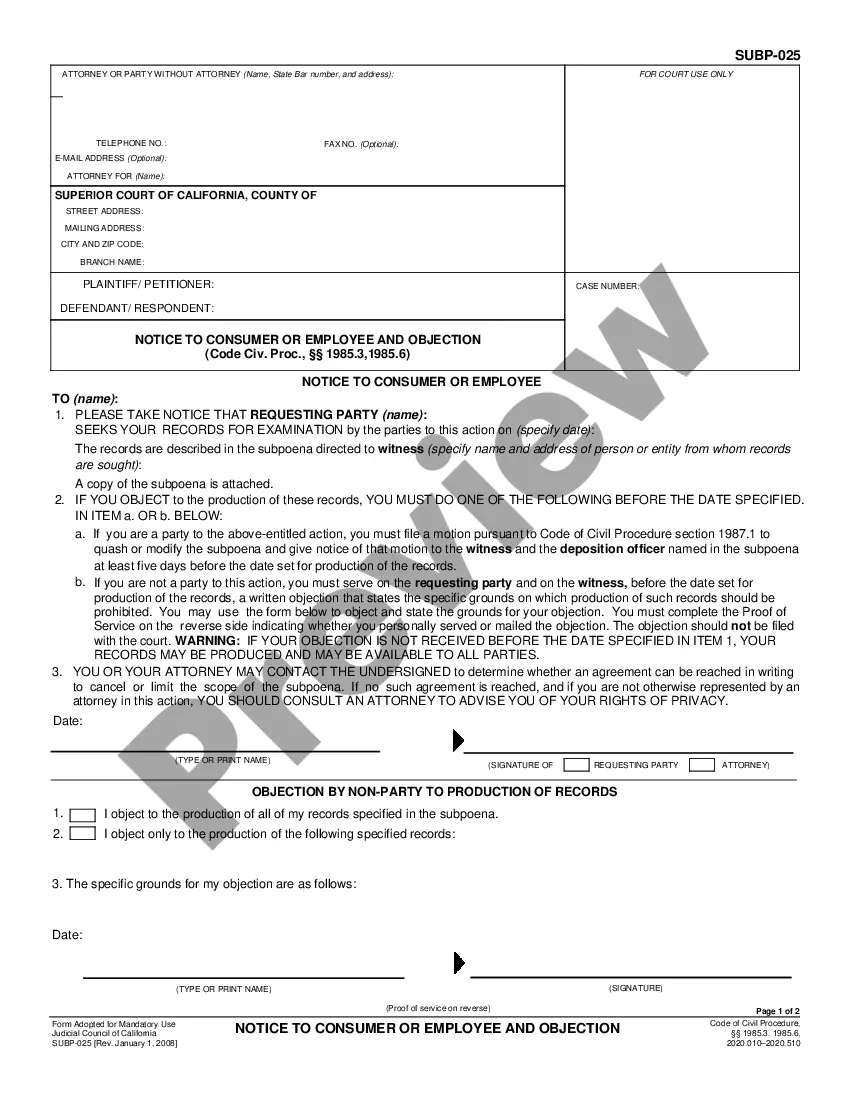

- If you're a returning user, log in to your account and verify your subscription is active. Click the Download button for the necessary form template.

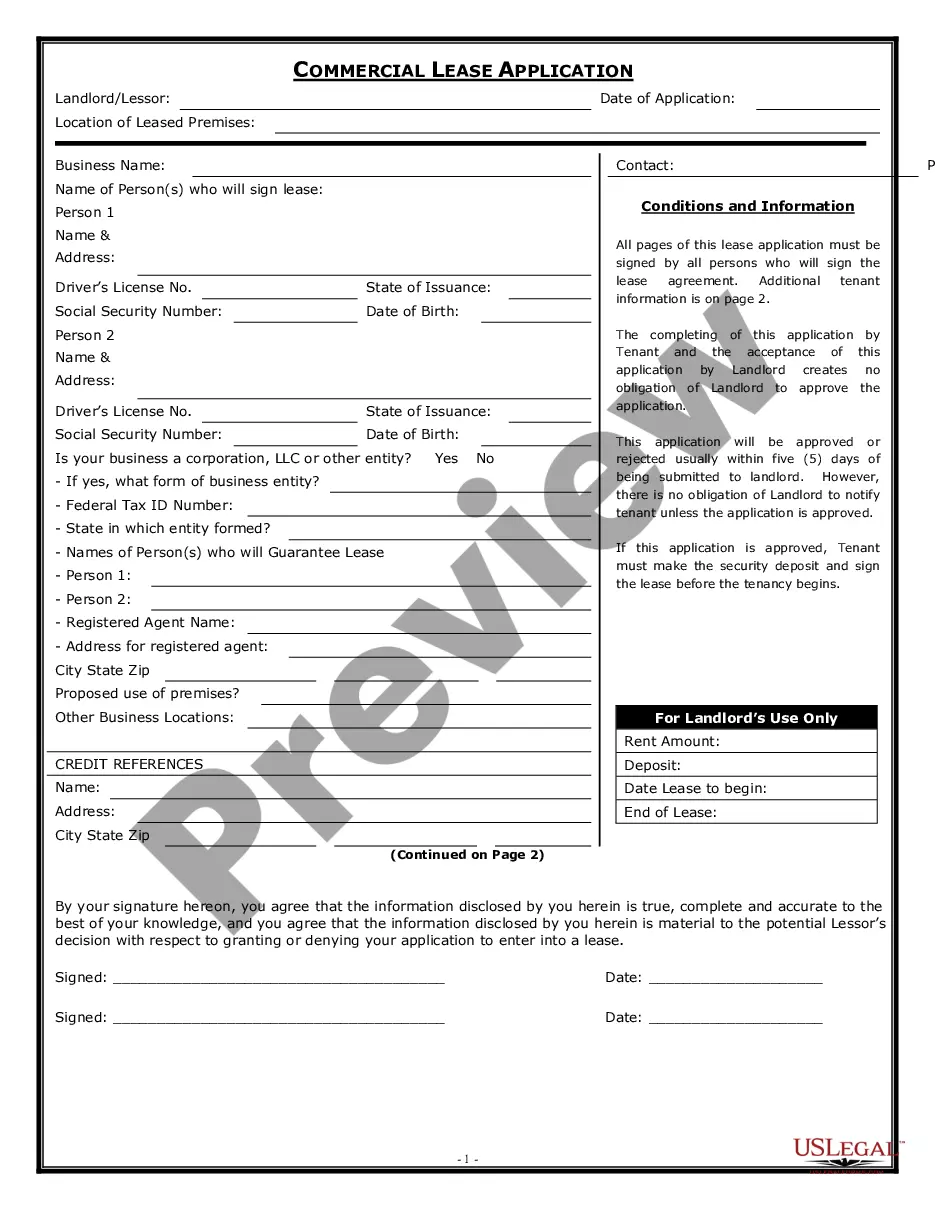

- For new users, start by reviewing the Preview mode and form description to ensure you select the right trust accounting form for your jurisdiction.

- If needed, utilize the Search tab to find alternative templates that match your requirements.

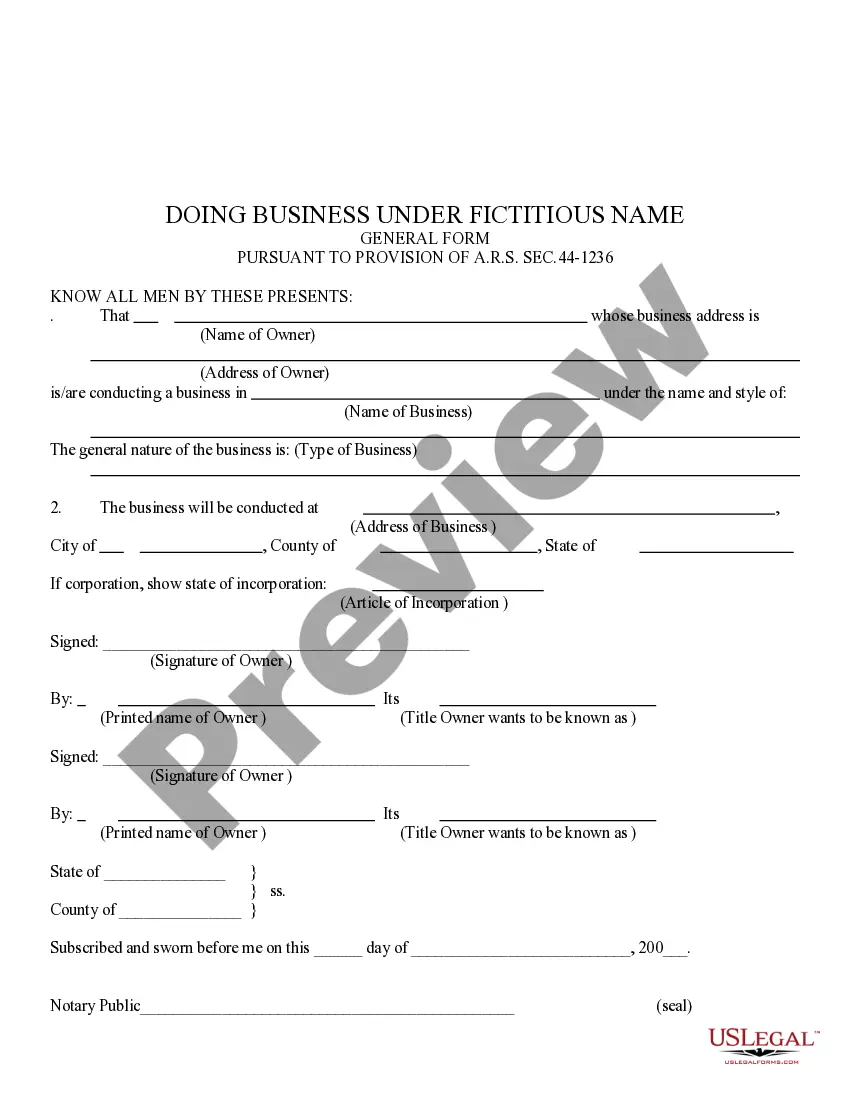

- Purchase the desired document by clicking the Buy Now button and selecting your preferred subscription plan. You will need to register for an account.

- Complete your purchase by providing your payment details, including credit card information or PayPal account.

- Once the transaction is successful, download your trust accounting form and save it on your device. Access it anytime via the My Forms section of your profile.

With US Legal Forms, you benefit from an extensive library of resources and expert assistance, ensuring your forms are completed accurately and efficiently.

Start simplifying your legal documentation process today by visiting US Legal Forms and exploring their vast collection of forms!

Form popularity

FAQ

Reporting income from a trust involves filling out IRS Form 1041, which provides a comprehensive view of the trust's taxable income. Furthermore, include all income earned by the trust in the trust accounting form for trust. This process ensures you meet your tax obligations. To make this process easier, consider accessing form templates and guidance from USLegalForms to streamline your reporting.

Generally, any trust that earns income needs to file Form 1041 with the IRS. This includes irrevocable trusts and some revocable trusts that have generated taxable income. Correctly completing the trust accounting form for trust ensures you are reporting as per regulations. For guidance, using USLegalForms can provide you with the right resources and simplify the filing.

Yes, if your trust has generated income, you must file IRS Form 1041, which is essential for reporting the income of a trust. The form captures income received, deductions, and distributions made to beneficiaries. It's crucial to complete the trust accounting form for trust to provide accurate data on your filing. Leveraging USLegalForms can enhance your understanding of this requirement and help you with the filing process.

Form 10B is specific to a certain type of trust and addresses the trust's income and distributions. It's important to understand how this form applies to your trust to maintain compliance with tax regulations. By filling out the trust accounting form for trust accurately, you can ensure all required information is included. If you need assistance, consider using USLegalForms to access tailored resources and templates.

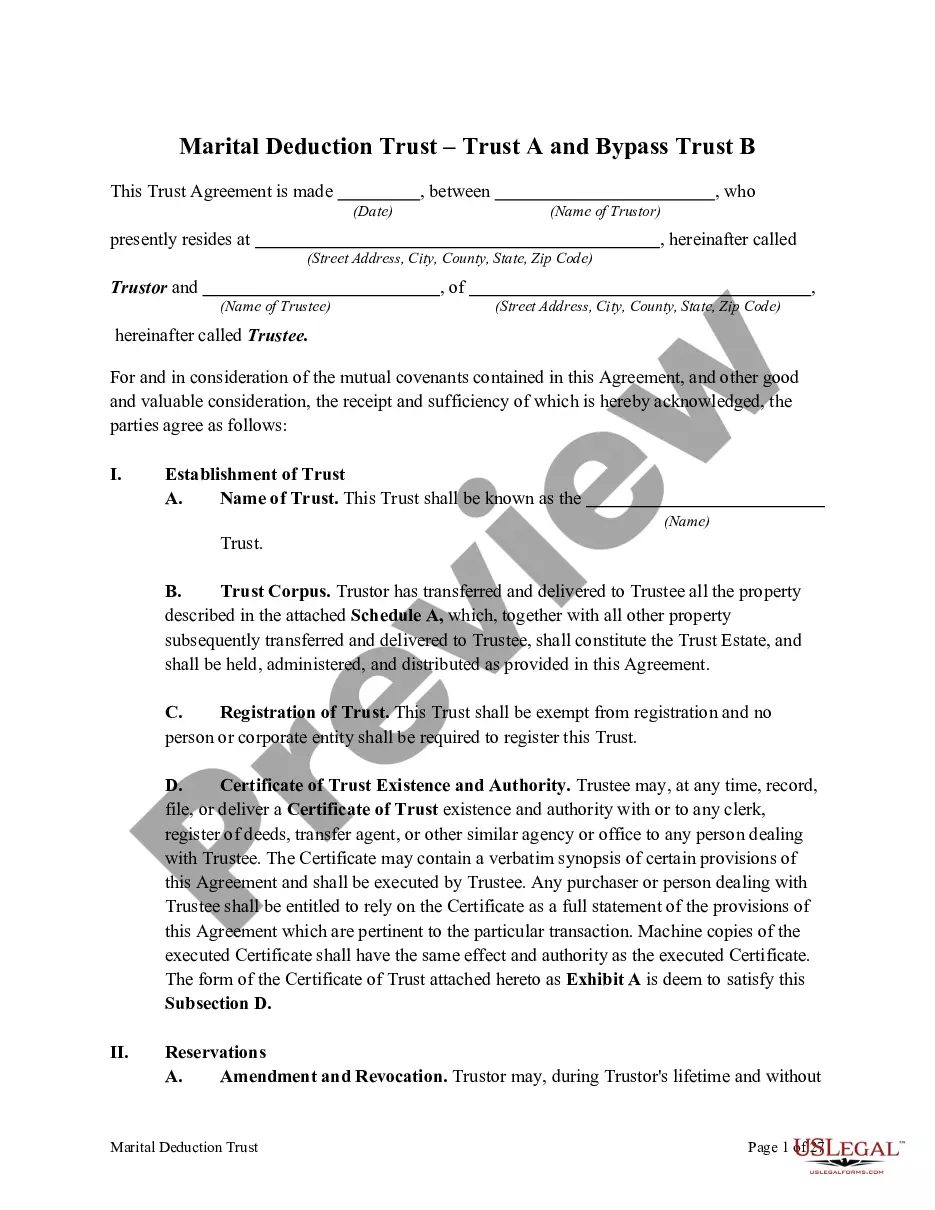

To manage a trust properly, you will need to complete a trust accounting form for trust. This form helps you report the trust’s income, losses, and distributions. Depending on the type of trust, additional forms may also be necessary, like the IRS Form 1041. Using a reliable platform like USLegalForms can simplify this process and provide you with the correct forms.

The obligation to file a 1041 typically falls on estates and trusts that generate gross income of $600 or more. Also, if a beneficiary is a nonresident alien, a 1041 must be filed regardless of income. It's important for trustees to know their responsibilities to ensure compliance with the IRS regarding the trust accounting form for trust.

Performing an accounting for a trust involves documenting all income, expenses, and distributions. Start by organizing financial records, categorizing each transaction accurately. This process is essential for ensuring compliance with regulations and understanding the trust's financial health, particularly when preparing the trust accounting form for trust.

Not all trusts are required to file a 1041. Only trusts that generate income exceeding $600 during the tax year need to submit this trust accounting form for trust. Knowing when to file can help trustees manage their obligations efficiently while avoiding unnecessary paperwork.

Any estate or trust with gross income of $600 or more must file IL 1041 in Illinois. This requirement applies regardless of whether the income is distributed or retained. Understanding this requirement is vital for fiduciaries managing assets, particularly when utilizing the trust accounting form for trust.

The minimum income requirement for filing Form 1041 is generally $600 for the tax year. If a trust generates income above this threshold, it must file the trust accounting form for trust. This ensures that trustees remit any taxes owed on the income the trust produces, fostering compliance with IRS regulations.